NewGeography.com blogs

by Anonymous 09/12/2012

The Democratic Party in Chicago is at war. The one party town is seeing an important element of the coalition on strike. Rahm Emanuel is at war with a real adversary: teacher’s union boss Karen Lewis. Last year Lewis began laying the groundwork for a strike as witnessed in this Chicago Magazine interview with reporter Carol Felsenthal:

CF: So you have an issue with [Secretary of Education, former CPS CEO] Arne Duncan?

KL:Yeah, because he has a bachelor’s in sociology from Harvard and played basketball [he’s an education expert]? I think he’s completely and totally unqualified to do this job. And to me, it’s sort of indicative of how education is such a political tool now, as opposed to [his] having a real bent toward education. I think this is a way for Obama to try to make an olive branch with Republicans. There’s this mentality that outsiders and people with no education background are the… experts…. They want to privatize public education…. Arne’s policies here were a disaster.

Karen Lewis, like Rahm Emanuel, isn’t shy about expressing her opinions. Conflict is in the air. For 25,000 teachers to be on strike weeks before a Presidential election is a major problem for Barack Obama and Rahm Emanuel. Karen Lewis has even organized children to chant slogans against Rahm Emanuel. As veteran Chicago reporter Greg Hinz has said:

Mr. Emanuel has loudly declared what he wants, issued his demands in what I hear was an f-bomb-filled meeting with Ms. Lewis, and moved to impose some items by fiat — i.e., enacting a longer school day and directing the board to rescind a negotiated 4 percent pay hike.

Chicago is running out of money. There’s much blame to go around. The financial math is a threat to the status quo. The public school system has been a lucrative racket for some. Chicago Tribune columnist John Kass explains:

Unfortunately, the system works just fine. It works for the teachers union that wins the big raises (the current offer: a 16 percent bump over the next four years) and for the bureaucrats who are creatures of patronage, and for the vendors who feed from the almost $6 billion budget.

It works for Democratic politicians. They increase property taxes to pay for union raises and, in exchange, receive union support and political donations in election years. It's been going on that way for years.

But does it work for the kids? Not when nearly half don't graduate.

As New Geography readers remember, we warned that Chicago was on the downswing. The 2010 Census confirmed this decline. The difficult part of decline is the hardship that comes with layoffs. University of Chicago Professor Tim Knowles says 5000 Chicago Public School teachers could lose their jobs because of 100 schools may shut. When you lose 6.9% of your population in 10 years, closures are inevitable.

In conclusion, Karen Lewis has picked a perfect time to strike: right before a Presidential election. The Democratic party needs all the help it can get from unions to get out the vote in nearby battleground states. What if they don’t get out the vote in Ohio and other unions strongholds in November?

In a recent Evolving Urban Form article, we speculated that Tokyo, the world's largest urban area (population more than 35 million) could be displaced by fast-growing Jakarta or Delhi as early as 2030. If the prediction of central jurisdiction administrators and academics come true, Tokyo could be passed by many other urban areas in population by 2100.

The Japan Times reports forecasts that the population of the Prefecture of Tokyo, the central jurisdiction of the metropolitan area, could decline by nearly 50 percent (chart) between 2010 and 2100 (Note). Yet, while the overall population is dropping in half, the elderly population would increase by more than 20 percent. The resulting far less favorable ratio of elderly to the working population would present unprecedented social and economic challenges.

The article provides no information on the population of the entire urban area in 2100. The Prefecture of Tokyo constitutes somewhat over one third of the present population of the urban area.

During the last census period (between 2005 2010) the four prefecture Tokyo metropolitan area (Tokyo, Kanagawa, Saitama and Chiba), gained approximately 1,100,000 new residents, while the balance of the country was losing 1,400,000 residents. Japan is forecast to suffer substantial population losses in the decades to come. The United Nations forecasts that its population will decline from approximately 125 million in 2010 to 90 million in 2100. This is the optimistic scenario. The National Institute of Population and Social Security Research forecasts a drop to under 50 million, a more than 60 percent population reduction.

There are serious concerns about the projected population decline. According to the Japan Times, the researchers said that " ... it will be crucial to take measures to turn around the falling birthrate and enhance social security measures for the elderly," A professor the National Graduate Institute for Policy Studies, expressed concern that "If the economies of developing countries continue growing, the international competitiveness of major companies in Tokyo will dive."

----

Note: the Prefecture of Tokyo government is called the Tokyo Metropolitan Government. This term can mislead, because the prefecture itself is not the metropolitan area, but only part of the four prefecture metropolitan area. The pre-– amalgamation predecessor of the current city of Toronto was called the Municipality of Metropolitan Toronto. Like the Prefecture of Tokyo, the Municipality of Metropolitan Toronto comprised only part of the Toronto metropolitan area. Confusion over these terms not only resulted in incorrect press reports, but even misled some academic researchers to treat these sub-metropolitan jurisdictions as metropolitan areas.

In an article entitled Fourth Time Unlucky, The Economist wonders why Brazil, with "a long list of more worthwhile infrastructure projects", does not dismiss high speed rail "out of hand."

After three unsuccessful attempts to attract international bidders to build its Rio de Janeiro to Sao Paulo and Campinas line for a bargain basement price, the nation has decided that taxpayers will foot some (probably all) of the bill.

The Economist continues:

"Everywhere, new-build rail projects are horribly likely to come in way over budget and to be used much less than expected. A 2009 paper by Bent Flyvbjerg of Oxford’s Saïd Business School, ominously entitled "Survival of the Unfittest: Why the worst infrastructure gets built—and what we can do about it."

As Flyvbjerg and others have noted, promoters, whether private or public, often seem to have a simple goal: to get the line under construction. That positions the projects for taxpayer bailouts when they run into problems.

With bidders able to call upon other people's money (taxpayer's money) this time, it seems likely there will be takers. And, based upon the experience with major infrastructure projects around the world, that will be just the start of the taking.

If elsewhere provides any guidance, the winning bidder can be confident that, down the road, the captive customer (the taxpayers) will pay any cost overruns. At the same time, the routine could be repeated in which a government kicks and screams, claiming it had no warning.

They did. In this day and age, a link to the Economist's warning is forever. A wise government will obtain the unlimited guarantees any company involved in the winning joint venture. Only then will Brazil's taxpayers be protected.

The Central Japan Railway (Note 1), which operates one of only two high-speed rail segments (Tokyo Station to Osaka Station) in the world that has been fully profitable (including the cost of building), proposes to build a line from Dallas to Houston, with top speeds of 205 miles per hour. This is slightly faster than the fastest speeds now operated. This line is radically different from others proposed around the nation and most that have been proposed around the world. The promoters intend to build and operate the route from commercial revenues.

There is the understandable concern that eventually, the promoters will approach the state or the federal government for support. Not so, say Texas Central High Speed Railway officials. According to President Robert Eckels, not only is there no plan for subsidies, but "investors would likely walk away from a project that couldn’t stand on its own." He also told the Texas Tribune “If we start taking the federal money, it takes twice as long, costs twice as much,” Eckels said. “My guess is we’d end up pulling the plug on it.” There is the understandable concern that eventually, the promoters will approach the state or the federal government for support. Not so, say Texas Central High Speed Railway officials. According to President Robert Eckels, not only is there no plan for subsidies, but "investors would likely walk away from a project that couldn’t stand on its own." He also told the Texas Tribune “If we start taking the federal money, it takes twice as long, costs twice as much,” Eckels said. “My guess is we’d end up pulling the plug on it.”

Eckels is a former Harris County Judge (Houston), a position the equivalent of a county commission or county board of supervisors chair in other parts of the nation. Eckels developed a reputation for fiscal responsibility during his tenure at the county courthouse.

The Texas project is in considerable contrast the California High Speed Rail project, which if built, is likely to require a 100 percent capital subsidy and perhaps subsidies for operations. It is also different from the Tampa to Orlando high speed rail project, which would have required a 100 percent capital subsidy and was cancelled by Florida Governor Rick Scott. The Texas project can also be contrasted with the Vegas to Victorville, California XpressWest high speed rail line that would require at least a $5.5 billion federal loan and a subsidized interest rate. Our recent Reason Foundation report predicted that XpressWest would not be able to repay its federal loan from commercial revenues and could impose a loss on federal taxpayers of up to 10 times the Solyndra loan guarantee loss (see The Washington Post, "Solyndra Scandal Timeline").

From the horrific record of private investment in startup high speed rail lines and the huge losses that have been typical, I am certainly skeptical. The Taiwan high speed rail private investors have lost two-thirds of their capital investment and debts are guaranteed by the government. The Channel Tunnel rail line to St. Pancras station has been bailed out by British taxpayers. However, if any company can make money at high speed rail in the United States, it would be the Central Japan Railway.

So far the Texas Central High Speed Railway seems to be doing it right. Like the other intercity modes, the airlines system and the intercity highway system (Note 2), this project would be paid for by people who use it.

Without government subsidies or loans, the Texas Central High Speed Railway will certainly have an incentive to get the sums right. If they are not, it sounds like the plug will be pulled. If they are, high speed rail could be on the right track in the United States for the first time. More power to them.

------

Note 1: Central Japan Railway, and other companies purchased the assets of the Japanese National Railway in the late 1980s. The nationalized railway had run up a debt of nearly $300 billion, which was eventually transferred to taxpayers.

Note 2: There is a small subsidy to the airline system from the Federal Aviation Administration. Intercity highways have been financed by users until contributions from the federal general fund in recent years. However these contributions have been far less than diversions over the past 30 years from highway user fees, principally to mass transit a major transfer of highway trust fund interest to the general fund and now ongoing interest transfers.

Photograph: Central Japan Railway corporate headquarters at Nagoya Station (by author)

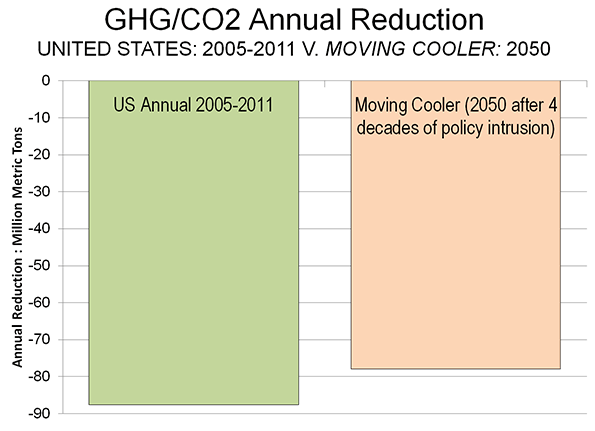

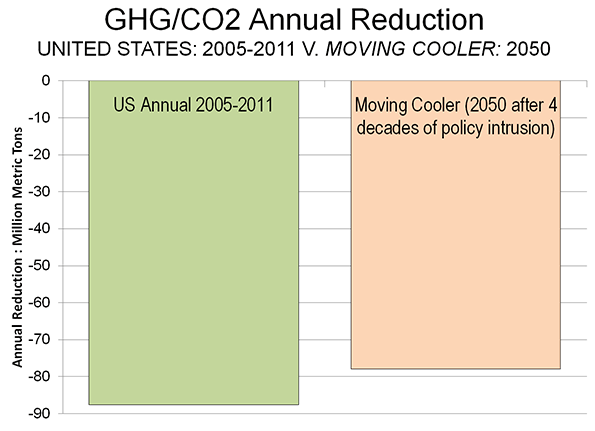

Congratulations to America. According to the US Department of Energy, Energy Information Administration, carbon dioxide (CO2) emissions were reduced 526 million tons from 2005 to 2011. This is no small amount. It is about the same as all the CO2 emissions in either Canada or the United Kingdom. Only five other nations emit more than that.

The bigger news is that this was accomplished without any of the intrusive behavioral modification proposed by planners, such as by California's anti-detached housing restrictions, Plan Maryland, or the state of Washington's mandatory driving reduction program.

Of course, part of the national reduction was due to the economic difficulties since 2005. However, even with 1.8 percent gross domestic product growth in 2011, EIA shows that CO2 emissions fell 2.4 percent in 2011.

The magnitude of the decline over six years is impressive. Actual GHG/CO2 emissions were reduced more annually between 2005 and 2011 than smart growth proponents claim for their strategies after 45 years of draconian policy intrusions.Modeled smart growth forecasts in Moving Cooler's middle scenario (by Cambridge Systematics and the Urban Land Institute) show the annual GHG/CO2 emission reduction in 2050, calculated from 2005, to be less than the emissions reduction in the average year between 2005 and 2011.

This is despite what would be four decades of trying to force people to live where they don't want, in housing they don't prefer, while trying to drive them out of the cars that required to sustain economic growth in modern metropolitan areas.

Moving Cooler's forced densification and anti-automobile strategies were so radical that the Transportation Research Board authors of Driving and the Built Environment, could not agree that a similar approach was feasible, because it would be prevented by public resistance to the personal and political intrusions (Note 1). They would also be hideously expensive, as the Moving Cooler authors ignored the much higher costs of housing associated with smart growth's behavioral strategies.

This comparison demonstrates the conclusion of a recent Cambridge University (United Kingdom) led study (see "Questioning the Messianic Conception of Smart Growth", which stated:

In many cases, the potential socioeconomic consequences of less housing choice, crowding, and congestion may outweigh its very modest CO2 reduction benefits.

Government policies have had little to do with the reductions, except to the extent that they precipitated the greatest economic downturn since the Great Depression (such as by encouraging loose lending standards and the smart growth housing policies that drove house prices up so much that the housing bust became inevitable).

Market forces have made a substantial contribution to the reduction. There was a substantial shift to the use of natural gas from coal, a conversion that is really only starting. There was also a modest improvement in automobile fuel efficiency (though much more is to come).

In 2007, the McKinsey Corporation and The Conference Board published a study (co-sponsored by the Environmental Defense and the Natural Resources Defense Council), which said that sufficient GHG emissions reductions (Note 2) could be achieved without driving less or living in more dense housing. Our more recent Reason Foundation report showed that the potential for GHG emission reduction from more fuel efficient cars and carbon neutral housing far outweighed any potential for reductions from smart growth's behavior modification.

------

Note 1: Transport consultant Alan E. Pisarski evaluated Moving Cooler in an article entitled ULI Moving Cooler Report: Greenhouse Gases, Exaggerations and Misdirections.

Note 2: Most of GHG emissions are CO2.

|

There is the understandable concern that eventually, the promoters will approach the state or the federal government for support. Not so, say Texas Central High Speed Railway officials. According to President Robert Eckels, not only is there no plan for subsidies, but "investors would likely walk away from a project that couldn’t stand on its own."

There is the understandable concern that eventually, the promoters will approach the state or the federal government for support. Not so, say Texas Central High Speed Railway officials. According to President Robert Eckels, not only is there no plan for subsidies, but "investors would likely walk away from a project that couldn’t stand on its own."