NewGeography.com blogs

Anyone who needed a poll by the LA Times and LA Business Council Institute to tell them that overwhelming numbers of Angelenos consider homelessness the city’s biggest problem hasn’t been paying attention for quite a while.

And anyone who thinks homelessness in LA can be addressed without confronting public corruption overlooks a problem that tears the fabric of the city.

The odor of corruption hangs over a deal at a warehouse at 1426 S.Paloma Street on the industrial edge of Downtown LA. The City Council and Mayor Eric Garcetti approved a lease that requires $35,000 a month in rent for space to be converted into a 115-bed homeless shelter there. They’ve also agreed to pay a nonprofit $4 million a year to run the shelter.

The numbers involved are relatively small compared to the $1.2 billion voters approved under Prop HHH three years ago to address the crisis.

You can look here to see why they nevertheless indicate the potential for much bigger problems.

And you can consider these 10 questions, which Garcetti has been unable or unwilling to answer for weeks and months while the shelter has yet to open even as the city pays $35,000 a month to the landlord:

- Why isn't there a homeless shelter in operation at 1426 S. Paloma Street?

- What sort of market analysis was done on the lease

- Do plans still call for the development of a shelter at the property

- If so, when is it expected to open?

- Are there any concerns that the landlord of the property has been involved in cases of money laundering and counterfeiting in the past?

- How was Home at Last CDC chosen as the operator of the homeless shelter?

- How was the $4 million annual value of Home at Last CDC’s services determined?

- Are there any concerns that Home at Last CDC has recently demonstrated a lack of organizational capacity and transparency about its operations?

- Are there concerns that city documents indicate plans for 60 fulltime employees to staff a 115-bed facility?

- Has the city surveyed industry standards on staffing levels for emergency shelters?

These shouldn’t be tough questions for a mayor with hundreds of public employees on his staff, including dozens dedicated to communications and homelessness programs.

They are offered without apology because the people of anyrepresentative democracy has a right to know – and because LA will never meet the challenge of homelessness unless we start to talk about public corruption.

Jerry Sullivan is founder and chief columnist for SullivanSaysSoCal.com @SullivanSaysSC

The folks at EMSI, a labor market analytics firm, have issued their latest Talent Attraction Scorecard. They look at, among other things, the places that are gaining the most skilled workers. Obviously their ranking heavily correlate with population growth. What I found most interesting is their specific look at smaller counties and even “micro-counties” with a population of less than 5,000. Plenty of names you might not know but are worth checking out.

Also, I couldn’t resist posting the “This City Is Making a Comeback” bingo game that was circulating on the internet recently. Pretty hilarious. Of course, there’s nothing wrong with having most of these things. In fact, they are great to have. But still a fun meme.

This post first appeared on aaronrenn.com.

Heartland Forward is a first-of-its-kind "think and do" tank committed to advancing economic performance in the center of the United States.

President and CEO of Heartland Forward Ross DeVol, states: "Throughout my decades of research experience, I've observed that national research and policy discussions too often overlook the center of the country, especially its small cities and rural areas. The Heartland region faces more economic challenges than the coasts, but it also holds immense potential, and that's why I felt so strongly about launching an organization like Heartland Forward."

You can learn more about the organization at www.heartlandforward.org

London’s Daily Telegraph reported on September 21 that the cost of HS-3, the high-speed rail line from London’s Euston Station to Birmingham, Manchester and Leeds is now expected to cost £106.4 Billion. The Telegraph notes that this cost is double the amount maintained by former Prime Minister Theresa May’s government until her recent resignation. In fact, the cost is more than three times the £33 billion announced in 2010, which is indicated in a detailed times in the Telegraph article.

Chapman University President Emeritus and Professor of Economics Jim Doti gave more than the red meat of prognostication at the recent mid-year update on the economic forecast from the A. Gary Anderson Center at the Argyros School of Business and Economics.

Doti also offered a couple of headscratchers to the crowd that gathered at the Musco Center on Chapman’s central-casting campus in Orange. It was the sort of stuff that takes an economist to come up with but offers a fair intellectual challenge to anyone who cares to consider the data and analysis behind the econometrics involved.

Here’s the short version: Doti told the crowd that Orange County’s housing market is a bit underpriced these days.

Underpriced?

With a median price for a single-family home well above $700,000?

Yes, declared Doti, who backed up his contention with some research by a class of Chapman students under his supervision.

The research was based on four key data points produced with the application of regression analysis to assign dollar values to certain aspects of OC’s housing market.

All of that was factored into an equation to compare OC with 107 other metro markets across the U.S., as measured by the federal government as of 2016, the most recent data available.

The four factors were:

• Median prices for single-family homes, as reported by the U.S. Census Bureau

• Median household income, as reported by the Bureau of Economic Analysis of the U.S. Department of Commerce

• A score for natural amenities that considers factors such as weather and other quality-of-life conditions, as reported by the U.S. Department of Agriculture

• Pacific Ocean shoreline

The analysis compared OC’s 2016 median home price of $733,000 to the $322,000 median nationwide.

Then it applied the regression analysis to account for the difference, figuring how much a higher median income, plentiful natural amenities such as a Mediterranean climate and varied topography, and 42 miles of coastline add to the value of a house in OC.

Here’s how Doti and his econometrics crew figured it:

Take the national median home price of $322,000.

Consider that OC’s median household income was $86,000, about 25% higher than the national level of $68,800. Factoring that in as part of a mean-regression calculation adds $137,000 to the price of a home in OC, based on a broader market of would-be buyers able to pay more.

Also consider OC’s amenities score of 8.74 from the USDA compared with an average 3.05 for the 3,142 counties throughout the U.S. That’s good enough, according to Doti’s analysis, to tack another $95,000 to the price of a home in OC.

Then there’s the proximity to the Pacific Ocean, which adds another $194,000 to the market for OC homes.

Add it up: $322,000 + $137,000 + $95,000 + $194,000=$748,000.

That’s slightly more than the median of $733,000 recorded for 2016.

And that’s economics – as explained by Doti with the help of some econometrics that help drill down on the supply and demand of OC, where homes are so expensive in no small part because the market is so attractive.

Jerry Sullivan is founder and chief columnist for SullivanSaysSoCal.com.

Anyone else notice that Orange County continues to square up on homelessness in a way that escapes neighboring Los Angeles?

Sure, LA’s challenge is larger. But so are the resources that both the City of LA and County of LA have at their disposal.

The least LA officials could do is check out what seem to be some best practices in OC, from the court order that led to a genuine effort to find housing for homeless folks living along the Santa Ana River to a new program aimed at helping military veterans off the streets.

The program for vets stems from Assemblywoman Cottie Petrie-Norris’ success in getting $2.9 million from the state budget for the current fiscal year for the Welcome Home OC program of United Way. The program involves the County of Orange, Orange County Housing Authority, the Apartment Association of Orange County, individual property owners and various service providers.

The money from the state will be used to provide homeless individuals with vouchers for rental assistance in OC. United Way has lined up owners of private property to participate in the program.

The most recent count of homeless folks in OC brought an estimate of 312 vets.

There currently are two projects in the works and on track to deliver a combined 124 units of housing for homeless vets. The rent vouchers under the $2.9 million for the Welcome Home OC program are expected to be enough to get the remaining 188 homeless vets into existing rental units for a year.

That comes to about $15,500 per person for the voucher program.

Compare the benchmark of the OC program with the more than $600 million budget of the City of LA – and there was more spending by the County of LA – for programs that led to a net increase of 11,400 homeless individuals getting housed last year. The increase is based on a comparison with the annual totals of homeless individuals getting housing in 2014, before voters approved extra taxes to raise billions of dollars for city and county programs.

The cost in LA comes to a minimum of $38,771 per person, about 150% higher than OC – and that’s before you even factor in the county’s spending alongside the city’s budget.

Perhaps LA could send a contingent down to OC to study best practices, especially when it comes to deploying the assets of the private sector in matching some segments of the homeless population with existing rental units.

Jerry Sullivan is founder and chief columnist for SullivanSaysSoCal.com.

Most Houstonians are familiar with Houston's most famous piece of graffiti, the "Be Someone" message in giant letters on the Union Pacific bridge over I45 north of downtown. It's gone through a lot of iterations and defacement over the years, including recently, but the fact that it keeps coming back is a testament to its popularity. Long ago I did a post here titled "What message is your city telling you?" discussing an essay by Paul Graham (of Y Combinator fame). His basic theme is that each city has its own subtle message it's sending you about what's important and how you should direct your ambition.

Here are some of his examples:

New York: "You should make more money."

Boston/Cambridge: "You should be smarter." (or at least better read)

Silicon Valley: "You should be more powerful." (i.e. change the world)

"Cambridge as a result feels like a town whose main industry is ideas, while New York's is finance and Silicon Valley's is startups."

SF/Berkeley: "You should live better." (more conscientious, more civilized, better 'quality of life')

LA: "You should be more beautiful and famous."

DC: "You should know more important people."

Paris: "You should do things with more style."

London: "You should be more aristocratic." (higher class - although he says this signal is weaker than it used to be)

Here's the summary list of messages he came up with:

"So far the complete list of messages I've picked up from cities is: wealth, style, hipness, physical attractiveness, fame, political power, economic power, intelligence, social class, and quality of life."

And here's what I came up with at the time for Houston:

"So what about our little town of hard working engineers and entrepreneurs? The city of Canion, Cooley, DeBakey, and a gaggle of energy and real estate mavericks? Well, I think we can rule out style, hipness, physical attractiveness, fame, political power, intelligence, social class, and quality of life. Wealth, maybe a bit, but I think the primary one is economic power - "You should be a bigger player in business."(even the business of medicine) We don't seem to care too much whether you're an entrepreneur, developer, or top executive - just so long as you're a big shot. And if you're not a big shot, the message is to become one by whatever path necessary - whether on your own or through a large organization.

Maybe not the ideal message I'd choose (although not bad), but I think it's an accurate reflection of the culture of the city."

Later my friend Anne suggested maybe "industriousness" is a better ambition message for Houston rather than "economic power", because it's more inclusive of people working hard in all sorts of endeavors, including nonprofits. Both of those certainly fit well with a "Be Someone" motto encouraging people to go out and make a difference in the world.

I think it would great for the city to embrace "Be Someone" as our official motto and start baking it into our identity as a city (cue the T-shirts). It's a great message we could put just about everywhere. A similar example of an inspiring motto is "Live a Great Story". On a practical note, that probably means cleaning up the sign and protecting it from future defacement, maybe with a protective spray-paint-repelling clear coat and/or some sort of physical protective shield added to the bridge. But the real value is beyond the sign itself, but in the collective sense of identity it can unify Houstonians around.

Would love to hear your thoughts in the comments...

A new report by Edward Pinto of the American Enterprise Institute (AEI), which rates the “Ten Best and Worst Metro Areas to Live in for Science, Technology, Engineering, and Math (STEM) Jobs,” comes to some apparently surprising conclusions (full report). Pinto, Co-director of the AEI Center on Housing Markets and Finance considers the 30 metropolitan areas with the most STEM jobs, and considers three factors, (1) the number of STEM jobs, (2) job growth since 1990 and (3) relative housing affordability for first time home buyers. Job growth is included as a measure of economic vibrancy. Pinto explains the inclusion of housing affordability.

On one hand, some metro areas with relatively high home prices are desirable places to live in terms of jobs and local amenities. On the other hand, house prices may be higher than they really need to be due to local policies that needlessly drive up the price of land and thereby constrain the amount of new housing. Households should be aware of these tradeoffs.

All of the top four metropolitan areas are in the South, Dallas-Fort Worth, Houston, Atlanta and Austin. Chicago, with superior housing affordability, ranks unusually high at number five. Four of the bottom five are in California, Los Angeles, Sacramento, San Diego and fifth worst San Jose, the historic world leader in technology. Baltimore ranks fourth worst. Just outside the bottom five is tech leader San Francisco, at sixth worst.

The map below summarizes the rankings (see map below, used by permission).

Please continue reading the AEI findings here (full report).

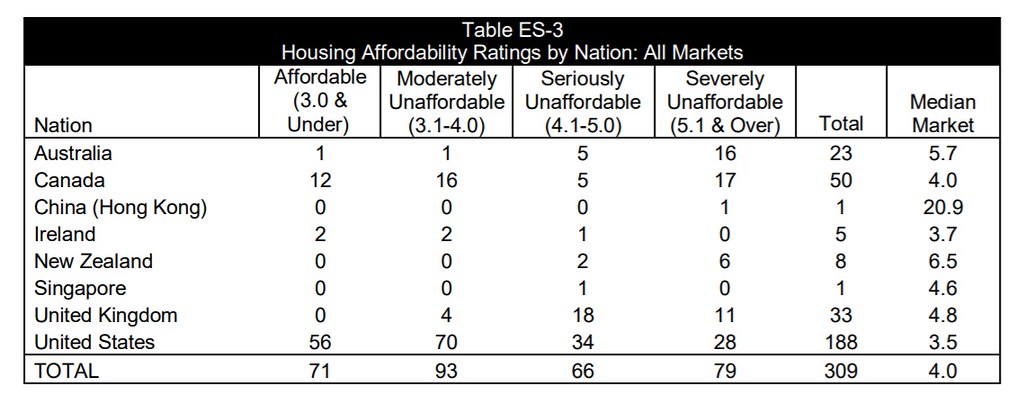

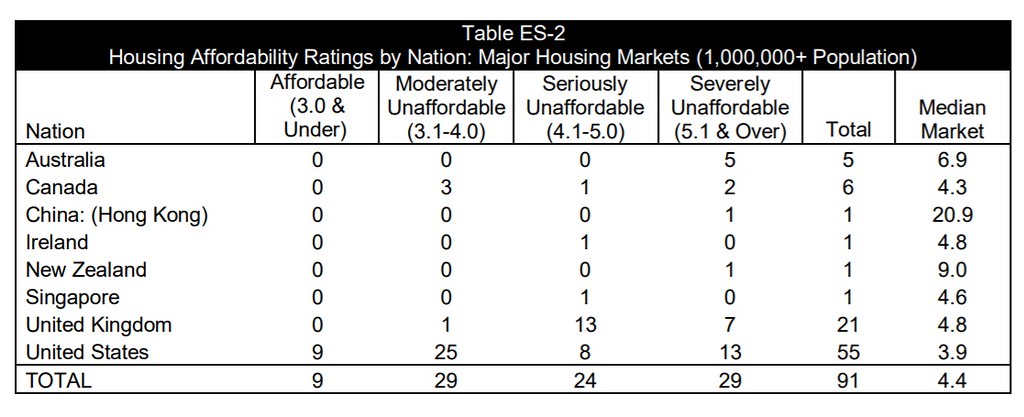

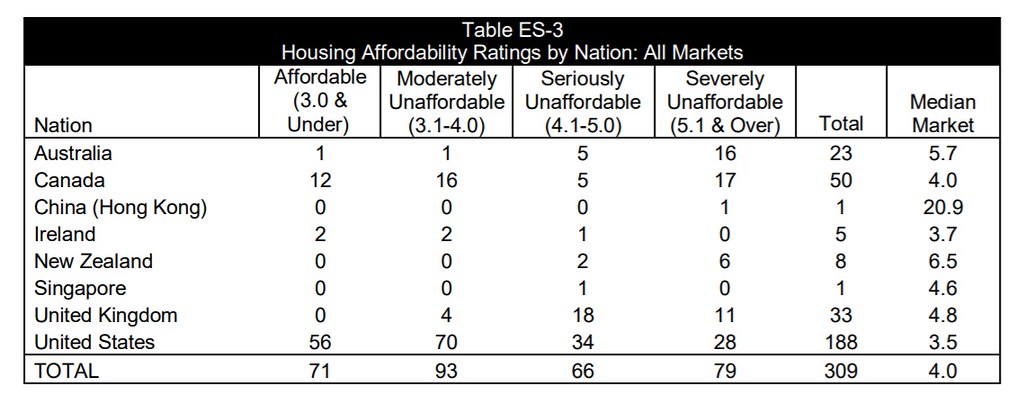

The 15th Annual Demographia International Housing Affordability Survey covers 309 metropolitan housing markets (metropolitan areas) in eight countries (Australia, Canada, China [Hong Kong Only], Ireland, New Zealand, Singapore, the United Kingdom and the United States) for the third quarter of 2018. A total of 91 major metropolitan markets (housing markets) --- with 1,000,000+ population --- are included, including three megacities, with more than 10,000,000 residents (New York, London and Los Angeles).

Middle-Income Housing Affordability

The Demographia International Housing Affordability Survey rates middle-income housing affordability using the “Median Multiple,” which is the median house price divided by the median household income. The Median Multiple is widely used for evaluating housing markets. It has been recommended by the World Bank and the United Nations and has been used by the Joint Center for Housing Studies at Harvard University. The Median Multiple and other price-to-income multiples (housing affordability multiples) are used to compare housing affordability between markets by the Organization for Economic Cooperation and Development, the International Monetary Fund, The Economist, and other organizations.

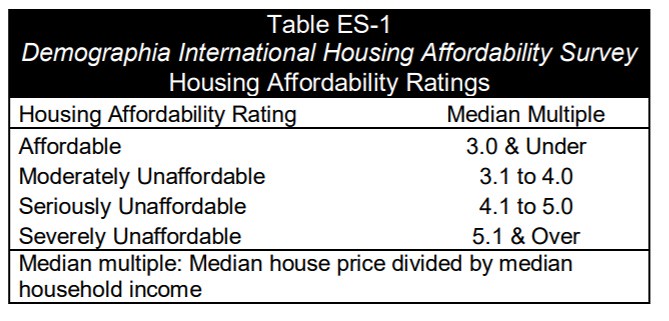

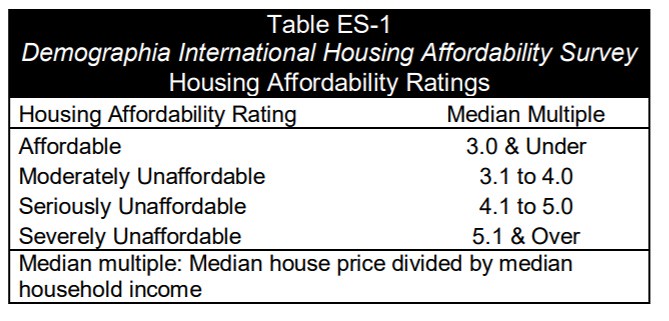

Historically, liberally regulated markets have exhibited median house prices that are three times or less that of median household incomes (a Median Multiple of 3.0 or less). Demographia uses the housing affordability ratings in Table ES-1.

Housing Affordability in 2018

Over the past year, there has been moderation of house prices in some of the most unaffordable markets. In some markets, prices have stabilized, while in others actual declines have occurred. However, none of the price declines have been sufficient to materially improve housing affordability. These developments could, in the long run, simply be further indication of the price volatility exhibited associated with stronger land use regulation.

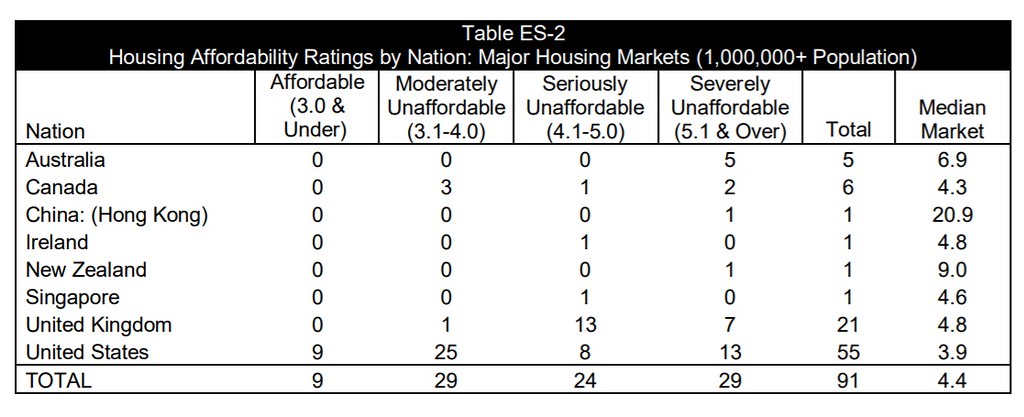

There are 9 affordable major housing markets, all in the United States. There are 29 severely unaffordable major housing markets, including all in Australia (5), New Zealand (1) and China (1). Thirteen of the major markets in the United States are severely unaffordable (out of 55), seven in the United Kingdom (out of 21 major markets) and two out of Canada’s six.

The most affordable major housing markets are in the United States, with a moderately unaffordable Median Multiple of 3.9, followed by Canada (4.3) and Singapore (4.6). Ireland and the United Kingdom both have Median Multiples of 4.8. The major markets of Australia (6.9), New Zealand (9.0) and China (20.9) are severely unaffordable (Table ES-2).

There are 9 affordable major housing markets, all in the United States. Pittsburgh and Rochester are the most affordable, with a Median Multiple of 2.6. Oklahoma City has a Median Multiple of 2.7, while Buffalo, Cincinnati, Cleveland and St. Louis each has a 2.8 Median Multiple. Indianapolis (2.9) and Detroit (3.0) are also affordable.

There are 26 severely unaffordable major housing markets in 2018. Again, Hong Kong is the least affordable, with a Median Multiple of 20.9 up from 19.4 last year. Vancouver has replaced Sydney as the second least affordable, with a Median Multiple of 12.6. With slightly declining house prices, Sydney’s Median Multiple dropped to 11.7. Melbourne (9.7), San Jose (9.4), Los Angeles (9.2) and Auckland (9.0) were also among the least affordable. San Francisco (8.8), Honolulu (8.6), as well as London (Greater London Authority) and Toronto (both 8.3) were also among the 10 least affordable major markets. Schedule 1 includes Median Multiples for all major markets.

Table ES-3 summarizes housing affordability in all markets.

Well-Functioning Cities

There has been significant progress in the reduction of poverty around the world, first in the high income world and now in other nations. Paradoxically, threats are emerging in some urban areas of the high-income world, as middle-income households face intensifying economic challenges.. Much of the cause can be traced to much higher house prices.

Former World Bank principal urban planner Alain Bertaud’s new book (see Introduction: Avoiding Dubious Urban Policies) expresses concern that urban policy in cities is being driven by planning that ignores fundamental economics. This, he warns, can lead to a “costly utopia.” According to Bertaud, “The objective of the book is not to propose new urban forms but to apply already consensual basic economic principles to the practice of urban planning.”

In the environment of current urban policy, principally urban containment policy, middle-income housing has become too expensive for many middle-income households and poverty has increased. Significant national economic losses have been associated with more restrictive land use regulation.

Economists Paul C. Cheshire, Max Nathan and Henry G. Overman of the London School of Economics state the obvious priority: “… the ultimate objective of urban policy is to improve outcomes for people.” Economists Edward Glaeser of Harvard University and Joseph Gyourko of the University of Pennsylvania, have that “well functioning” housing markets are crucial to housing affordability. Housing affordability requires well functioning land markets.

Bertaud adds: “The main objective of the planner should be to maintain mobility and housing affordability” This would produce substantial opportunities, permitting residents the widest access to employment and shopping and other pursuits--- in short, well functioning cities (labor markets).

15th Annual Demographia International Housing Affordability Survey

Wendell Cox is principal of Demographia, an international public policy and demographics firm. He is a Senior Fellow of the Center for Opportunity Urbanism (US), Senior Fellow for Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), and a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California). He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.

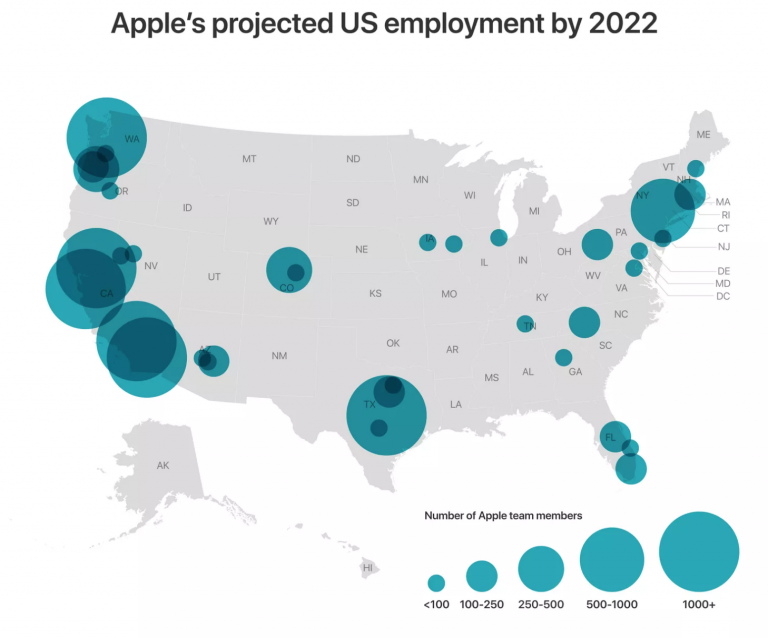

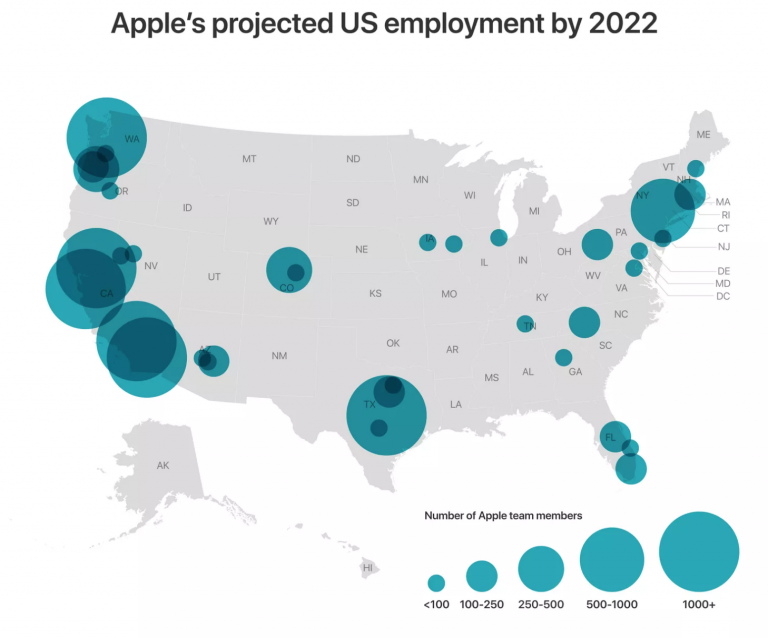

Apple has picked Austin as the site of its new $1 billion campus, one that will ultimately have 15,000 employees. The Verge has the initial details:

Along with the 6,200 employees that Apple already has in the city, its new 133-acre development is expected to make it the largest private employer in Austin. Apple expects the new campus to accommodate 5,000 employees at first, though it will ultimately have a total capacity of 15,000. The new Austin campus will handle tasks ranging from engineering to customer support for the company. Like all Apple’s other facilities worldwide, the facility will run on 100 percent renewable energy.

…

Along with its new Austin campus, Apple has also announced expansions across a number of other US cities. Seattle, San Diego, and Culver City will each grow to have over 1,000 employees apiece, and Apple also plans to expand its operations in Pittsburgh, New York, and Boulder, Colorado, over the next three years. In total, Apple employs 90,000 people across the US, and has over 1,000 employees per state across 16 states.

Once again we see a major tech company going with the “usual suspects.” Austin is not a superstar city, but is a booming Sunbelt city with a longstanding tech cluster. Apple picking Austin may help explain how Amazon ended up in Nashville over Austin.

The other places Amazon is going to are all already on the list so to speak. This map from Verge says it all about how things are playing out in American tech:

Click through to read the full piece over at the Verge.

This piece originally appeared on Urbanophile.

|