Ian Hathaway at the Center for American Entrepreneurship recently took at look at startup financing to see whether tech was dispersing or concentrating. He found that first financings remain heavily concentrated in the top five markets:

Among his findings:

• After a stellar five-year period of expansion, a sharp contraction in the number of startups raising a first round of venture capital has occurred the last three years—falling to 2,496 first financings in 2017 from a peak of 3,465 such deals in 2014, for a decline of 28 percent. It previously rose 155 percent over the five years between 2009 and 2014, up from 1,360 deals.

• This contraction has been geographically widespread. Fewer metro areas had a startup that raised a first round of venture funding and those that did had a smaller number of them. More than three-quarters of U.S. metropolitan areas had either no activity or declining activity in first financings between 2013-14 and 2016-17 (for the metro-level analysis, data are pooled into two-year periods to reduce year-to-year noisiness).

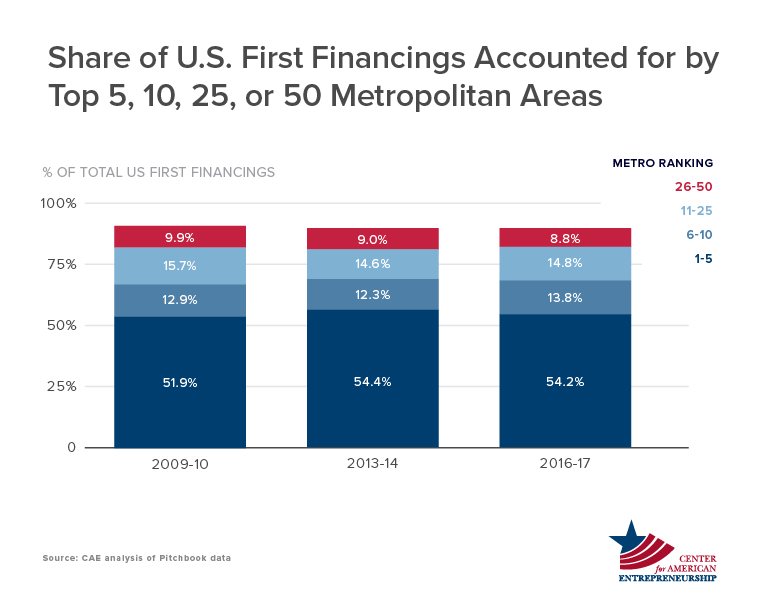

• First financings are still highly concentrated among a small number of cities. In 2016-17, five metros captured 54 percent of all U.S. first financings and ten metro areas accounted for 68 percent. That represents a slight expansion from 2009-10, when those same figures were, respectively, 52 percent and 65 percent.

• But, a number of startup communities continue to expand—including Boulder, Columbus, Indianapolis, Charlotte, Denver, and Durham-Chapel Hill. Key metros with relative rises (stable or slight declines during the period of sharp contraction overall) include Madison, San Diego, Pittsburgh, Raleigh, Houston, Baltimore, Seattle, Ann Arbor, Honolulu, Philadelphia, and Santa Barbara, among others.

Click over to read the whole thing.

This piece originally appeared on Urbanophile.

Aaron M. Renn is a senior fellow at the Manhattan Institute, a contributing editor of City Journal, and an economic development columnist for Governing magazine. He focuses on ways to help America’s cities thrive in an ever more complex, competitive, globalized, and diverse twenty-first century. During Renn’s 15-year career in management and technology consulting, he was a partner at Accenture and held several technology strategy roles and directed multimillion-dollar global technology implementations. He has contributed to The Guardian, Forbes.com, and numerous other publications. Renn holds a B.S. from Indiana University, where he coauthored an early social-networking platform in 1991.

Photo by David Shankbone [CC BY 3.0 ], from Wikimedia Commons