Advocates of higher density housing development in Australia’s major cities – inner city areas in particular - are fond of pointing to a range of statistics as evidence of rising demand. Dwelling approvals, dwelling commencements, tower crane counts and various other sources, both reputable and dodgy, are referenced and then highly leveraged to support claims that our housing preferences have fundamentally changed in favour of high density apartments. But what’s the one inescapable fact that these advocates are missing?

“Higher density living on the rise” is typical of the light weight PR puffery that passes for market analysis these days. This piece is typical of the boosterism:

“Since 2008/09 multi-unit housings’ share of dwelling approvals in Queensland has jumped from 31% to 46%. Much of the increase can be attributed to an increase in approvals for high-rise apartments, with the sector’s share of dwelling approvals doubling between 2008/09 and 2013/14, from about 12% to approximately 24%.” So far, correct.

But it goes on to draw this unjustified but widely supported conclusion: “the popularity of apartment living in the larger capital cities had been driven by a number of factors including decreasing housing affordability and the changing lifestyle of baby boomers and young professionals.”

Or how about this piece of PR chasing nonsense pumped out by a bank no less: “Australians are favouring smaller, more affordable homes, with approvals for the construction of flats, townhouses and semi-detached houses nearing their highest level in 20 years.”

What’s wrong with these conclusions? Simply this: rising dwelling starts for apartments in inner city areas do not necessarily reflect ‘changing lifestyles’ or any ‘popularity’ for this product by home buyers. What it does reflect is a (so far) ravenous investor appetite for the product. This is entirely different to an owner occupier appetite. If owner occupiers were buying these apartments in large numbers, you could then conclude that inner city apartment living was becoming more and more popular. But speculative investors have no intention of living in the product they’re buying.

Owner occupiers in the main aren’t looking for tiny one or two bedroom units. Some developers have targeted the owner occupier unit market, and their designs feature more three and even four bedroom units, spacious in design and with features designed for living in as adults or families. The price points are vastly different. This is so far a niche market which is performing strongly, but it’s completely different to the cookie-cutter apartment stock which is driving the stats.

What is happening in Australia now, and which is being reflected in the dwelling stats for apartment construction, is a nation-wide frenzy of speculative investment in inner city apartments, fuelled by negative gearing, SMSFs, foreign buyers and the search for returns in a very low yielding market. For many apartment projects, more than 80% or 90% of the stock is sold to investors, not to people with the intention of living there. This includes a significant proportion of first home buyers as investors, as Michael Pascoe recently pointed out.

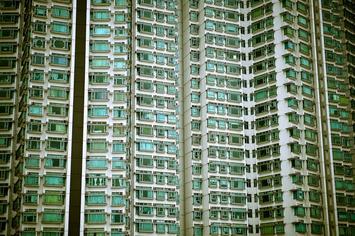

To meet the investor market, apartments are getting smaller and smaller – to meet the price points demanded by investors. Typically, most projects offer a mix of one and two bedroom units only – and these are designed to squeeze every square inch of efficiency out of them. Construction economics and pricing is all about size, features and finishes and every dynamic is put under the microscope and cut from the project if it means the unit offering can be sold for less without sacrificing margin. Many continue to be offered through project selling agencies or “investment channels” in order to achieve a certain level of pre-sales. ‘Rental guarantees’ from developers provide investors with some certainty that their investment will perform predictably for the first year or two. A successful project is one that is sold out, preferably pre-sold. Actually being occupied is another thing altogether.

What this is doing is creating a large pool of rental units of similar size and design and in similar locations. And contrary to the sort of froth and bubble many commentators attach to the ‘rising popularity’ of apartments, many are vacant: simply locked up and not used by their owners (often overseas buyers). Others are looking for tenants, but can’t rent for what investors need to get. Inner city apartment vacancy rates are rising, and rents are starting to fall: a sure sign of market where supply is beginning to exceed demand.

‘Official’ vacancy stats produced by Real Estate Institutes only count the properties actively being marketed for rent. The ones that are simply unoccupied and not available for rent don’t form part of the figures. A recent study in Melbourne reviewed water consumption in a number of Docklands Towers and concluded that those apartments with next to no water consumption were effectively empty. They put the vacancy at nearly one in four. Or you can simply look at these towers at night, and count the lights that are on, and draw your own conclusion. Or maybe ask some restaurant or shop owners who took leases in new projects on the promise of “a bustling inner city café society” what the trade is really like.

Increasingly, smart developers are selling sites with approvals in place but before a sod has been turned. In some cases they’re selling even before the approval has been obtained. Why go through the grief of developing something when someone else is happy to pay you a premium many times what the site cost you?

I don’t actually see anything wrong with any of this. Property markets going through booms and busts are not a new thing. Just ask industry people on the Gold Coast. Or have a look at CBD office markets. Plus, if it weren’t for the frenzy of activity we’re seeing in the apartment market now, there’d be precious little else going on. So it’s keeping an industry alive, and all those whose jobs depend on it. Investors are entitled to take risks and they are just as entitled to lose money as make it. There are no guarantees.

But please, stop suggesting that what we’re seeing is anything but a case of investor-fueled activity. Investors are buying a financial product, not a lifestyle choice. To suggest it means Australian society is surrendering a three or four bedroom home in favour of a one bedroom apartment is stretching the conclusions that can be drawn from the stats way way way too far.

Ross Elliott has more than 20 years experience in property and public policy. His past roles have included stints in urban economics, national and state roles with the Property Council, and in destination marketing. He has written extensively on a range of public policy issues centering around urban issues, and continues to maintain his recreational interest in public policy through ongoing contributions such as this or via his monthly blog The Pulse.

About speculation

Ross,

I am surprised you have no issue with people buying dwellings on a purely speculative basis. As this drives the market in actual housing construction, to the detriment of other less profitable forms of housing being created, it artificially exasperates the negative trend of availability, and affordability of housing for those who need it.

While everyone has a right to make a buck, it seems that the forces of the market are creating problems that do not need to exist.

Would you be so cavalier about creating artificial scarcity, and pricing people out of a given market if we were to substitute water for housing as an example.

Man at walkershawman.com

http://walkershawman.com

only naked is better