Demographic projections have become an essential tool of national, state and local governments, international agencies, and private businesses. The first step in planning for the future is to get a picture of what the terrain is going to look like when you get there. That’s mainly what I do for clients, audiences and subscribers, and demographics provide the frame (like assembling all the straight-edge pieces of a jigsaw puzzle first). read more »

Housing

Will New Urbanists Deliver A Home-Win With Miami 21?

By Richard Reep

“A walkable city, more like… Manhattan, Chicago, or San Francisco,” is how The Miami Herald characterizes the future of Miami under Miami 21, the new form-based code adopted on October 22nd by the Miami City Commission. This seems to be the hot new dream not just of Miami, but of all cities struggling under corruption and greed, codes and regulations, with an imagined underground urbanity, yearning to breathe free. Citizens may now expect to see Miami remodeled after cities that grew before the car came, but the lyrics to The Who’s “Won’t Get Fooled Again” echo in the minds of some: “Meet the new boss…same as the old boss.” read more »

When Granny Comes Marching Home Again... Multi-Generational Housing

During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing 22.11% of its value and trillions of investor equity. The Federal Government pushed a $700 billion bail-out through Congress to rescue the beleaguered financial institutions. The collapse of the financial system in the fall of 2008 was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

*******************************************

The driveway tells the story. The traditional two-story 2,200 square foot suburban home has a two-car attached garage. Today’s multi-generational families fill the garage, the driveway and often also occupy the curb in front of the home. The economic crisis that is transforming America is also changing the way we live. The outcome will change the way America views its housing needs for the balance of the 21st Century. read more »

So Much for Evidence-Based Planning

Has evidence-based planning fallen from grace in favour of catchy slogans and untested assumptions? In the case of urban planning, arguably that is just what’s happened. The evidence, in Australia at least, is worrying.

“We must get people out of cars and onto public transport.” “We must stop urban sprawl and the consumption of valuable land.” “We must build higher density communities to achieve sustainable environmental outcomes.” Phrases like this are now de rigueur across many discussions about urban planning in the media, in politics and in regulatory circles in Australia. They are rarely challenged on the basis of what the actual social, economic or scientific evidence is really saying. read more »

Housing Bubbles: Why are Americans Ignoring Reality?

Dr. Housing Bubble (based in California), in "The comprehensive state of the US housing market", asserts that of the 129 million residential units in the United States, some 15,950,000 are vacant, resulting in a huge oversupply of residential stock across the country.

Other United States commentators are making the same assertions, such as Colin Barr of Fortune magazine with "Housing market still faces a big glut". read more »

When the Fat Lady Sings: The Fate of Commercial Real Estate

During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing trillions of investor equity. The Federal Government pushed TARP, a $700 billion bail-out, through Congress to rescue the beleaguered financial institutions. The collapse of the financial system was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

*********************************** read more »

California: The Housing Bubble Returns?

To read the periodic house price reports out of California, it would be easy to form the impression that house prices are continuing to decline. Most press reports highlight the fact that house prices are lower this year than they were at the same time last year. This masks the reality of robust house price increases that have been underway for nearly half a year. The state may have forfeited seven years of artificially induced house price escalation in just two years but has recovered about one-fifth of it since March. read more »

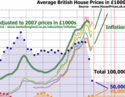

Predicting the Future of British House Building

People are expecting British house building to pick up. Sadly they will be disappointed, even as the housing market inflates into another bubble.

There have been declines and recoveries in British house building before the 2007 collapse in construction activity. Data is in abundance. The total number of homes built annually has more than halved since the late 1960s, as successive governments withdrew from publicly funding the post-war welfare programme of council house building. read more »

- Login to post comments

Honest Services From Bankers? Increasingly Not Likely

Once you understand what financial services are, you’ll quickly come to realize that American consumers are not getting the honest services that they have come to expect from banks. A bank is a business. They offer financial services for profit. Their primary function is to keep money for individual people or companies and to make loans. Banks – and all the Wall Street firms are banks now – play an important role in the virtuous circle of savings and investment. When households have excess earnings – more money than they need for their expenses – they can make savings deposits at banks. Banks channel savings from households to entrepreneurs and businesses in the form of loans. Entrepreneurs can use the loans to create new businesses which will employee more labor, thus increasing the earnings that households have available to more savings deposits – which brings the process fully around the virtuous circle. read more »

- Login to post comments

Congress and the Administration Take Aim at Local Democracy

Local democracy has been a mainstay of the US political system. This is evident from the town hall governments in New England to the small towns that the majority of Americans choose to live in today.

In most states and metropolitan areas, substantial policy issues – such as zoning and land use decisions – are largely under the control of those who have a principal interest: local voters who actually live in the nation’s cities, towns, villages, townships and unincorporated county areas. This may be about to change. read more »