The latest Statistics Canada population estimates indicate that much of the nation's growth continues to be in the census metropolitan areas (CMAs) of the Greater Golden Horseshoe, centered on Toronto, and in the Prairie Provinces of Alberta, Saskatchewan and Manitoba.

In addition to Toronto, the Greater Golden Horseshoe includes Hamilton, Kitchener-Waterloo, Oshawa, Brantford, Barrie, Peterborough St. Catherine's-Niagara and Guelph census metropolitan areas. The Prairie Provinces metropolitan areas are Calgary, Edmonton, Winnipeg, Saskatoon and Regina.

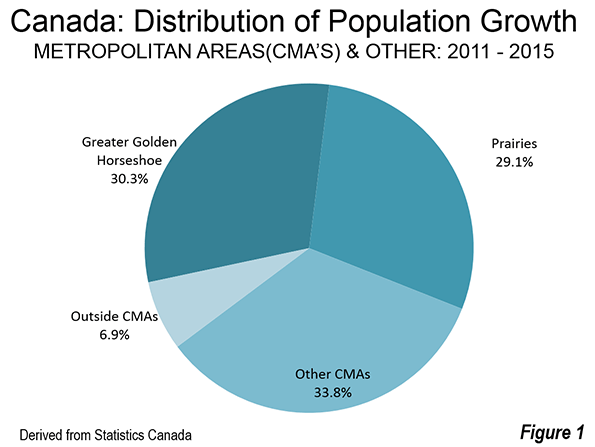

Between the 2011 census and 2015, the Greater Golden Horseshoe accounted for 30.3 percent of the national population increase (Figure 1). The five Prairie Province metropolitan areas had 29.1 percent of the growth.

Growth in the Greater Golden Horseshoe was above its national share of the population of 25 percent. The Prairie Province CMA growth was more than 2.5 times its population share, which was less than 11 percent in 2011.

The CMAs outside the Greater Golden Horseshoe and the Prairie Provinces accounted for approximately 34 percent of the growth, somewhat more than their 30 percent share of the population. Areas outside the CMA's accounted for only seven percent of the growth, a fraction of their 34 percent population share. This is a continuing indication that the metropolitan areas continue to draw more of the population growth.

Changing Distribution of Growth

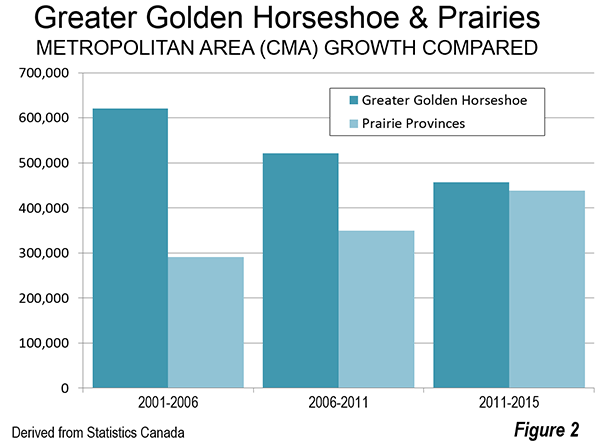

The last decade and a half has seen substantial changes in the distribution of CMA growth. Between 2001 and 2006, the Golden Horseshoe metropolitan areas welcomed 40 percent of Canada's population growth, well above the 30 percent over 2011 to 2015. At the same time, the Greater Golden Horseshoe reduction in the share of growth has been compensated by the gain in the Prairie Province metropolitan areas. Between 2001 and 2006, the share of national growth was 19 percent, which rose to 29 percent over 2011 to 2015.

The population growth rate has slowed considerably in the Greater Golden Horseshoe metropolitan areas, from 1.7 percent annually between 2001 and 2006 to 1.1 percent between 2011 and 2015. Growth has risen considerably in the Prairie Province metropolitan areas, from 1.2 percent annually between 2001 and 2006 to 2.8 percent between 2011 and 2015. Numerically, the Prairie Province metropolitan area growth is now challenging that of the Greater Golden Horseshoe, despite the latter's more than twice as many residents (Figure 2).

Winnipeg's would pass Québec in population by the 2021 census, if the growth rates of the last four years continue and would become the 7th largest metropolitan area.

Fastest Growing Metropolitan Areas

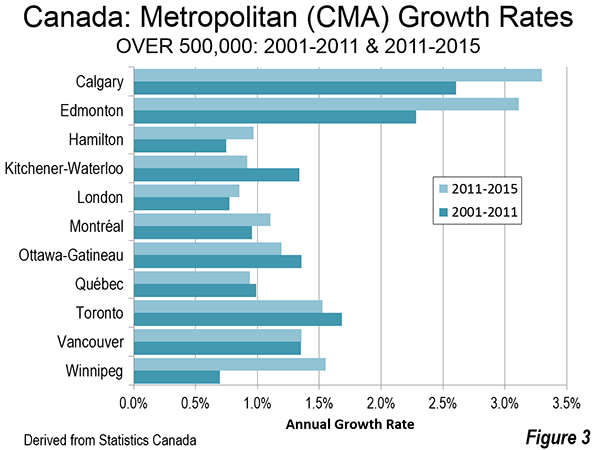

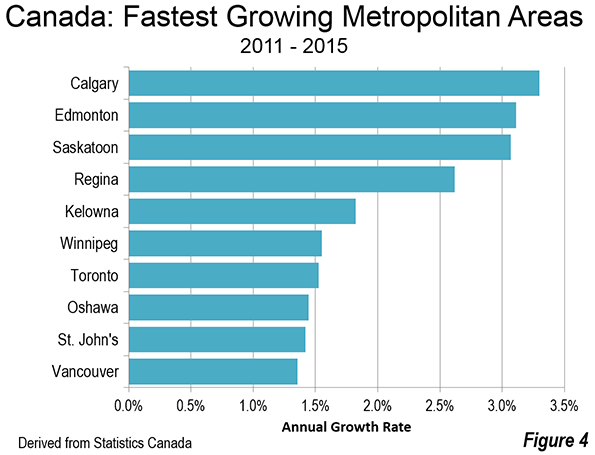

Five of the six fastest growing metropolitan areas between 2011 and 2015 were in the Prairie Provinces. Calgary, Edmonton and Saskatoon topped the list, growing more than three percent annually (Figure 3). This is an extraordinary rate, better than three times the national growth rate. Regina grew 2.5 percent annually. Over this period, Calgary and Edmonton have both grown larger than Ottawa-Gatineau, which had been the fourth largest CMA for at least 40 years. One can expect growth in the two Alberta cities to slow with the decline in energy prices, while the other prairie metropolitan areas, less oil dependent, though resource dependent, should do better.

Winnipeg, which was the nation's fourth largest metropolitan area until 1961 and nearly as large as Vancouver as late as 1931, has begun once again to grow more quickly, after decades of lackluster growth. Having slipped to 8th largest by 2001, Winnipeg ranked sixth in growth since 2011, trailing only the four other Prairie Province metropolitan areas and fast growing Kelowna, BC (1.8 percent annual growth). Unusually, Winnipeg's growth rate exceeded that of Toronto between 2011 and 2015. Winnipeg's annual growth rate was 1.6 percent, more than double its 2001-2011 growth (0.7 percent). Should Winnipeg's growth continue at the most recent rate through the 2021 census, it could exceed the population of the Québec CMA and would trail only the six metropolitan areas with more than 1,000,000 population.

The changing growth rates of the largest CMAs is indicated in Figure 4, which indicates the rising growth rates in the Prairie province metropolitan areas, with more mixed performance among the other larger CMAs.

Largest Metropolitan Areas

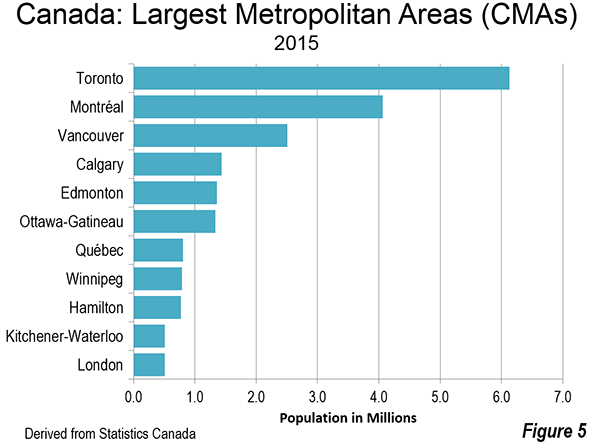

Canada has eleven metropolitan areas with more than 500,000 residents. Toronto remains by far the largest, at more than 6 million and seems unlikely to be challenged in the foreseeable future. Montréal is closing in on 4.1 million, while Vancouver has just passed 2.5 million (Figure 5).

The Future

Canada's fastest growing metropolitan areas also face the greatest growth challenges. The energy downturn has been particularly rough on Calgary and Edmonton, exacerbated by the disastrous Fort McMurray fire. There was a noticeable downturn in growth between 2014 and 2015 in both CMAs, yet only Kelowna grew faster in the last year. Other Prairie province metropolitan areas, less impacted by the energy decline, have seen their population growth rates fall. The growth rate was one third less than the 2011 to 2015 rate in Saskatoon and about 30 percent less in Regina between 2014 and 2015. Winnipeg fared best, maintaining 90 percent of its 2011-2015 growth rate.

Other metropolitan areas face challenges every bit as complex. The economic dynamo of Toronto should continue to grow, though has faced strong domestic out-migration between 2004 and 2014, as the population disperses to outer metropolitan areas in the Greater Golden Horseshoe and outside Ontario altogether (See: "Moving from Canada's Biggest Cities"). Montréal also experienced strong domestic migration losses, with half moving to other parts of Québec and half to other provinces. Vancouver, despite its incomparable attractiveness is also losing net domestic migrants. In all three metropolitan areas, the rising cost of living seems likely to be a major factor in the losses, with "tanking" housing affordability the apparent cause. Vancouver now ranks as the third least affordable major metropolitan area among 87 in the nine nations covered by the Demographia International Housing Affordability Survey, while Toronto's house prices have risen at more than four times average household incomes since 2001 (see the Frontier Centre policy report: "Canada's Middle-Income Housing Affordability Crisis"). House prices escalated almost as much in Montréal.

With the outcomes of these conflicting influences unclear, Canada's metropolitan area growth could go in different directions. This could range from growth patterns that are similar in the coming years, to the continued discovery by households of smaller metropolitan areas, a higher quality of life is possible because of the lower cost of living. This, has already been evident in the smaller metropolitan areas of Ontario and Québec, as households have been exiting Toronto and Montréal. Meanwhile, Canada is in the midst of its every five year census for 2016, the results of which should be available in seven months (February 2017).

Photo: North Saskatchewan River from Edmonton central business district (by author).

Wendell Cox is principal of Demographia, an international pubilc policy and demographics firm. He is a Senior Fellow of the Center for Opportunity Urbanism (US), Senior Fellow for Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), and a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California). He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.