For decades, political interests and academics have proposed measures to require consolidation of local governments under the assumption that “bigger-is-better,” and that larger governments are inherently more efficient. Often such initiatives equate efficiency with a smaller number of governments. The data indicates otherwise.

Our recent report for the Ohio Township Association (Ohio Townships: Spending Taxing and Borrowing Less) analyzes local government financial data from the Auditor of State (2015), updating a previous analysis.

Local Government in Ohio

Financial performance is examined by the size and type of local government, using median measures. This analysis is provided at the overall state level and within metropolitan areas. The data generally shows that current expenditures, local taxes and long-term debt per capita are higher in the larger jurisdictions. Moreover, in similar sized jurisdictions, townships tend to have lower current expenditures, local taxes and long-term debt than municipalities of similar population.

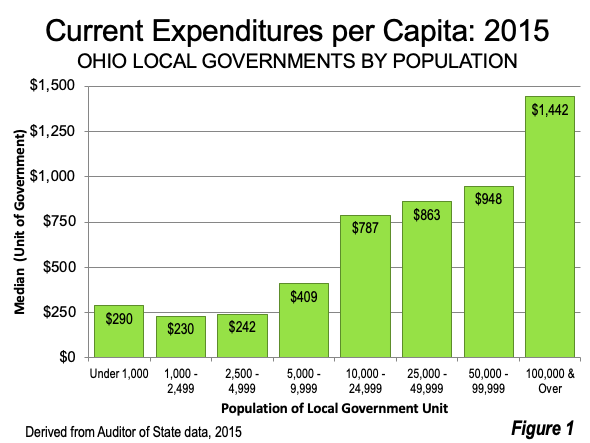

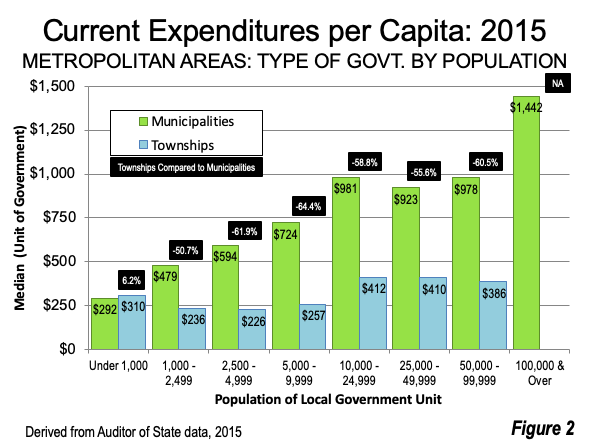

Current Expenditures per Capita: The analysis of current expenditures indicates that smaller local governments spend considerably less than larger governments per capita (Figure 1). In metropolitan areas, smaller governments also spend less than larger governments. Overall, townships spend approximately one-half as much per capita as municipalities, both statewide and in metropolitan areas (Figure 2).

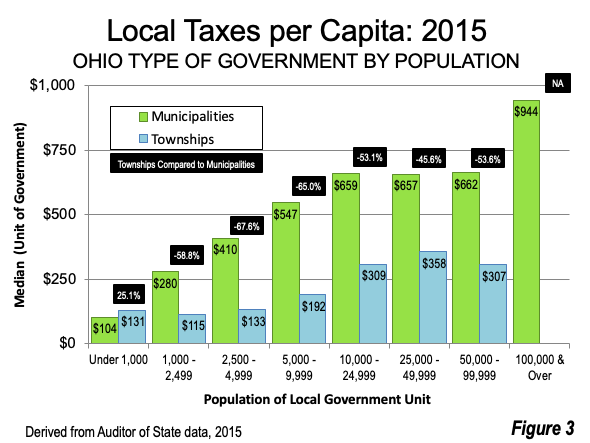

Local Taxes per Capita: Smaller governments also have considerably lower local taxes per capita than larger governments. A similar relationship is indicated in metropolitan areas, where smaller governments levy lower local taxes per capita than larger governments. In each size category, townships tax less per capita than municipalities. Overall, township tax revenues are more than one-half lower than those of municipalities (Figure 3).

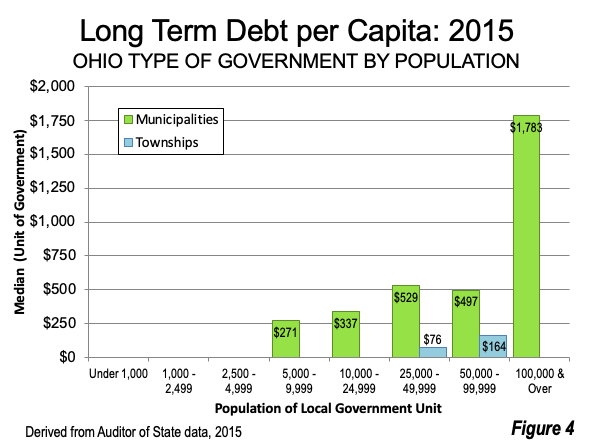

Long - term Debt per Capita: Smaller governments are less likely to incur long-term debt for governmental activities (as opposed to proprietary activities) than larger governments. Moreover, township governments, are less than half as likely to incur debt as municipal governments.

Similarly, smaller governments have considerably less long-term debt per capita than larger governments. For example, the median local government with fewer than 5,000 residents has nolong-term debt. Above 5,000 population, long-term debt per capita tends to rise with population, though township long-term debt is considerably less than that of municipalities (Figure 4).

Sustainability of Local Governments

Ohio has been a leader among the states in financial oversight of local governments. Pursuant to Ohio law, the Auditor of State reviews local government finances and when certain standards are met, can declare them to be in Fiscal Distress. This program was established after the city of Cleveland bankruptcy in the 1970s.

Larger governments have been associated with a higher degree of Fiscal Distress declarations. Townships have been declared in Fiscal Distress much less frequently than municipalities. The larger townships are about two-thirds (or more) less likely to be declared in Fiscal Distress than similarly sized municipalities.

Employee compensation is the largest element of local government expenditure and has been an important factor in local government fiscal crises across the nation. Township employee wages per capita are two-thirds less than those of municipalities, a factor that generally improves fiscal sustainability.

Why Township Governments Tend to be More Efficient

This research concludes that smaller units of local government in Ohio, especially townships, are more efficient than larger governments, as evidenced by their spending less per capita for the services that respond to the desires of their electorates. By spending, taxing and borrowing less, smaller governments provide powerful evidence that consolidating into larger units is highly unlikely to improve efficiency

Despite support, especially among some academics, for local government consolidation, research on actual spending, taxing and borrowing levels suggests just the opposite --- less efficiency. This can be traced to multiple factors:

- Political necessity tends to require employee compensation, the largest expenditure category, to be harmonized at the rates of the costlier consolidated government.

- Political pressure can force service levels to be leveled up to the highest level among the consolidating governments.

- The political influence of special interests, nearly always favoring more spending, is increased, as the influence of voters is diluted in larger jurisdictions.

- Differing political cultures between the consolidating governments can complicate efforts to improve efficiency, regardless of the factors above.

Toward a More Prosperous Ohio

Ohio, much of it located in the “Rust Belt,” has experienced comparatively modest economic growth in recent decades. Yet, current demographic trends could favor improved economic growth for Ohio in the future, especially the revival of manufacturing and continuing expansion of natural gas production.

At the same time, another advantage going forward is Ohio’s affordable housing market. The median value of owned housing in the state averages 2.7 times median household incomes, according to the 2019 American Community Survey. Ohio is the fourth most affordable state in the union. This could be a material advantage from Covid related trends favoring spacious housing and lower densities.

There also are positive net domestic migration trends, with Columbus having the best rate from 2010 to 2019 of any major metropolitan area (over 1,000,000 population) in the Midwest and better than any in the Northeast. In the last three years, Cincinnati’s long domestic migration losses have turned to modest gains

A more prosperous Ohio, with greater population growth and greater economic growth could well emerge from the nation’s changing geographic balance, as indicated by the larger differences in the cost of living. Townships are well positioned for growth, often with large inventories of land for business expansion and the continuing development of single-family homes preferred by most households. There’s a great future ahead for Ohio --- and much of it will come from smaller government.

Photograph: Ohio Statehouse, Capitol Square, downtown Columbus (by author).

Wendell Cox is principal of Demographia, an international public policy firm located in the St. Louis metropolitan area. He is a founding senior fellow at the Urban Reform Institute, Houston and a member of the Advisory Board of the Center for Demographics and Policy at Chapman University in Orange, California. He has served as a visiting professor at the Conservatoire National des Arts et Metiers in Paris. His principal interests are economics, poverty alleviation, demographics, urban policy and transport. He is co-author of the annual Demographia International Housing Affordability Survey and author of Demographia World Urban Areas.

Mayor Tom Bradley appointed him to three terms on the Los Angeles County Transportation Commission (1977-1985) and Speaker of the House Newt Gingrich appointed him to the Amtrak Reform Council, to complete the unexpired term of New Jersey Governor Christine Todd Whitman (1999-2002). He is author of War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life and Toward More Prosperous Cities: A Framing Essay on Urban Areas, Transport, Planning and the Dimensions of Sustainability.