Redlining and Bluelining Are Detrimental to a Neighborhood, But Bluelining Is Devastating to Low-Income Blacks and Other Groups

Redlining a neighborhood is very detrimental to the neighborhood, but it made homeownership for low-income groups more accessible. Bluelining a neighborhood is also very detrimental to the neighborhood, but it is devastating to low-income blacks and other low-income groups that want to buy a home.

Redlining a Neighborhood Turns Off the Spigot of Loans

Redlining a neighborhood is the act of the government and lenders turning off the spigot of loans in a neighborhood by drawing a line around a neighborhood and denying loans to be made in that neighborhood. Munger Place in Dallas is a good example of a neighborhood that was ripe for redlining and suffered the consequences of this policy.

Bluelining Turns on a Firehose of Free Government Money to Apartment Developers

Bluelining a neighborhood is the act of the government and lenders turning on a firehose of free government money and benefits to developers in a designated neighborhood to build low-income apartments. This free government money to developers might include a 99-year property tax exemption for school, City, County and Community College tax. Free government money might also include Community Development Funds, Housing Finance Corporation grants, and the City of Dallas bestowing benefits like added zoning density allowances not desired by the development’s neighbors. Dallas City Council District 3 is a good example of a neighborhood that has suffered the consequences of being blueline.

Redlining Has Been Blamed for the Low Rate of Black Homeownership

Redlining has been blamed for the low rate of black homeownership and black wealth creation. It is commonly accepted that lenders deliberately redlined a neighborhood because it was predominantly black. It has also been widely thought that because lenders and government-assisted institutions like the Federal National Mortgage Association (FNMA) and the Federal Housing Administration (FHA) did not make loans in redlined areas, blacks could not buy homes in those redlined neighborhoods.

Primary Cause of Redlining – Older Housing Stock, Deteriorating Neighborhoods and Adding Higher Density Zoning

Redlining had very sinister origins that often included a city making discriminatory city policy regarding neighborhoods that included people of color. However, the policy was motivated as much by money as by racism. Ultimately, it was not race but the condition of a neighborhood that was the primary reason a lender would redline the neighborhood. Lenders did not like older housing stock, deteriorating neighborhoods, or neighborhoods with apartments or apartment zoning. These were neighborhood conditions that would undermine the viability and desirability of a single-family home loan for a lender.

Older neighborhoods with homes built in the 1800’s did not have indoor plumbing. Homes built in the early 1900’s did not have central air and heat. The neighborhoods with these older homes would attract lower income residents and migrating southern black families because the rents were less expensive. While the housing may have been substandard, it was accessible. The condition of the homes and increasing number of rooming houses and apartments propelled lenders to redline these older neighborhoods.

Government Facilitated Racial Segregation

There is a good argument that the government used zoning to segregate neighborhoods. This might be true and the government’s imposition of racial segregation might have been the seed of some redlining; however, at the very least, redlining was a two-step process. Richard Rothstein in his book, The Color of Law, explains that the 1917 Supreme Court Buchanan ruling banned racial assignments. He also explained that in 1919, St. Louis passed a zoning ordinance that allowed industrial zoning in black neighborhoods and later the St. Louis Planning Commission permitted taverns, liquor stores, nightclubs, houses of prostitution and rooming houses, and houses to be divided up into apartments in black neighborhoods that already had some non-single family uses.

At the same time of this permissive zoning, homes in single family districts, which by and large were white, could not be legally subdivided. “Later in the 20th century, when the Federal Housing Administration (FHA) developed the insured amortized mortgage as a way to promote homeownership nationwide, the zoning practices rendered African Americans ineligible for such mortgages, because banks and the FHA considered the existence of nearby rooming houses, commercial development or industry a risk to the property value of a single-family area.” This detrimental multifamily and commercial zoning might have been inserted into black neighborhoods in an effort to segregate the neighborhood, or because the black community did not have the political influence to prevent this zoning, or because the white civic leadership thought the blacks would benefit from more affordable housing in their neighborhoods and industrial jobs closer to their homes. Nevertheless, the detrimental multifamily and commercial zoning of black neighborhoods came first. Redlining these neighborhoods destabilized by detrimental zoning came second.

Multifamily Zoning Caused Munger Place to be Redlined

This Munger Place home on Victor Street in 1976, before its renovation, was the first home in Munger Place to receive a bank loan as redlining was being lifted. The same urban pioneers that bought this then dilapidated home for $15,000 continue to reside in it today organizing the rotating porch parties for Munger Place neighbors.

My experience in Munger Place and Old East Dallas further validates the premise that it was not race that caused neighborhoods to be redlined. Here in Dallas the City imposed zoning for multifamily apartments, taverns, honkytonks, and other undesirable uses, set the stage for the resulting redlining. Munger Place is a good example of multifamily zoning being the cause of redlining, not a black population being the cause of redlining. Old East Dallas had the greatest number of different languages spoken in Dallas, representing people from across the country and around the world, but there was a comparatively low percentage of black residents.

Munger Place in 1907 Was the Most Expensive Neighborhood in Dallas

Munger Place was the most prestigious and expensive neighborhood in Dallas in 1907, when a home at 5011 Junius sold for $10,500. In the 1930’s, some homes were turned into rooming houses, others added what we would now call ADUs, and other homes were subdivided into four apartments. This was followed, in the 1950’s, with the entire area being rezoned for two-story multifamily apartments. In addition, very inexpensive beer, and wine licenses, not governed by the state liquor control board, were indiscriminately issued by the city. These seedy beer bars began to fill almost every commercial or retail building in Old East Dallas.

Dallas City Council Identified Old East Dallas as Worst Area in City

In 1973, the Dallas City Council Housing Committee, led by City Council person and architect Pedro Aguirre, identified Old East Dallas as the Dallas area with the highest crime rate, most murders, most disease, highest transience rate of residents, and highest rate of dwellings being torn down. FNMA and the banks redlined the neighborhood, not because of black residents, which were very few in Old East Dallas at that time, but because of the deterioration in the neighborhood caused by the multifamily zoning and resulting proliferation of beer-licensed honkytonks. Redlining was the result of this condition of the neighborhood and not the creditworthiness of its residents.

In 1907 Munger Place Home Sold for $10,500, In 1977 Sold for …

The Munger Place home at 5011 Junius sold for $10,500 in 1907. After the corrosive effect of the higher density zoning and the resulting deterioration, the same home at 5011 Junius sold in 1977 for $7,500. Over a 70-year period this home lost 30% of its value.

Economic Incentives to Reverse Migration in an Inner-City Neighborhood

My Master’s Thesis in Public Administration was The Economic Incentives to Reverse Migration in an Inner-City Neighborhood. This thesis was a direct response to the 70-year decline of Munger Place. The core of this thesis discussed the benefits for rezoning Munger Place and 100 blocks of Old East Dallas to single-family zoning. I then chaired the effort to successfully rezone this 100-block area to single family, which prompted FNMA to choose Munger Place for its first inner city lending demonstration area in the country. Munger Place was the first neighborhood in the country where redlining was reversed. The hope or threat of new apartments being built was eliminated. Loans for the first time in decades were available to homeowners to buy a single-family home or buy a four-unit apartment house and renovate it back to its original single-family use.

Bob Logan, an owner of a 1960’s apartment complex, who agreed to be my co-chair of the Property Owners for Single Family Zoning, also initiated the East Dallas Bar Ordinance which prohibited any new city beer and wine licenses to be issued in Old East Dallas. This ordinance shut down hundreds of beer bars. This 100-block single-family rezoned area is now comprised of Munger Place Historic District, Junius Heights Historic District, and Peak Suburban Historic District, reflecting the 45year march back to civility and prosperity.

The house at 5011 Junius, after four decades of neighborhood revitalization, is now worth more than 100 times what it sold for in 1977.

Redlining Also Offered Opportunity for Low-Income Homebuyers

As I look back at the successful effort to reverse the redlining and revitalize the neighborhood, I realize that as bad as redlining was, for a short period it had a positive effect on homebuyers like my artist friends who introduced me to the neighborhood and encouraged me to buy a home. When potential investors with great credit and income were unable to obtain a loan in this redlined area, it forced property owners in Old East Dallas to carry the note and finance the sale of their own properties.

Only because Munger Place was a redlined neighborhood, was I able, a few months after I graduated from SMU, to buy a home with the savings from my college summer job working in a warehouse. As a graduate student working part-time jobs, I would have never qualified for a bank loan. Virtually every home or divided up rent house at that time sold with owner financing. With redlining and the further deterioration of the neighborhood, homes plummeted in price.

These conditions also provided opportunities in the neighborhood for the Hispanic population which relied more heavily on a cash economy. I saw many Hispanic buyers pay cash for small homes for as little as $2,000, and then a few years later buy another home to rent. When redlining eliminated conventional loans for buyers, low-income families were able to make advantageous cash purchases. Mount Auburn homes in Old East Dallas that Hispanics were buying 45 years ago for $2,000 are now worth well over $200,000, and many of these homes are owned by the same owner or by the same family of the original purchaser. Redlining was horrible for the neighborhood and the city, but it actually provided a good opportunity for low-income residents to buy a home and create wealth.

Bluelining Has Devastating Effect on a Neighborhood Without the Benefits of Redlining

Common wisdom says that the way to mitigate the negative effect of segregation and redlining is to pour government subsidies and money to developers in order to promote the building of low-income apartments. This is “bluelining,” and while the intentions behind it may be good, the results are devastating to the neighborhood and especially to its homeowners and potential homeowners.

Bluelining has an even more negative effect on a neighborhood and the city than redlining, because it does not have the silver lining of redlining that can make it easier for low-income families to buy a home and create wealth. In fact, bluelining a neighborhood makes it much more difficult for a low-income family to buy a home. In a blue lined neighborhood, low-income homebuyers must compete with the free government money pouring into developers. Aided by city, state, and federal grants, tax credits, tax exemptions, tax abatements, and zoning perks, developers can pay more for an inexpensive home that they plan to tear down than can an individual homebuyer. This causes the prices of inexpensive homes to go up. Also, when developers purchase these inexpensive homes only to tear them down for low-income apartment developments, that reduces the potential inventory of affordable homes for low-income homebuyers who desire single-family homes.

Redlining Turns Off the Spigot of Lender Money

Redlining a neighborhood turns off the spigot of any lender loans or government backed loans in a neighborhood, which starves the neighborhood of conventional investment.

Bluelining Creates a Firehose of Free Government Money for Developers

Bluelining a neighborhood creates a firehose of free government money and loans for developers so they can buy inexpensive homes to tear down to build low-income apartment developments.

Redlining Drives Down Affordable Home Prices – Bluelining Drives Up Affordable Home Prices

In a redlined neighborhood, low-income homebuyers may ultimately be able to buy homes at depressed prices because speculators and investors with good credit cannot get loans. In a blue lined neighborhood, low-income homebuyers must compete with developers who are getting free money from the government to buy up these affordable homes. Developers will pay more for property if they are spending free money, which drives up prices. Every time a developer acquires an inexpensive home to tear down, the inventory of affordable single-family homes dwindles, leaving fewer opportunities for low-income buyers to buy a home and create wealth.

Bluelining In District 3 Depresses Development Other than Low-Income Apartments, Leaving Hundreds of Acres of Undeveloped Land

District 3 in Dallas has vast tracts of vacant land and smaller tracts of many acres that would be ideal for single-family home development.

Bluelining is more insidious than redlining because redlining stopped new apartments from being built. Bluelining rapidly spawns new apartments, accelerating the decline of a neighborhood. Also, bluelining has a far-reaching effect of stopping any further development other than low-income apartments, which in Dallas District 3 has left vast swathes of vacant land. It is this vacant land that gives District 3 an advantage. This vacant land is ripe for single-family homes that can bring District 3 the revitalization success Munger Place experienced when its redlining was reversed.

Possible Good Intentions of Planning Commissions Resulted in Redlining and Bluelining

Looking back at the history of redlining, another thought comes to mind. While it appears now that the St. Louis Planning Commissions’ decisions in the early 1900’s to allow rooming houses, taverns and industrial uses was racially motivated, I wonder if at the time they were acting with good intentions just like the Planning Commissions in the early 21st century are doing now.

Could it be that the early Planning Commissions of St. Louis and across the country were well intentioned planners who thought they were benefitting the black community by allowing rooming houses and rezoning neighborhoods for multifamily so that black families would have more opportunities for affordable housing?

Just as planners are doing now by bluelining a neighborhood for low-income apartments, were the planners then just following textbook planning models that expanded housing opportunities in low-income neighborhoods? Were planners then like planners now, more flexible with adding a greater diversity of uses in already mixed-use or declining areas than in thriving single-family neighborhoods?

Deteriorating Neighborhoods Prompted Undesirable Zoning Changes

Most of the higher density zoning changes occurred not in all-black neighborhoods, but in older neighborhoods that were going through a transition or were perceived to be in decline. I have not seen any archival material on the 1900’s St. Louis Planning Commission’s motivations, but I wonder if the archives would show these planning commissioners were at the time considered progressives for providing affordable housing opportunities for black people. Now these planning commissioners are looked back on as racists for using zoning to make black neighborhoods less desirable than white neighborhoods, setting the stage for redlining.

Will History View Dallas’ Current Affordable Housing Policies as Racist?

Thinking back on St. Louis brings up the question of how our civic groups, real estate organizations, business groups, developers and city officials will be viewed 20 years or 50 years from now. Presently, anyone that calls for more affordable apartment housing units is praised for being sensitive to the needs of low-income blacks and other minorities needing affordable housing. Many developers that receive free government money to buy properties for their low-income apartment developments are lauded and given awards for their contribution to Dallas affordable housing.

Southern Dallas Residents Oppose Low-Income Apartment Developments Caused by Bluelining

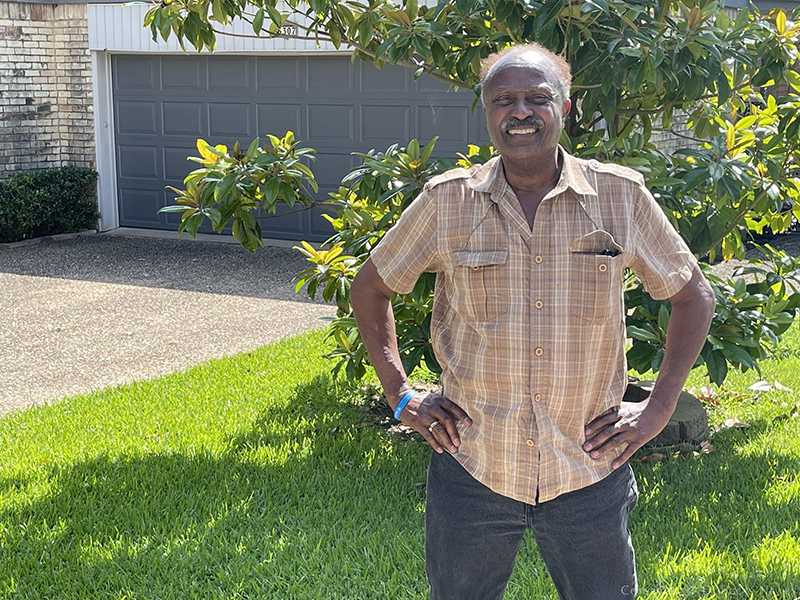

Architect Darryl Baker, retired City of Dallas planner, is an Oak Cliff homeowner in District 3 who is leading the neighborhood opposition to more government money going to developers to build low-income apartments in District 3. He advocates for quality single-family home development in District 3.

Southern Dallas residents, in predominantly black City Council District 3, oppose low-income apartment developments. However, the Dallas establishment and advocates for a Dallas housing plan calling for 20,000 new affordable residential units are clamoring for more low-income apartment developments to satisfy this goal. One group of residents in Dallas City Council District 3 is led by black architect and retired City planner, Darryl Baker. Mr. Baker has written and spoken extensively on stopping the 18th low-income tax credit apartment development in District 3, his Southern Dallas Oak Cliff neighborhood. He and his group have prompted a review at the state level of this development that is proposed to received $33 million in grants from the Housing Finance Corporation, when the developer is only investing $22 million of their own money in this proposed low-income apartment development.

Beautiful land perfect for single family homes will be spoiled by proposed low-income apartments in which a developer is being subsidized by the City of Dallas.

Vacant Land in Southern Dallas District 3 is Perfect for Quality Single-Family Homes

Some of the most beautiful vacant land for single-family homes is in Oak Cliff’s District 3 as seen here in the Bretton Woods neighborhood. It also has the advantage of being inexpensive.

Award-winning architect Ron Womack, FAIA, has been retained to design a modern home on this Oak Cliff lot in District 3 in Bretton Woods neighborhood.

Southern Dallas City Council District 3 has neighborhoods of beautiful homes and is also a district with vast amounts of inexpensive vacant land perfect for quality single-family homes. It is ironic that apartment construction costs per square foot are higher than single-family construction costs per square foot, and yet the city’s primary push is to build more “affordable apartments” in Dallas. This push for new “affordable apartments” is even more disappointing when an affordable apartment might rent for $1,000 a month, which is sometimes more than the monthly costs (mortgage, taxes, insurance) of buying a single-family home in the same neighborhood.

In 2021 Low Income Apartment Developers and Dallas Establishment Are Praised for Advocating for More Apartments

In 2021, low-income developers, housing advocates, and civic real estate groups, are revered for supporting the city’s call for 20,000 more units of affordable housing. Is this that much different than civic leaders 100 years ago in St. Louis advocating for more rooming houses and affordable apartments in black neighborhoods?

Every time the city, state, or federal government subsidizes a low-income apartment development in a neighborhood, that diminishes the neighborhood’s chances to attract quality single-family homes and services that single-family neighborhoods attract.

Is 1900‘s St. Louis and 2000‘s Dallas Playbook the Same?

In the 1900’s, higher density uses, liquor stores, and industrial uses prohibited in white single-family neighborhoods were allowed in black St. Louis neighborhoods. In the 2000’s, higher density uses, liquor stores, and industrial uses, not found in white single-family Dallas neighborhoods, are allowed and even subsidized in Southern Dallas’ predominantly black neighborhoods. Those that push for black homeownership in Southern Dallas that creates wealth for black families are often told that there are not any affordable single-family homes where anyone would want to live. Could there be an underlying assumption that black families are not capable of renovating a dilapidated home, or revitalizing a deteriorated neighborhood, or even owning a home?

“Communities of color have been expected to be poor in Dallas for far too long. My neighbors have stood up and shouted back a resounding ‘NO’ to City Hall.”-Darryl Baker, Black Architect, Retired Dallas City Planner

District 3 in Southern Dallas Has the Most Potential Of Any Neighborhood In Dallas

Home on Gladiolus Lane in Brenttonwood Neighborhood.

Large lots accentuate desirability of Kimball Square Neighborhood.

Adding to the desirability and beauty of the Coombs Creek neighborhood, is an overlook placed along Five Mile Creek.

Kiest wood neighborhood trail and bike path run through Oak Cliff.

Kiest wood home set back into nature.

Midcentury homes take advantage of the topography of the Kiest wood neighborhood.

Kiest wood has a very large collection of midcentury homes.

Kiest wood topography accentuates homes.

Dallas District 3 has the luxury of land that can be thoughtfully prepared for quality single-family homes and neighborhoods.

Many Dallas neighborhoods are already built with homes too close together and without the influence of nature. District 3 has fresh land for a more organic urbanism approach.

Southern Dallas neighborhoods like those found in District 3 have more potential to be a thriving 21st century neighborhood than any neighborhood in Dallas, because it has the luxury of vacant land. These neighborhoods can flourish by expanding on their strong single-family neighborhoods already in place. Southern Dallas can also flourish by taking advantage of this asset no other area of Dallas has—abundant inexpensive vacant land. The city could zone this land for single-family homes and create and pay for a beautiful infrastructure of parkways, boulevards, sidewalks, street lights, trees, and greenways like those found in Greenway Parks, Swiss Avenue, Highland Park, Volk Estates and Munger place. The City of Dallas should be spending money on the neighborhoods, not spending money on developers to build apartments.

The Alternative Is to Continue Bluelining Southern Dallas Neighborhoods

The alternative is for Dallas to continue bluelining Southern Dallas neighborhoods for low-income apartment development that undermines the value of the current single-family homes in the district and undermines the future development of single-family homes in the district.

History Will Be the Judge

Munger Place flourished when it was rezoned single family and the redlining was reversed. It became a national example of inner-city revitalization. District 3 can flourish if bluelining is reversed. The Oak Cliff neighborhoods in District 3 can be a national example of a neighborhood transformed by vacant land dedicated to a beautiful infrastructure of greenways, boulevards, trees, sidewalks, and new quality single-family homes. Those in favor of past redlining and current bluelining probably had the best intentions for low-income residents. History will be the judge if redlining or bluelining a neighborhood is considered more racially egregious. Redlining was like turning off the irrigation to a neighborhood that was wilting. Bluelining was like irrigating and fertilizing the weeds (low-income apartments) that overshadowed and starved off single-family homes and quality development.

Dallas Leadership Has Opportunity to Buck the National Bluelining Trend

The leadership in Dallas now has the opportunity to buck the national trend of bluelining and set a path for prosperous, thriving, Southern Dallas neighborhoods through organic urbanism and quality single-family home development.

Where else in Dallas other than Oak Cliff can Dallas and a developer plan a single-family home neighborhood around creeks, hills, and trees.

Douglas Newby is a national award-wining real estate broker who writes about real estate, cities, architecture and Organic Urbansim. He gave the TEDx Talk Homes That Make Us Happy. You can read more about him and his work on his website Architecturally SignificantHomes: DougNewby.com and on his blog DouglasNewby.com.