Lately, Texas has been noted frequently for its superior economic performance. The most recent example is the CNBC ratings, which designated the Lone Star state as the top state for business in the nation. Moreover, Texas performed far better than its principal competitor states during the Great Recession as is indicated in our How Texas Averted the Great Recession report, authored for Houstonians for Responsible Growth.

Introduction: How Texas averted the Great Recession:

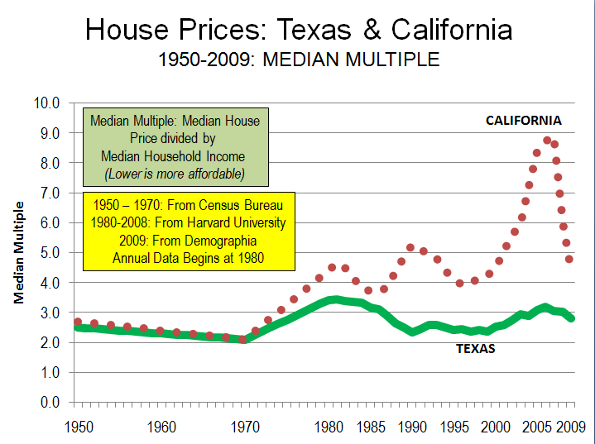

One reason that Texas did so well is that it fully escaped the “housing bubble” that did so much damage in California, Florida, Arizona, Nevada and other states. One key factor was the state’s liberal, market oriented land use policies. This served to help keep the price of land low while profligate lending increased demand. More importantly, still sufficient new housing was built, and affordably. By contrast, places with highly restrictive land use policies (California, Florida and other places, saw prices rise to unprecedented heights), making it impossible for builders to supply sufficient new housing at affordable prices (overall, median house prices have been 3.0 times or less median household incomes where there are liberal land use policies).

The Great Recession: The world-wide Great Recession was the deepest economic decline since the Great Depression: This downturn hit average households very hard. According to Federal Reserve Board "flow of funds" data, gross housing values declined 9 quarters in a row through the first quarter of 2009. The previous modern record is a single quarter. From the peak to the trough, household net worth was reduced a quarter, which is more than 1.5 times the previous record decline.

Texas Largely Avoided the Great Recession. Texas has largely escaped the economic distress experienced around the nation, and especially that of its principal competitors, California and Florida. By virtually all measures, Texas has performed better in growth of gross domestic product, employment, unemployment, personal income, state tax collections, and consumer spending This is in part due to much less mortgage distress in Texas. At the bottom of the economic trough, the Brookings Institution Metropolitan Monitor ranked the performance of the 6 largest Texas metropolitan areas among the top 10 in the nation. The latest Metropolitan Monitor ranked each of the 6 metropolitan areas in the highest performance category.

Throughout the past decade, Texas has experienced far smaller house price increases than in California, Florida and many other states. During the bubble, California house prices increased at a rate 16 times those of Texas, while Florida house prices increased 7 times those of Texas. As a result, after the bubble burst, subsequent house price declines were far less severe or even non-existent in Texas. Texas had experienced its own housing bubble in the 1980s, however even then overall prices did not exceed the Median Multiple of 3.0 (The Median Multiple is the median house price divided by the median household income).

Unlike Texas, all of the markets with steep house price escalation had more restrictive land use regulations. This association between more restrictive use regulation and higher house prices has been noted by a wide range economists, from left-leaning Nobel Laureate Paul Krugman to the conservative Hoover Institution’s Thomas Sowell. It is even conceded in The Costs of Sprawl ---2000, the leading academic advocacy piece on more restrictive land use controls, which indicates the potential for higher house or land prices in 7 of its 10 recommended strategies.

Comparing Texas and California: Unlike California, housing remained affordable in Texas. California’s housing affordability - in relation to income – largely tracked that of Texas (and the nation) until the early 1970s (Figure). After more restrictive land use regulations were adopted prices started to escalate. This relationship has been well demonstrated by William Fischel of Dartmouth University. Other factors have had little impact. Construction cost increases have been near the national average in California. Other factors, like underlying demand as measured by domestic migration, have been lower in California than in Texas..

Comparing Texas and Florida: The contrast with Florida is similar. Housing affordability in Florida was comparable to that of Texas as late as the 1990s. However, with strict planning control of land for development in Florida, land prices rose substantially when profligate lending increased demand.

Comparing Texas and Portland: Further, the Texas housing market avoided the huge price increases that have occurred in Portland (Oregon), which relies on extensive restrictive land use regulation. In 1990, Portland house prices relative to incomes were similar to those of the large Texas metropolitan areas. At the recent peak, the median Portland house price soared to approximately 80% above Texas prices. Portland did not experience the price collapses of California, but due to the greater price volatility associated with smart growth price declines in relation to incomes that were five times those of Texas.

How the Speculators Missed Texas: Speculation is often blamed as having contributed to the higher house prices that developed in California and Florida. This is correct. Moreover, with some of the strongest demand in the United States, Texas would seem to have been a candidate for rampant speculation. After all, it happened back in the 1970s when a huge oversupply of housing, industrial, retail and office space collapsed in the face of falling energy prices.

But it did not happen this time, despite solid population growth. During the housing bubble, Dallas-Fort Worth and Houston ranked second and third to Atlanta in population increases among metropolitan areas with more than 5 million population. Austin is the nation’s second fastest growing metropolitan area with more than 1 million population. Each of these metropolitan areas had strong underlying demand, as indicated by domestic migration data.

Yet the speculators were not drawn to the metropolitan areas of Texas. This is because speculators or "flippers" are not drawn by plenty, but by perceived scarcity. In housing, a sure road to scarcity is to limit the supply of buildable land by outlawing development on much that might otherwise be available.

However, the speculators did not miss California and Florida. Nor did they miss Las Vegas or Phoenix, where the price of land for new housing rose between five and 10 times as the housing bubble developed. Despite their near limitless expanse of land, much of it was off limits to building, and the exorbitant price increases were thus to be expected.

The Threat: Yet, despite the success of the less restrictive land use policies in Texas, there are strong efforts there to impose more smart growth policies. The impact could be devastating, especially from strategies that ration land that would raise land and house prices, as has occurred in California and Florida. In 2009, Governor Perry vetoed a bill that would have required the state to promote smart growth. Federal initiatives, under proposed climate change and transportation acts could do much to destroy not only the affordability of Texas metropolitan markets, but could also make Texas less competitive in the decades ahead.

Photograph: Suburban San Antonio (by the author)

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

I just wonder if this can

I just wonder if this can work out from best wordpress themes 2015 that can based on wordpress themes 2015.

--------------

Everything can be done from best collection wordpress themes & best wordpress themes 2015

It is good to work with

It is good to work with these ideas about the development and how we can apply the same way.

--------------

http://www.proweb365.com/web-design

http://www.proweb365.com/services

Domino effect of the

Domino effect of the recession is still felt today, especially in some countries. It's very devastating recession. But it also provides very valuable lessons for economists, policy makers and market participants. In order for them to be more careful in making policies to anticipate such crisis will be not repeated. specforce alpha reviews

It is a wellspring of online

It is a wellspring of online business sector which inspire privet riches application that are handling get cash in the online business. We need to do a substantial specialized result in here. You don't have to inquiry any data of an alternate site. We are including all of discretionary, in fact and different information in here. You have to stick to the straightforward suggestions and use the force of use and accommodation rapidly. Private riches application has skimming application mode are honestly usable. Privet well being application has been accomplishing genuine profit from it. We furnish respectable choice with you. In the event that you need to get opportunity you ought to enter into with this. It is accomplishment of key to individual client.Fast Income App Reviews

High Frequency Trading App

Visual offer is a single of the least demanding techniques to mix the eagerness of any ordinary human sitting tight. Is has been amongst the most abused instruments in progressions for quite a while. Any affiliation trying for stretching arrangements through pushing and diverse activities utilizes this truth to its benefit. Land business is no exception and there are different firms that accumulate in the production of true area flyers. They show the house that is accessible to be bought and notice the superb business locales that it has. High Frequency Trading App

If you plan for

If you plan for a pregnant woman, take the initiative to protect them. We all know that I hate wearing them, because they take care of themselves how effective is birth control,such as using condoms, do not rely on your face.

Best Online Quick Income Way

At the point when chipping away at the web having an online brand will serve to lessening your deliberations while expanding your showcasing adequacy. Numerous hurrying their approach to online wealth have a tendency to neglect this part of their business advancement methodology. Being that brand building does not gain you a prompt wage it is straightforward why forceful advertisers might basically put it further down on their this site...Best Online Quick Income Way

ne reason that Texas did so

ne reason that Texas did so well is that it fully escaped the “housing bubble” that did so much damage in California, Florida, Arizona, Nevada and other states.samuel

the point of sardining is to

the point of sardining is to make as much money as possible for those who already have the most . This is the raw truth that fuels the hype, and of course pays for it as well. zorpia

This served to help keep the

This served to help keep the price of land low while profligate lending increased demand. More importantly, still sufficient new housing was built, and affordably. By contrast, places with highly restrictive land use policies (California, Florida and other places, saw prices rise to unprecedented heights),icon brickell for sale