Prior to the fifteenth century, China led the world in technological sophistication. Then, it went into a period of long decline. Here’s what Gregory Clark had to say about it in Farewell to Alms:

... When Marco Polo visited China in the 1290s he found that the Chinese were far ahead of the Europeans in technical prowess. Their oceangoing junks, for example, were larger and stronger than European ships. In them the Chinese sailed as far as Africa.

The Portuguese, after a century of struggle, reached Calicut, India, in the person of Vasco da Gama in 1498 with four ships of 70-300 tons and perhaps 170 men. There they found they had been preceded years before by Zheng He, whose fleet may have had as many as three hundred ships and 28,000 men. Yet by the time the Portuguese reached China in 1514, the Chinese had lost the ability to build large oceangoing ships.

Similarly Marco Polo had been impressed and surprised by the deep coalmines of China. Yet by the nineteenth century Chinese coalmines were primitive shallow affairs, which relied completely on manual power. By the eleventh century AD the Chinese measured time accurately using water clocks, yet when the Jesuits arrived in China in the 1580s they found only the most primitive methods of time measurement in use, and amazed the Chinese by showing them mechanical clocks. The decline in technological abilities in China was not caused by any catastrophic social turmoil. Indeed in the period after 1400 China continued to expand by colonizing in the south, the population grew, and there was increased commercialization.

China’s technological decline is a fascinating topic, with lessons for us today.

Right now, the United States is approximately six million jobs short of our pre-recession high, even though we’re almost three years into a recovery. We have about the same number of jobs as we had in 2000. That is worth saying again. On net, the United States has seen no job growth in over a decade, even though we’ve recently seen some slow job growth — slow relative both to past recoveries, and to potential.

Prospects for improved growth are not good. Already, the Federal Reserve has all but promised to keep I low interest rates through 2013. This is a sure sign that its 300+ economists don’t anticipate significant improvement soon.

Some observers are claiming that this is 'the new normal,' and we have to get used to a future of slower growth. These people are doing us a disservice. The United States still has all of the economic potential it ever had. Our job growth is unacceptably low because of our policy choices.

Bad policy is not a partisan issue. The disastrous Sarbanes-Oxley was passed during the George W. Bush administration, as was the irresponsible expansion (subsidizing prescription benefits) of the by-then-obviously-troubled Medicare program. The supposedly free-market administration instituted a tariff on steel imports, presided over an increase in government spending as a percentage of gross product, and ran persistent federal budget deficits. Finally, in a panicked reaction to the September 2008 financial crisis, it created the TARP program, a program that exacerbated our financial sector’s existing moral hazard problems.

The current administration has dramatically expanded the size and scope of government. Today, total government spending is over 35 percent of gross national product. This exceeds that of World War II. Federal debt, as a percentage of GNP, will soon surpass that of World War II, and no decline is in sight. The Dodd-Frank Act does not address any of the problems that caused the 2008 financial crisis, while imposing huge regulatory burdens on financial firms. The healthcare restructure imposes another large regulatory burden while failing to address the fundamental problem: consumption of medical services and payment for medical services have become separated.

Our bureaucracies are growing at the expense of the private sector. For evidence, look at Joel Kotkin’s piece on the relative prosperity of the Washington DC area, a region that has boomed throughout the recession. Similarly, the Sacramento Bee recently ran an article on the 200,000 plus people trying to get a job with the State government.

When government bureaucracies become very large, they attract people directly through working conditions, benefits and pay packages, job security, and power. The bureaucracy becomes the place where important decisions are made, and talented people want to make important decisions. Dealing with bureaucracy also becomes a major growth industry. Financial institutions need more compliance officers to stay out of trouble with the regulators. Pharmaceutical companies need people to navigate the approval process for new drugs. Companies across America need specialists to help them comply with employment and environmental regulations. When profits become dependent on regulatory compliance, the best and brightest become employed in facilitating compliance, or finding ways around it. Production suffers as a result.

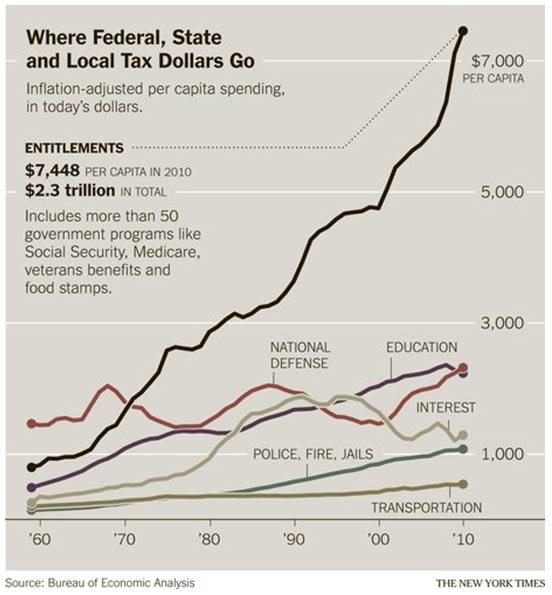

Some would argue that government is the source of prosperity. Outside of the relatively small government necessary to ensure property rights, this is not true. As the following chart from the New York Times shows, most of government’s increased spending has gone to transfer payments.

What’s to be done? I’ve argued elsewhere that legal immigration should be increased. That can be done immediately, and it would have immediate impacts. Repeal of Sarbanes-Oxley and Dodd-Frank would also have immediate benefits. Redoing healthcare in such a way that consumption of medical services would be tied to the payment of medical services would help, too. Increasing United States carbon-based energy production would provide an immediate boost.

In the longer run, government’s share of the economy needs to decline. The least painful way would be to cap inflation-adjusted total government spending, and keep it capped while the economy grows, allowing governments share to decline to, say, 2000 levels. This would require changes to Social Security and Medicare benefits.

Which brings us back to China. It appears that a large centralized bureaucracy was a significant contributor to China’s decline. It did this through three channels: Central bureaucracies imposed inefficiencies on the economy (just as we saw in the failed USSR). Bureaucracies are also risk averse, which limited China's upside potential. And, like other bureaucracies, it attracted the best talent.

This is not to say that the United States is 14th century China, and about to enter into an extended period of decline. But it is to say a cause of the United States sub-par economic performance is its large and growing central bureaucracy.

Photo by IvanWalsh.com: Museum of Ancient Architecture, Beijing, China

Bill Watkins is a professor at California Lutheran University and runs the Center for Economic Research and Forecasting, which can be found at clucerf.org