A systematic mapping of where the world’s global leading companies in deep tech are located shows that the US continues to have a significant advantage. However, Europe is catching up somewhat and is clearly the part of the world that is second best in having world leading deep tech companies. There is also a close connection between technological success in business and academia.

The number of world leading technological institutions in mathematics and engineering that are located in Europe is slightly higher than in North America. Now that Europe is open to trade with the outside world while the US is not as open, there is a particular global relevance to the technological competence that is located in Europe.

The US in particular, but also Canada, is currently leading in deep tech. A full 67 percent of the 500 global leading companies in advanced technology are located in North America. However, Europe is a clear second with just under 19 percent of the companies, followed by Asia with 11 percent. Oceania, Africa and South America have a total of approximately one percent each of the world's leading deep tech companies. Compared to last year, Europe has increased, and the US has declined, with Santa Clara Valley in particular losing some of its previously towering lead.

Europe currently has particular strengths in clean tech, fintech, and computers and quantum computers. London, Zurich, Eindhoven, Stockholm and Cambridge are examples of regions in Europe with world-leading deep tech companies.

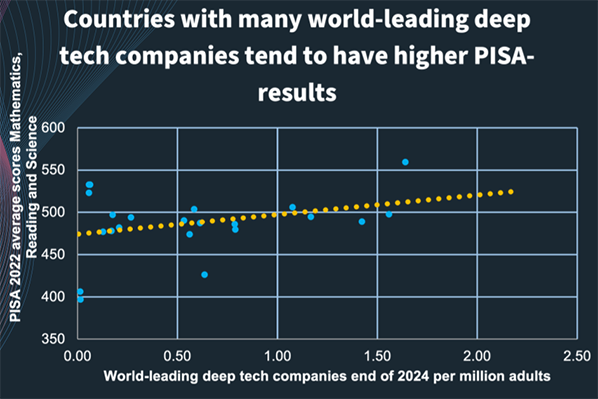

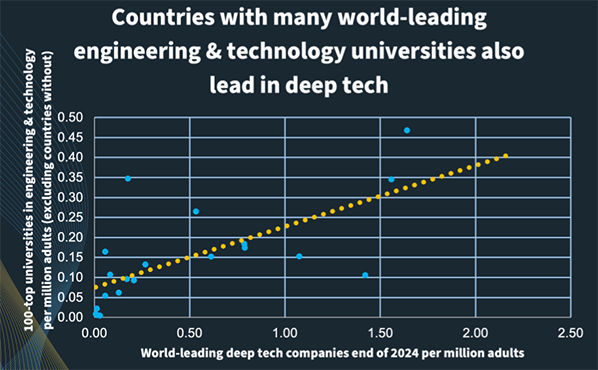

There is a clear connection between technological progress in academia and in business. Countries that have a higher proportion of the world’s top 100 universities in mathematics and engineering per million adult population also tend to have more world-leading deep tech companies per capita. High PISA scores are also clearly linked to having more successful deep tech companies.

Here, Europe’s advantage is clear. Europe has 31 of the world’s top 100 universities in mathematics and engineering. Just under 32 in Asia, but more than 23 in the US and 27 in North America including Canada. Now that the US is becoming somewhat less easy to do business with and travel to for academics and experts, there is an increased opportunity for Europe to grow as a leading technology partner to the world.

In Sweden, school results according to the PISA measurement are now about as good as in the USA. However, in Estonia, Ireland and Switzerland we find European countries with good school systems where high taxes do not undermine the value of education – here the school results of pupils in 9th grade are according to the global comparison clearly higher than in the USA.

A global benchmark shows that countries with stronger property rights, lower taxes on corporate profits and lower taxes on capital gains tend to have a higher concentration of world-leading deep tech companies per million adult inhabitants. Europe's large economies need growth reforms, so they stop punishing growth through excessive tax burdens.

While China is a world leader in the efficient production of, for example, cars and batteries, the country is still somewhat behind in deep tech. China and the rest of Asia are investing heavily in technology, but Europe still has an important lead that should not be underestimated.

Many global value chains will also in the future include Europe, the US and the rest of the world. To the extent that countries seek alternative trading partners than the US, however, Europe has a unique position. The fact that Europe now tends to have lower salaries for experts compared to the US is a competitive factor.

In institutional competition, it was long the case that the US could grow faster than the major European economies through lower taxes and more business-friendly regulations. With changed economic policies on both sides of the Atlantic, with an increased focus on growth in Europe and protectionism in the US, conditions are allowing for Europe to catch up.

The US alone currently has 62 percent of the world's leading deep tech companies. Four of the leading regions in the world with the most world-leading technology companies are Santa Clara Valley, Boston, New York and Los Angeles in the US. The fifth, London, is in Europe, however. The fact that Europe is second only to the US in advanced technology means that the expertise exists in many tech areas, while prices are typically lower. From a global perspective, this is an important competitive advantage. As economic policies in Europe are more focused on growth than before, this is Europe's chance to catch up.

Nima Sanandaji, Director, European Centre for Entrepreneurship and Policy Reform (ECEPR)

Graphs: courtesy the author. Lead photo: ETH Zürich (Swiss Federal Institute of Technology in Zurich) is an engineering, science, technology, mathematics and management university. It is consistently ranked among the top universities in the world, currently ranked 4th in Europe overall, and 3rd best university in the world in engineering, science and technology. Photo by Dennis Jarvis, via Flickr, under CC 2.0 License.