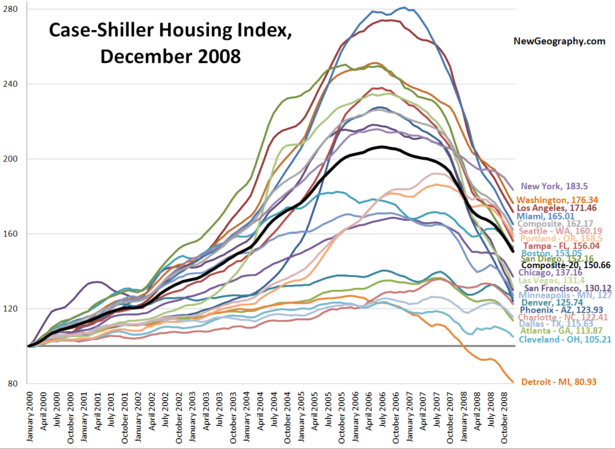

S&P released the December Case-Shiller Housing Price Index data this morning: no market has been spared from the free fall. Steep price declines continue in ultra-bubble regions Las Vegas, Miami, San Diego, Phoenix, and Las Vegas. Even the relatively healthy markets of Charlotte, Dallas, and Atlanta have been sliding since mid-2008. Here's the line chart:

Cleveland is seeing the slowest decline, but that isn't saying much. My pick for healthiest markets? Denver, where prices are still up 25% from the 2000 baseline but still down 5.2% from the most recent upswing in July 2008. And Dallas, down 6.1% from the July 2008 peak and down 8.6% from June 2007. Dallas is up 22.9% since the Jan 2000 baseline.