The New York Times ran a Timothy Egan editorial on California on March 6. The essay entitled Jerry Brown's Revenge was reverential towards our venerable Governor. It did, however, fall short of declaring Brown a miracle worker, as the Rolling Stone did last August. These and other articles are part of an adoring press's celebratory spasm occasioned by the facts that California has a budget surplus and has had a run of strong job growth.

Egan at least pauses in his panegyrical prose to mention that all is not perfect in California:

Without doubt, California has serious structural problems, well beyond the byzantine hydraulic system that allows the state to flourish. For all the job growth, the unemployment rate is one of the highest in the nation. It has unsustainable pension obligations, a bloated public-employee sector led by the prison guard union. And it is so expensive to live here that clashes over the class divide are threatening to get nasty.

That's not the worst of it. Before going there, though, let's consider Brown's most celebrated achievement, a budget surplus.

California has a budget surplus because of a temporary income tax on its highest earning citizens and because of large capital gains reaped during an amazing year for stocks. The S&P 500 was up almost 30 percent last year, an event unlikely to be repeated. California's tax revenues are excessively dependent on a relatively few wealthy tax payers. This makes revenues extremely volatile. When these tax payers do well, Sacramento is flush with cash. When the high end tax payers don't do well, Sacramento has very serious problems.

By increasing California's reliance on a few wealthy tax payers, Brown's tax increase made California's revenues more volatile. The ongoing bull stock market would have generated higher tax revenues for California without the tax increase. It generated even more with the tax increase. When a bear market comes, the state will again face deficits. This is one reason that Standard and Poors ranks California's credit as second worst in the country, only above Illinois.

So far, to his credit and in stark contrast to what we saw in the dot-com boom under Gray Davis, Jerry Brown has, with the exception of his pet project, the high-speed train, effectively resisted the legislature's knee-jerk impulse to increase long-term spending commitments. What he has not done is perhaps more important: addressing California's other financial issues, the ones that are contributing to California's dismal credit rating.

California has had several quarters of stronger-than-the-nation job growth, but is still 113,500 jobs below the level in 2007; in contrast Texas is 844,300 jobs above that number.

Nor can it be sure that growth will continue. Unfortunately, the day after Egan's celebratory essay, California's Economic Development Department announced that the state had lost 31,600 jobs in January. That's an initial estimate, and it will be changed, but it's hard to tell which direction. The data released with that estimate appear to be a bit of a mess and are internally inconsistent. We've asked for some clarification.

Regardless of the most recent data point, California's job performance has been better than expected, and we should all be thankful for that. However, comparison with the United States average is not the only metric. Comparison with California's potential is the correct metric, and there California is underperforming in a big way. Given all of its advantages, California should be leading the nation in job creation and opportunity.

California has been averaging about 27,000 new jobs a month over the most recent 12 months for which we have data. It should be averaging at least 40,000. This would be slightly more than Texas' average of 33,900,. But, it still represents only 3.2 percent job growth, well below Texas' 3.7 percent job growth rate.

The state is sitting over estimated oil reserves that are about four times as large as the Bakken Shield, a major contributor to North Dakota's boom. Any serious effort to tap that resource would generate huge numbers of jobs. Many of those jobs would be high wage positions for less educated workers who were hurt the most by the recession.

California has many advantages over North Dakota, or Texas for that matter, besides oil. These are well known and include location between Pacific Rim producers and the world's largest consumer market, ports, workforce, and climate. Even without oil, we should be doing better. Policy though, particularly environmental policy, is restraining the state's job creation.

Egan makes a big deal of migration. Here is his first paragraph (emphasis is his):

Let’s review. Just a few years ago California was a punching bag for conservative scolds — a failed state, profligate with its spending and promiscuous with its ambition. Ungovernable. And everybody’s leaving.

Later, he returned to the topic:

Third, the great exodus never happened. Since the dawn of the recession, the state has added about 1.5 million people — almost three Wyomings. And yes, 67,702 people moved from California to Texas in 2012. But 43,005 people moved from Texas to California. (Population growth is not necessarily a good thing, especially in this overstuffed state, but that’s another topic).

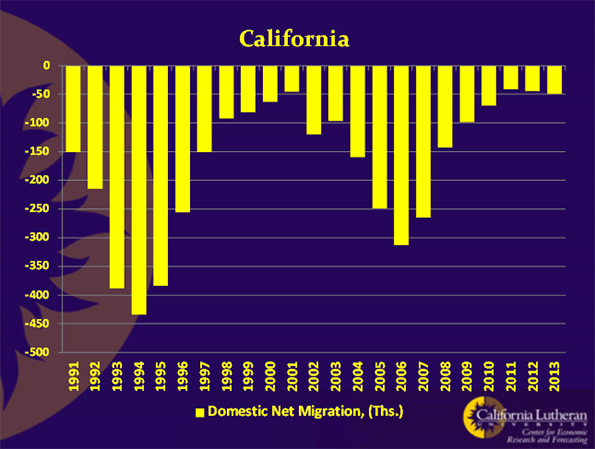

This is really curious. A whopping 57 percent more people moved from California to Texas than moved from Texas to California, which was the case for decades. This is an argument that people aren't leaving California? California's population is up 1.5 million? California's population growth is mostly a result of California's fertile young people. Census data show that California's domestic migration has been negative for over 20 consecutive years. It may not be The Great Exodus, but it's a reversal of about a 150 year of migratory trend.

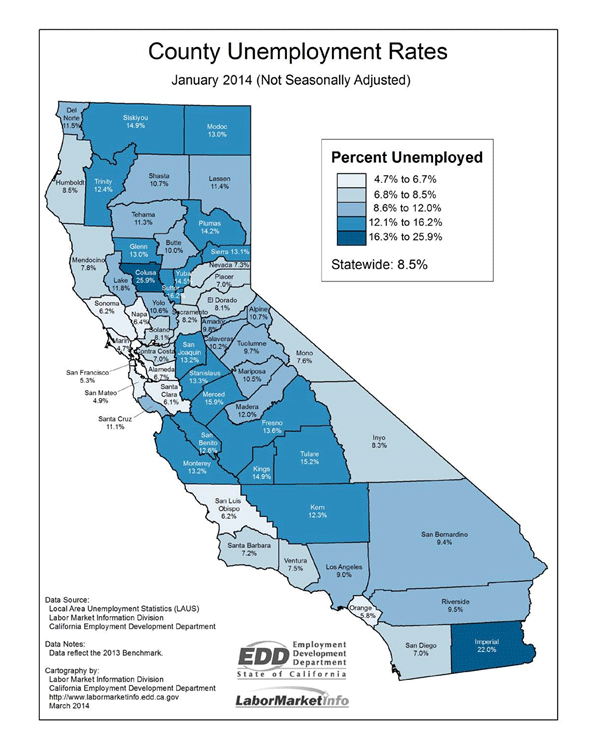

Then there is poverty and unemployment. Poverty, unemployment and lack of opportunity are why California's domestic migration data is negative. Lack of opportunity may be hard to measure, but we have lots of data on unemployment and poverty. Some examples:

- San Bernardino has the second highest poverty rate of any major U.S. metropolitan areas. Only Detroit is worse.

- California, with about 12 percent of the U.S. population, has 34 percent of U.S. welfare recipients.

- Two California counties, the geographically separated Colusa and Imperial, have unemployment rates over 20 percent.

- Thirty-one of California's 58 counties have unemployment rates in double digits.

The geographic distribution of California’s poverty is one reason many people fail to understand California. Most of California’s poverty is concentrated in regions where the political class ---or wayfaring editorialists --- seldom venture. It's mostly inland, not where most of California's elite live or travel. If you stay on the 101 corridor, or hug scenic Route 1, it’s easy to avoid. You can find it, but you have to have eyes that are open to it, and it helps if you get off the beaten path.

Egan wrote his piece in Santa Barbara, where life can be as good as it gets, particularly for the affluent and boomers who bought their homes decades ago. But, the city of Guadalupe in Santa Barbara County could give him a taste of how the other half lives. Just take a look sometime: it’s about as hardscrabble a town as the Texas town in the movie “The Last Picture Show”.

California's poverty is harder to ignore along the 99, but is even more evident in roads like 33 which winds along the eastern side of the coastal range. Go there, and you will find it hard to believe that you are still in the United States, much less California. There you will find grinding, hopeless poverty more reminiscent of the Third World than the center of the economic jobs.

A high speed train won't help these people. Neither will Silicon Valley tech jobs, even if they don’t shrink in the inevitable social media shakeout. Neither will Sacramento, apparently. Until we start doing something for the state's huge and struggling working and middle class, and that means creating opportunity for them, we should refrain from congratulating ourselves and each other for our good work.

Bill Watkins is a professor at California Lutheran University and runs the Center for Economic Research and Forecasting, which can be found at clucerf.org. A slightly different version of this story appeared in CLU Center for Economic Research and Forecasting's September, 2013 California Economic Forecast.