Everyone knows that subprime mortgages lie at the root of our current financial crisis. Lenders originated too many of them, they were securitized amidst an increasingly complex credit market, and the bubble popped. The rest is painful history. read more »

Economics

Rust Belt Outliers

What kind of migration patterns will emerge as a result of the current economic downturn? The recession is uneven; some places are much worse off than others. Those differences can give labor cause to move. Economic geographer Edward Glaeser thinks cities with marginal manufacturing legacies should attract a lot of people because the well-educated, living in dense urban environments, should get through the crisis relatively unscathed. If Glaeser is correct, then shrinking Rust Belt cities can expect more of the same even after the recovery begins in earnest. Pittsburgh brains should continue to drain. read more »

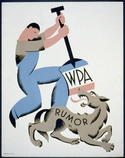

Why We Need A New Works Progress Administration

As the financial bailout fiasco worsens, President Obama may want to consider a do-over of his whole approach towards economic stimulus. Instead of lurching haphazardly in search of a "new" New Deal symphony, perhaps he should adapt parts of the original score.

Nothing makes more sense, for example, than reviving programs like the Works Progress Administration (WPA), started in the 1935, as well as the Civilian Conservation Corps (CCC), begun in 1933. These programs, focused on employing young people whose families were on relief, completed many important projects – many still in use today – while providing practical training to and instilling discipline in an entire generation. read more »

Story of the Financial Crisis: Burnin’ Down the House with Good Intentions and Lots of Greed

Last week, the Chairman of the Federal Reserve, Ben Bernanke, told Congress that he didn’t know what to do about the economy and the repeated need for bailouts. This week, the Oracle of Omaha Warren Buffett, Chairman of Berkshire-Hathaway told the press that he couldn’t understand the financial statements of the banks getting the bailout money. read more »

Cash, Not Pretense: An Entrepreneur's Guide to the Credit Crisis.

Compared with most businessmen, 41-year-old Charlie Wilson has some reason to like the economic downturn. President of Salvex, a Houston-based salvage firm he founded in 2002, Wilson has seen huge growth in the bankruptcy business over the past year. It is keeping his 10-person staff, and his 55 agents around the world, busy. read more »

Compensation Confidential

The salary of the chief executive of a large corporation is not

a market award for achievement. It is frequently in the nature of a warm personal gesture by the individual to himself.

John Kenneth Galbraith

What would Galbraith have said about the AIG bonuses? read more »

Why The Stock Market Matters

My father was a career enlisted man in the United States Air Force. I was in the third or fourth grade when he graduated from high school. My mother graduated from high school after I was married. My dad worked for several companies after his Air Force career. He was working for Disney when he died. My mother worked part time in child care from time to time. read more »

The Former East Germany: Is It Time for Red Nostalgia?

2009 marks the 20th anniversary of the reunification of East and West Germany into one country. Germany was divided into two separate nations with competing economic and political ideologies. Now it’s time to reassess the results of this melding of two very different systems and the impact on the urban environment.

Emerging from the ashes as one of the world’s most powerful economies, Germany may be the quintessential example of the triumph of capitalism over communism. Yet now with Frankfurt’s powerful banking sector reeling from the global economic meltdown, reticent Marxists may well be coming out of the woods to proclaim the death of capitalism. read more »

One Fundamental Problem: Too Many People Own Homes

Ben Bernanke made the following statement as he attempted to justify bailing out bad borrowers:

“…from a policy point of view, the large amount of foreclosures are detrimental not just to the borrower and lender but to the broader system. In many of these situations we have to trade off the moral hazard issue against the greater good.” – Ben Bernanke, February 25, 2009

I think he is wrong on this, and the moral hazard issue is only a small part of my objections. read more »

Sunbelt Indianapolis

For decades, the overwhelming majority of population and economic growth has occurred in the Sun Belt – the nation’s South and West as defined by the United States Bureau of the Census. This broadly-defined area stretches south from the Washington-Baltimore area to the entire West, including anything but sunny Seattle and Portland. Any list of population growth or employment growth among the major metropolitan areas will tend to show the Sun Belt metropolitan areas bunched at the top and the Frost Belt areas (the Northeast and Midwest regions) bunched at the bottom. read more »