NewGeography.com blogs

It also wasn’t that long ago that Congress held hearings on the bonuses paid to AIG employees after the bailout. Now, according to New York Times reporter Louise Story Wall Street compensation is rising back to where it was in 2007 – the last year that these firms made oodles of money with investment strategies that turned toxic the next year.

And, yeah, we get it – there is a theoretic connection between compensation and performance. But we also know that there’s a difference between theory and practice. Too many of the same employees who either perpetrated the events leading to the meltdown or stood idly by while it happened are still in place.

When AIG finally revealed what they did with the bailout money, we found out that a big chunk of it went overseas. Now, New York Post reporter John Aidan Byrne tells us that the bailout recipients are bailing out – on U.S. workers! Story found that Bank of New York Mellon, Bank of America and Citigroup, all recipients of billions of bailout dollars, are shifting more jobs overseas. The explanation, that nothing in TARP prohibits them from moving jobs out of the US, is so lame I’m surprised Story even bothered to mention it.

The initial indicators of the current financial meltdown were visible in mid-2007. The deeper, underlying causes were recognized, talked about in Washington and then ignored as far back as 2004. The collective memory is short. Nobody wants to hear the bad news, especially when it’s this bad and it goes on for this long. The morning you wake up and wish the financial meltdown would just go away is your most dangerous moment – wishing won’t make it so.

Of the three monitors established by the legislation that created the Troubled Asset Relief Program (TARP), only one has the authority to prosecute criminals. That is the Office of the Special Inspector General (SIGTARP) whose motto is “Advancing Economic Stability through Transparency, Coordinated Oversight and Robust Enforcement.” The Special Inspector General in charge, Neil Barofsky, told Congress before the recess that he was by-passing the Rogue Treasury to get answers directly from TARP recipients about what they are doing with the bailout money. Now, SIGTARP has set up a hotline (877-SIG2009) for citizens to report fraud or “evidence of violations of criminal and civil laws in connection with TARP.” To date, they have received 200 tips and launched 20 criminal investigations.

What started out as a bailout costing $750 billion quickly turned into $3 trillion – an amount about equal to the U.S. government’s 2008 budget. This week, SIGTARP released a 250-page report in an attempt to place “the scope and scale [of TARP] into proper context” and to make the program understandable to “the American people.” I can’t recommend that you read a report of that length, or even that you download it (more than 10 megabytes) unless you have broadband internet access. (In fact, I don’t understand what makes them think that the American people are going to understand anything that takes 250 pages to explain… Isn’t over-complicating one of the problems they want to solve?) You can get all the high points in Barofsky’s statement to the Joint Economic Committee, which is only 7 pages and a few hundred kilobytes. If you have more time than patience, you can watch the testimony on C-SPAN.

I applaud the hard work of the SIGTARP to provide oversight to Treasury even though they are “currently working out of the main Treasury compound.” Let’s hope they can break free of the hazards associated with the self-regulation that got us into this financial mess in the first place.

Kudos to the Daily Beast for doing its homework and exposing the blatant hypocrisy behind green-tinged celebrity. People like Gore, Streisand, and Madonna have been filling airwaves with exhortations to pitch in and save the planet while living the good life that is supposedly destroying it. Gore himself has put forth a proposal that Professor William Nordhaus has said would ruin the economy. One way for these Green celebs to reduce their carbon dioxide emissions would be to have them stop blowing so much hot air on the topic. There is also the option of listening to the words of Freeman Dyson and stop viewing this thing as a matter of faith. These people should really look more closely at their own lifestyles before telling us how to live. It would be nice if a little of the vitriol could be removed from the debate and we could have a reasonable look at the possible options. Our world and economy are too important. has said would ruin the economy. One way for these Green celebs to reduce their carbon dioxide emissions would be to have them stop blowing so much hot air on the topic. There is also the option of listening to the words of Freeman Dyson and stop viewing this thing as a matter of faith. These people should really look more closely at their own lifestyles before telling us how to live. It would be nice if a little of the vitriol could be removed from the debate and we could have a reasonable look at the possible options. Our world and economy are too important.

The Housing & Economic Recovery Act of 2008 was passed last August. It created the HOPE for Homeowners Program, which the Congressional Budget Office estimated would help 400,000 homeowners to refinance their loans and stay in their homes. Here's a stunning revelation: According to the Federal Housing Authority (FHA), in the first six months since the law was passed, exactly one (1) homeowner refinanced under the program!

You can listen to the story on NPR, "Investors Support Overhauling Homeowner Program". One such investor, PIMCO, supports programs that would reduce the principal balance on mortgages by a small amount in order to keep the cash flow coming from mortgage payments. Given what we know about investment strategies to push companies into bankruptcy in order to benefit from credit default swap payouts, I was initially leery of such statements coming from bond investors. Then I remembered the problem with the paperwork on the mortgages – if bondholders can't prove ownership of the lien the homeowner keeps the house with no further payments. That's when it started to make sense.

Of course, if they can get the homeowners to come in for a re-fi they can correct the paperwork mistakes. It could be worth it to investors without default protection to accept principal reductions – if the homeowner goes into bankruptcy they may not be able to prove they own the mortgage without the new paperwork. With the re-fi, they get all new documentation.

These programs were designed for homeowners who are current on their mortgage payments but whose homes are "underwater", that is, the principal balance on the mortgage is more than the market value of the house. Some can keep up their payments with the hope that the market price of the home adjusts in the distant future; others might benefit by the modest reductions in principal favored by some bond investors. But in a situation described by a Stockton (CA) homeowner the principal reduction is unlikely to be enough – the home is worth $220,000 and the mortgage balance is $420,000. These homeowners' best financial strategy is to take the hit to their credit report and default on the mortgage. Investors like PIMCO might, if their paperwork is good, get half their investment back by taking possession of the property; they'll get it all back if they bought the credit default swap; and they get nothing if the paperwork is screwed up.

How many mortgages are underwater? Bank of America’s annual report says that 23 percent of their residential mortgage portfolio has current loan-to-market value ratios greater than 90 percent. When they include home equity loans in the calculation, totaling lending on a residential property, the share with less than 10 percent equity rises to 37 percent. At the end of 2008, Bank of America held $248 billion in residential mortgages and $152 billion in home equity loans, after taking write-offs of about $4.4 billion last year. On the other hand, Wells Fargo did not specifically report the share of their portfolio with loan-to-market value ratios greater than 90 percent. It’s hard to tell just how many mortgages are how far underwater at an aggregate level. I would imagine that these numbers are being checked in the Treasury’s stress testing of individual banks.

In any event, Congress is not giving up (although we almost wish they would before this gets any worse). The House Committee on Financial Services combined with the House Judiciary Committee has introduced a new bill to improve the old bill's version of Hope for Homeowners. Trying to take it a step further, the House Financial Services Committee is holding hearings on a Mortgage Reform Bill next week. The plan is to set lending standards for all mortgage originators. Chairman Barney Frank (D-MA) is of the view that the "great economic hole" we are in was started by“ policymakers’ distrust of regulation in general, their enduring belief that markets and financial institutions could effectively police themselves."

With this we do agree: self-regulation in financial services is a root cause of our current economic disaster. Until it is completely removed – not just from mortgage lending but from all financial products and services – nothing Congress does will prevent another crisis.

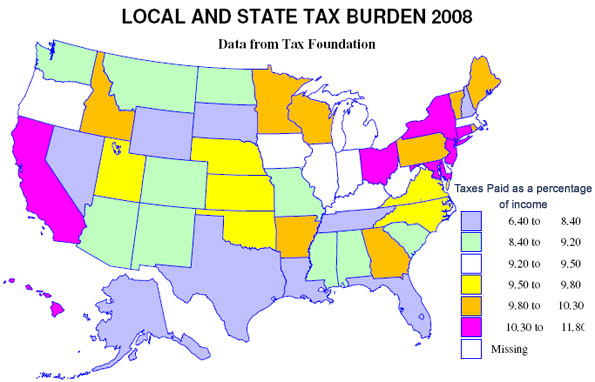

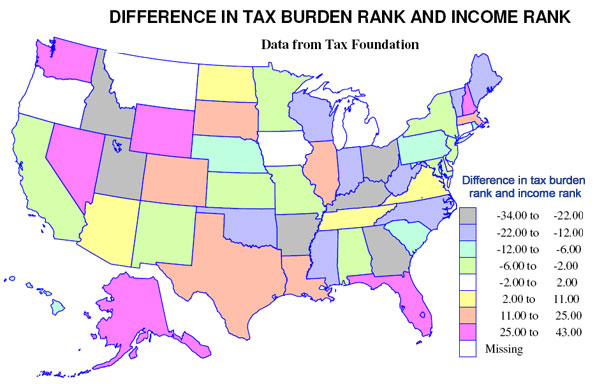

The Tax Foundation calculates the taxes paid per capita, including what is spent by people on average in neighboring states, including state and local fees. The two maps show, first, the tax burden, taxes paid as a percent of income, the second, the difference in the ranks of states in tax burden and in income.

The map for tax burden is colorful, so one might suppose there is a big difference in the local and state burden. There is variation, but the amazing story is how small the differences really are. The variation is from a maximum of 11.8 percent in New Jersey (note that Taxachusetts is in the middle of the pack) to a low of 6.4 percent in Alaska. But most states, 38, are in between 8.6 and 10.2 percent.

The lowest tax burdens are not surprising – Alaska (6.4) and Nevada (6.6), but the next lowest, Wyoming (7) and Florida (7.4), may be a surprise. The highest tax burdens, as may be expected, are megalapolitan New Jersey, New York (11.7), Connecticut (11.1) and Maryland (10.8), but Hawaii (10.6) in this group may be a surprise. The states in the middle, besides Massachusetts, include a contiguous set centered in Chicago – Illinois, Indiana, Iowa, Michigan, Kentucky and West Virginia (all 9.3 to 9.5).

The modest range of burdens implies that generally richer states have higher tax burdens and poorer states have lower burdens, but the second map shows that there are many exceptions. Richer states with higher tax burdens include (a small difference in tax and income ranks) District of Columbia, New Jersey, Connecticut, New York and Maryland, and poorer states with a moderately low tax burden are few – Alabama, New Mexico and Montana. Poorer states but with a high tax burden are Arkansas, Kentucky, Utah and Idaho, but this finding perhaps tells us the statistical problem or risk in using per capita rather than per household measures. Strongly Mormon Utah and Idaho, indeed all four states have high average household size, so are not as disadvantaged as the data suggest. For a similar reason, Florida may not be as good as it looks, since it has a quite low average household size.

Most interesting may be the richer states with lower ranking tax burdens, notably Wyoming, New Hampshire, Washington and Nevada. Other states with a relatively low burden (lower tax rank than income rank) include Alaska, Colorado, Florida, Massachusetts, and Texas and other states with a relatively high burden (much higher tax rank than income rank) include Georgia, Kentucky, Ohio and West Virginia.

Finally states with close to the same rank in income and tax burden include a set of contiguous Midwestern states, Iowa, Minnesota, Missouri, and Kansas, then Michigan, Oregon and California.

But in sum, choosing a state based on its local and state tax burden could be worth the effort, but the effects by themselves could be more limited than commonly supposed.

Only a few months ago, I admonished Michigan for its hysteria about brain drain. Given the recent news coverage concerning the exodus from the recession-plagued state, you might expect I’m ready to eat some crow. On the contrary, I’m here to report that Michigan has learned nothing from its past mistakes.

Richard Herman, an advocate for increasing rates of immigration to the Rust Belt, posts on his blog the same critique I have aired about how Michigan addresses its talent crisis:

However, the current focus on "brain drain" as the source of the problem misses the real issue.

While no doubt the Midwest economy is causing college grads who might otherwise want to stay home to leave, in an ever more mobile society, moving out is a natural part of people's lives. Indeed, if you read the typical account of how the elite global knowledge worker lives, you often hear about people flitting from place to place to place chasing opportunity.

The real problem is not that too many people are leaving, but rather that too few are coming. It isn't an outflow problem, it's an inflow problem.

The former urban industrial powerhouses of the United States all suffer from the same malaise. Every city is fixated on its local labor pool, asking institutions of education to staff the “factory.” The great irony is that economic growth doesn’t happen without immigration or domestic in-migration. There is no story of a great metropolis that successfully barred its people from leaving.

The tortured metaphor for brain drain stems from private enterprise. But even in the arena of human resources, the concept of churn isn’t an anathema:

The purpose of this article is to open your mind about the silliness of measuring only aggregate turnover. I can think of no better indication of a so-called expert’s lack of true understanding of employee turnover than when I read an article or a book on retention and the author invariably expounds on the need to keep everyone.

The burgeoning narrative is that churn benefits both employee and employer. The same is true for resident and state. Fear of the outsider prevents all parties from making a rational choice and improving human welfare.

Michigan should embrace its out-migration and aggressively seek new residents. I further recommend any reference to “retention” be abolished from official policy. Where, and how many, graduates go is largely immaterial. Instead of Cool Cities to keep Michigan talent instate; what would it take to get the next generation of engineers from Colorado schools or Asia to move to the Rust Belt?

On April 3, 2009, R. Glen Ayers spoke at the American Bankruptcy Institute in Washington, D.C. Mr. Ayers is a former bankruptcy judge, now with the law firm Langley & Banack in San Antonio, Texas. He spoke on a subject I covered here on March 4 – not all mortgage backed securities are actually backed by mortgages. The rush to write more mortgages and to issue more bonds meant that mistakes were made in the paperwork.

The Ayers speech is connected to an article he wrote with Judge Samuel L. Bufford, who had the California case I mentioned last month where the mortgage note disappeared after being transferred to Freddie Mac. In the article, “Where’s the Note, Who’s the Holder”, they drop this bombshell: “A lawyer sophisticated in this area has speculated to one of the authors that perhaps a third of the notes ‘securitized’ have been lost or destroyed.” Meaning that 1/3 of the mortgage-backed securities are not backed by mortgages!

This is the junk that Treasury Secretary Geithner wants to finance the hedge funds to purchase. As of the end of 2008, there was $6,838.7 billion worth of government-backed mortgage bonds outstanding. An additional $178 billion were issued in the first two months of 2009.

Scary stuff. No wonder the hedge funds are giving Geithner’s Public-Private Investment Partnership “two thumbs-down.”

More of the so-called “mainstream press,” like the Sacramento Bee, are catching up to what we wrote here about Warren Buffett back on March 16. He supported the bailout because his investments benefited from the handouts.

It seems obvious that Washington takes policy advice from Buffett because he has lots of money. Newsweek reporter Mark Hirsch uncovered evidence, in fact, that Buffett may have been the one that came up with the original proposal for Treasury to buy the junk bonds off the banks’ balance sheets. Given the direction that Berkshire Hathaway’s own credit rating is going, Buffett may have even more reason to support this plan – his companies will be able to invest in the junk at discounted prices after they sell the junk to the government’s partnership funds at inflated prices!

Some of the comments at Newsweek.com believe that the article is unfair to Buffett – after all, what company doesn’t support policies that will benefit them? But to the tune of $11.6 trillion, which is what the U.S. government has committed to this bailout? We bet even Karl Marx would find that excessive. We agree with the title of a book by William Black, an economist whose work we referred to in our own research on the Savings & Loan crisis – “The Best Way to Rob a Bank is to Own One.” Professor Black discussed the financial crisis with Bill Moyers on April 3, 2009.

Berkshire Hathaway has significant ownership stakes in more than one bank. This brings us to an article at the Mises Institute, the libertarian think-tank. The article contains a link to an article from 1948 written by Warren’s dad when he was the U.S. Congressman from Nebraska – “Human Freedom Rests on Gold Redeemable Money.” The younger Buffett has a preference for the freshly printed stuff that Treasury is doling out.

Is this a story from the Onion? No. Too Implausible. The Chicago Tribune reports:

Coming from as far away as Azerbaijan, dozens of corporate executives and government bureaucrats gathered at a downtown hotel Wednesday to hear Mayor Richard Daley share his tips for preventing corruption.

Absent from his speech at the international event was any talk of city hiring fraud, the Hired Truck program or the myriad other scandals that put Daley aides in federal prison or left them free pending appeals of official misconduct convictions.

In 2005, The Chicago Sun-Times explained “From an exhaustive Hired Truck investigation to a probe into patronage hiring at City Hall, there's so much corruption to investigate in the Chicago area, the FBI is adding manpower.” Chicago got a third public corruption squad while New York and L.A. only had two. The Hired Truck scandal was one of the biggest in recent history, where private trucking companies were paid to do nothing. Mayor Daley has yet to explain why a Chicago Mob bookmaker was running the program.

But, it’s not only Hired Truck. Mayor Daley’s Water Department was described by the Justice Department as a racketeering enterprise for at least 10 years. Just a week ago,the Chicago Democratic Machine’s own Rod Blagojevich was indicted for running a racketeering scheme even before he took office as Governor.

Blagojevich earned the early endorsement of the Machine in 2001. The Daily Herald reported powerful Alderman Burke's glowing endorsement, “I am with Rod 100% because he has what it takes to win – money, message and an army of supporters.”

Mayor Daley’s son and nephew have just hired a prominent criminal lawyer for their questionable business dealings with the city of Chicago. Mayor Daley’s son and nephew have just hired a prominent criminal lawyer for their questionable business dealings with the city of Chicago.

Mayor Daley isn’t the only Chicago Democrat lecturing audiences about ethics. Recently, Illinois Supreme Court Justice Anne Burke(wife of Alderman Ed Burke) lectured Illinois state workers on "Ethics in the Workplace" at University of Illinois-Chicago.Anne Burke has been accused by a top FBI informant of corruption.

Since 1971, 31 Chicago Aldermen have been convicted of felonies. Sometimes you just have to laugh. Or cry.

|

Mayor Daley’s son and nephew have just hired a prominent criminal lawyer for their

Mayor Daley’s son and nephew have just hired a prominent criminal lawyer for their