There is currently a significant shift happening in the USA, with cuts to government expenditure, and ambitions to reduce the regulatory burden. This creates institutional pressure for reforms of taxation, government spending and regulation also across the Atlantic.

The large European countries which are today stagnating, have in fact numerous reasons to reform their tax and regulatory burdens.

The first reason is that stagnation is the result of the high tax levels. During the 2010s, those advanced economies that had a lower tax burden had more economic growth. The same was true in the 2000s, the 1990s, the 1980s and the 1970s. The pattern that low taxes stimulate growth is a common theme in human history.

In accordance with this pattern, none of the high tax European economies are thriving with prosperity growth currently.

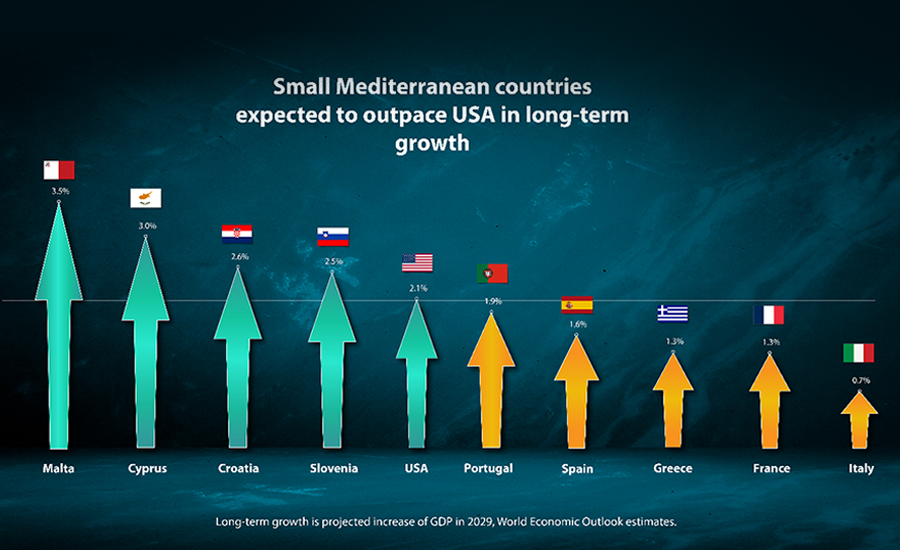

Compared to the USA, the large European economies have stagnated in prosperity growth for a couple of decades already. They are expected to keep behind in growth until 2029, yet this is not true of all European countries.

If we focus on the Mediterranean nations indeed Italy, France, Greece and Spain all are expected to lag behind the USA in growth also in the coming years. Portugal is however estimated to grow similarly to the USA while Slovenia and Croatia are expected to outpace it. Malta and Cyprus are expected to significantly outpace the USA in growth.

The pattern is that the smaller European economies, which are the ones offering low taxes and business friendly policies, are growing. In this column this is shown for the Mediterranean regions, but the same holds true in northern Europe – where for example Estonia and Ireland are growing while Germany and the UK are stagnating.

The large European economies are being stressed by the USA growing faster than them, while also their smaller neighbors are attracting talents, businesses and investments. The smaller European nations typically have more nimble government sectors reducing the taxation burden. Also, less public expenditure means less crowding out of private sector activity.

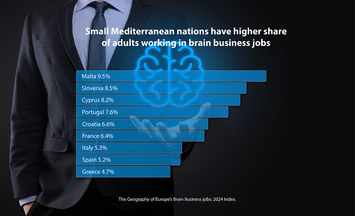

European nations are competing to attract knowledge intensive jobs. A comparison of the Mediterranean region shows that Greece, where Plato created the first Western institution of higher learning 2,400 years ago, has the lowest share of adults employed in very knowledge intensive jobs. Spain and Italy also have low rates, as does France. Many of the great universities through history have developed in the three latter countries, and they are home to some of the greatest artists in history - but these nations are despite their deep history of human civilization behind in the Mediterranean knowledge intensive race.

Croatia and Portugal have a relatively high share of adults employed in highly knowledge-intensive jobs. Cyprus and Slovenia have an even higher share. Malta is the leading knowledge intensive hub of the Mediterranean. The smaller European countries, with lower taxes and more business-friendly policies, are attracting more knowledge intensive jobs.

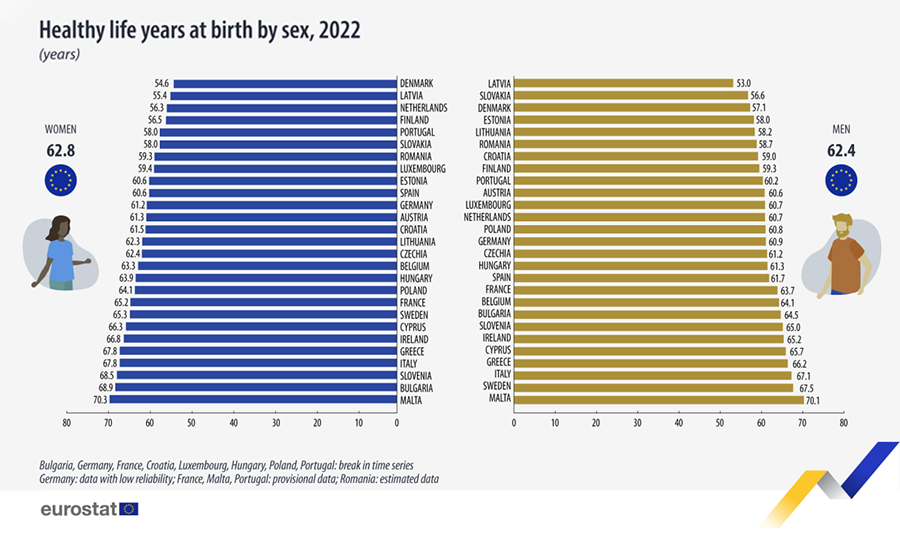

The European nations with higher taxes are falling behind in growth, and in the knowledge intensive jobs race. They are not benefiting from better welfare, as a result, though. In fact, even in this regard the lower tax countries tend to fare better.

As we show in an up-coming book with Professor Stefan Fölster, systematically today the pattern is also that countries with a lower tax burden have the best welfare results. Particularly education and labour market welfare are better in low tax countries, health is similar but the top ranking countries with longest life spans are today low tax nations. In Europe Malta is leading the healthy life expectancy league. High tax Denmark, on the other hand has least healthy life years expected for women and amongst the least for men.

This is probably interesting for Americans, who are interested in comparing the welfare outcomes of different European systems. Denmark has the advantage of having been a rich developed economy for long and having high taxes. Malta has the benefit of good climate combined with low taxes, despite historically being behind in development it is catching up in prosperity as well as welfare outcomes. The Mediterranean climate might help, but nonetheless the pattern is that low taxes might give more for less burden. Malta with lower taxes is leading the healthy life expectancy, while the high tax Danish welfare state is at the bottom.

The large economies in Europe are stressed, since they are being outrun by the USA in growth and reform pace, and since they are in Europe being outrun in prosperity, knowledge jobs and welfare outcomes.

This stress is ultimately good, since it will allow for growth inducing reforms, for the large European economies to escape stagnation. Europe already has a thriving free market model, it works great in the smaller nations in delivering welfare, prosperity and knowledge intensity. Through the institutional competition that through the millennia has the hallmark of European success, growth-inducing policies will spread.

Nima Sanandaji, Director, European Centre for Entrepreneurship and Policy Reform (ECEPR)

Graphs: courtesy the author.