On July 31, voters in a 10 counties of the 28 county Atlanta metropolitan area will vote on whether to raise the sales tax by one cent for $8 billion in transit and highway projects over 10 years. The measure is highly tilted towards transit spending. Sadly, this would do virtually nothing to reduce Atlanta's traffic or its travel times.

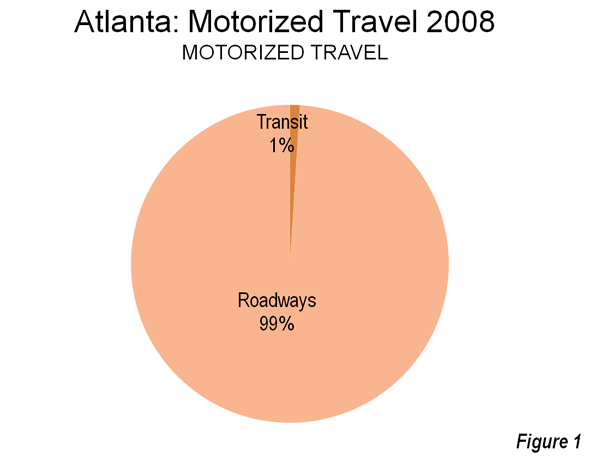

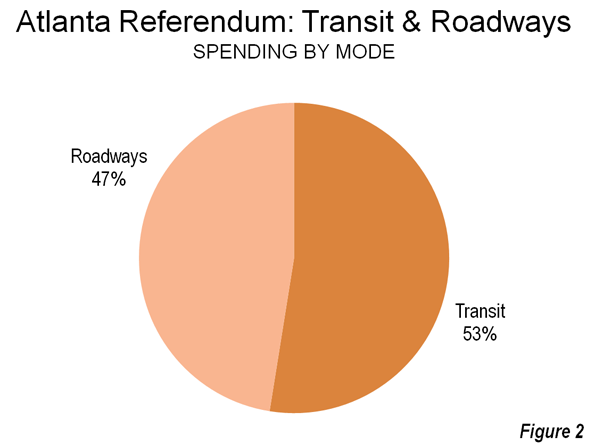

In a metropolitan area in which barely one percent of travel (Figure 1) and less than five percent of work trip travel is by transit, the tax measure devotes more than 50 percent of the funding to transit (Figure 2). Yet in reality, the focus of any transportation revenue issue should be on reducing travel times, whether by transit or highways. This is how transportation improves an urban economy. The reality is that with nearly all travel by highways and transit's inherently slower travel times, much of the tax money would have virtually no impact on reducing travel times or traffic congestion.

Atlanta's Traffic Congestion: Promoters of the tax claim that the highway projects will reduce traffic congestion. Atlanta is well known for its serious traffic congestion. There are two reasons for this:

- Atlanta’s sparse freeway system is limited to little more than a belt route (I-275) and three radial freeways (I-20, I-75 and I-85) that converge into two in the one place more capacity is needed, the core. Trucks are not permitted on freeways inside the beltway, which concentrates the considerable interstate traffic on a single roadway, I-275. If Atlanta had the higher freeway density (freeway mileage per square mile) of Los Angeles or Minneapolis-St. Paul, traffic congestion would be far less of a problem.

- Atlanta's regional arterial (high capacity streets) system is virtually non-existent. For this reason, I proposed (in 2000) development of a one-mile terrain constrained grid of arterials. The Atlanta Regional Council (ARC), the local metropolitan planning organization, has included a somewhat more modest (but useful) arterial grid in is regional plan.

Yet despite its reputation, Atlanta's traffic congestion could be worse. The latest INRIX National Scorecard rates the Atlanta metropolitan area as having the 15th worst traffic congestion in the nation, behind Portland, which is nearly 60 percent smaller and twice as dense, with its compact city policies. Among high-income world metropolitan areas with more than 5 million population, only Nagoya outside the United States may have a shorter work trip travel time (Note 1). Atlanta's world-competitive work trip travel time of 29 minutes is faster than that of far more transit-dependent Toronto (33 minutes), smaller Sydney (34 minutes) and much smaller Vancouver (31 minutes), despite their compact city policies.

The Transit Projects: So Much for So Little: The proposed transit projects have virtually no potential to reduce work trip travel times and traffic congestion. Approximately one-fifth of the transit funding would be used to rehabilitate and upgrade the MARTA subway system, a need that should have been legitimately funded from the existing MARTA sales tax. Another nearly 20 percent of the transit funding would be spent on the "Belt-Line" streetcar project in central Atlanta. The role of the Belt-Line is more "city building" (read "real estate speculation") than it is transportation. It will do nothing to reduce work trip travel times. Further, it is exceedingly costly. The extravagance of this project is illustrated by an annualized capital cost alone (principally construction) high enough to pay the lease on a new mid-sized car for each new regular passenger (Note 2). Moreover, that is before the likely capital cost escalation and the substantial operating subsidies (Note 3).

Transit's problem in Atlanta (and elsewhere) lies outside its core downtown job market (Note 4). Most destinations in a metropolitan area cannot be reached by transit in a way remotely competitive with the car. The transit tax would only modestly increase transit ridership. ARC projects the transit projects will boost daily transit ridership less than 10 percent. If all of the forecast new passengers were to be taken from cars (which is not likely), the net reduction in traffic volumes over ten years would be equal to less than three months of traffic growth. Put another way, at the best, the transit proposals would mean that the traffic congestion expected on January 1, 2025 would not occur until March of 2025. That's less than 90 days of traffic relief for 10 years of taxation.

The Road Projects: In a metropolitan area in which personal mobility predominates, roadway improvements, such as expansions, an arterial grid in Atlanta's case and completion of the GA-DOT HOT (high occupancy toll) system provide far greater potential for reducing travel times. There is another significant benefit to highway investments. As traffic speeds increase fuel efficiency improves and both air pollution and greenhouse gas emissions are reduced.

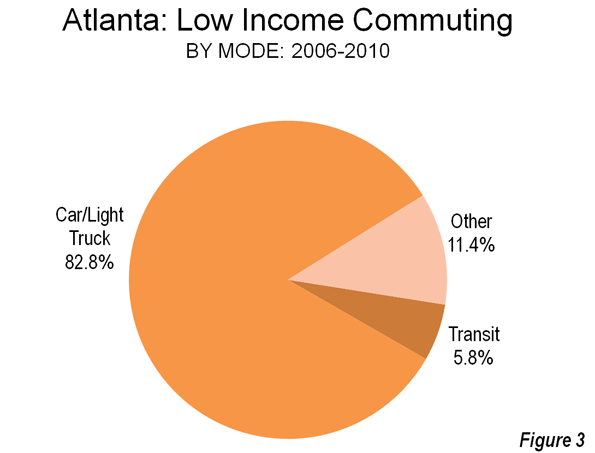

Under the tax referendum, a significant opportunity to improve mobility would be missed, to the detriment of the vast majority of Atlantans; over 88 percent of all commuters in Atlanta travel by car, but the figure is only slightly less (83 percent) among low income commuters (Figure 3).

What's Right About Atlanta: For all its problems, Atlanta has much to be proud of. Former World Bank principal planner Alain Bertaud said of Atlanta in a 2002 study:

While income and population were rising very fast, Atlanta managed to keep a very low cost of living. A worldwide cost of living survey conducted by the Economist Intelligence Unit in 2002 found that Atlanta had the lowest cost of living among major US cities and ranked 63rd among major cities around the world. This achievement is remarkable in view of the rapid rate of growth of the metropolitan area over the last 20 years. It shows that while demographic and economic growth has certainly contributed to generate pollution and congestion, the various actors responsible for the management of metropolitan Atlanta must have done a lot of things right. High income growth and high demographic growth combined with a low cost of living suggests that labor markets are functioning well and that housing does not encounter important supply bottlenecks (Note 5).

As successful as local land use policies have been in making Atlanta livable by making it affordable (the first principle of livability is affordability), local leaders need to start over with a proposal primarily designed to reduce traffic congestion, reduce travel times and grow the economy.

Politics Trumps Reducing Traffic Congestion: Traffic congestion is most effectively addressed by projects that reduce work trip travel times, since it is the concentration of work trips at peak hours that causes the worst congestion. The long-suffering commuters of Atlanta would have been far better served by a program that selected projects based upon their effectiveness in reducing travel times. A simple cost per hour of delay measure would have been appropriate. Atlanta deserves a much better deal.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

-----------------

Note 1: Based upon 109 metropolitan areas for which data is available. Japanese data is reported as median work trip travel time. Nagoya's median work trip travel time (27 minutes) is less than Atlanta's (29 minutes). The excessively long rail commute times of many Japanese commuters could make Nagoya's average work trip travel time as great or greater than Atlanta's. Dallas-Fort Worth has the shortest work trip travel time of any metropolitan area over 5 million population (and the lowest transit work trip market share)

Note 2: A team led by Oxford University professor Bengt Flyvbjerg found that passenger rail systems typically have cost overruns of 45 percent. If the average increase is experienced, the Belt-Line cost could escalate to $1 billion.

Note 3: The capital cost is discounted at 4 percent over 35 years, which equals more than $5,500 annually. A new Ford Fusion, Toyota Camry, Honda Accord or Nissan Altima could be leased for less than $5,000 annually, with no down payment, according to internet sources (such as http://www.leasecompare.com/)

Note 4: More than 93 percent of metropolitan Atlanta's employment is outside downtown (and Mid-Town). Downtown's share of employment declined from 2000 to 2009 (latest data available from the US Census Bureau, County Business Patterns).

Note 5: Atlanta was most affordable major metropolitan area in the US, UK, Canada, Australia, Ireland, New Zealand and Hong Kong in the 8th Annual Demographia International Housing Affordability Survey.

------

Photo: Atlanta Freeway (by author)

- Login to post comments

Email this Story

Email this Story

4% discount rate, in effect, badly undervalues taxpayers money

Tom is right about a far too-low discount rate. One would think that the return on such large urban investments could -and should- easily clear even such low hurdles as those set forth by the federal government, but the bang-per-buck is more commonly so low (approaching car leases per daily rider) that the proponents have to cheat on the numbers. [shakes head in despair]

But beside this, I like his point about utilization as the appropriate metric for evaluating a public transportation investment.

Which leads me to one of my new favorite (bad) examples: the institution of $3.50 peak tolls ($2.80 midday; $1.90 'off hours' and $0 middle of the night) on the 520 floating bridge across Lake Washington in Seattle.

Some $123 million in tolling equipment (paid for by federal stimulus funds I believe) is now in place on this (formerly) jam-packed lake crossing to Bellevue, Redmond, etc. After the tolls, this facility's daily traffic (utilization) is one-third lower. Not much lower at peak, but at every other hour of the day instead! Enough midday folks have forsaken the crossing around peak that travel times for peak have been halved.

To be sure, all this is raking in money (claimed 9% better than forecast) to repay half a billion in bonds sold against the tolls. (Also, the toll operator is doing nicely, as they reportedly collect about 30% of the revenue. Nice gig if you can get it, eh? but it sure seems to eat into the returns on this public facility.)

Anyhow, as the below* images depict, the midday traffic has been greatly reduced (people priced off the facility; about half of them have found other routes, the other half have apparently disappeared). They're the losers, while the peak users are big winners (though they pay a price in the form of a toll.)

My question is whether this is a 'victory' for transportation planners or a failure? How should the 'efficiency' (travel speed at peak) of a facility be traded for the 'effectiveness' (daily throughput) of a facility? Are these necessarily unreconciliable goals?

* https://dl.dropbox.com/u/29376876/520%20Noon%20Mon%20Apr%2023.jpg

* https://dl.dropbox.com/u/29376876/The%20520%20tolling%20equation.JPG

Discount Rate

Tom Rubin:

Wendell, you are being much too kind; your discount rate of 4% is far below the de facto national standard of 7%, which the Federal government applies to all of its capital decisions -- including applications for Federal Transit Administration 49 USC 5309 "new starts" grants. If 7% is the discount rate that MARTA, or any other Atlanta-area transit agency, would have to utilize in applying for Federal financial assistance for these projects, why should any other rate be utilized in an analysis of the justification for the projects?

The changes actually changes the numbers quite a bit. If we assume a 30-year useful life for the assets that would be purchased -- which is more-or-less the average factor for the usual inventory of assets in a new rail project -- the discount rate at 4% is 5.78%, vs. 8.06% for the 7% rate.

So, for a billion dollar project, using the 4% rate, the annualized cost would be $57.8 million, while, using the 7% rate, it would be $80.6 million -- almost 40% higher. Not only would it be cheaper to lease a mid-sized car for each new transit rider, but it appears the taxpayers could also pay the fuel, maintenance, insurance, and registration and still be money ahead.

If there is any justification for changing this rate, it would not be to lower it. Classic capital budgeting assigns discount rates according to risk; the higher the risk, the higher the discount rate utilized. Of course, this is in the private sector, when investors and companies are using their own money; in the public sector, we don't care about risk -- after all, the money being given away isn't ours, it came from someone else (the taxpayers), so we use a one-size fits all discount rate.

Unlike most private sector capital investment decisions, it is somewhat more difficult to quantify the expected return on investment. In the private sector, the intention is to get more money back than you put in, but, in the public sector, particularly transit, that's never going to happen. So, the "return" on investment should be measured in terms of transportation utilization -- and the risks measured in terms of the utilization being lower than expected, the capital costs and operating subsidies being higher than expected, and other promised benefits (such as travel time savings) not being achieved.

In the Atlanta-area transportation context, application of these risk factors to road and capital-intensive capital projects would likely produce the following comparisons:

1. Utilization -- which do you think would be more likely to achieve high transportation utilization, adding a lane to an Atlanta feeway or building a new rail line? Which do you think would achieve the projected levels of utilization sooner? I'll give a little help to those who may not have been following such projects on a national basis: new transit guideway projects frequently fall short of their projected usage; while freeway expansion projects often are quickly fully utilized.

2. Capital cost -- again, which do you think is more likely to come in on budget, or with lesser overruns? Again, the record of transit projects is not good; road projects generally produce better results.

3. Operating subsidies -- Same question, same answer. Transit projects frequently wind up with significantly higher operating subsidies, and capital renewal and replacement costs, than road projects. Of course, the operating costs of a road are fairly small as each vehicle's operating costs are paid by its owner. Roads have significant maintenance costs, but, again, generally far less than those of guideway transit lines.

So, overall, which type of transportation infrastructure investment -- road expansion or guideway transit -- appears to have the higher risks, and should be assigned the higher discount factor, making it less competative?

Do I really have to spell it out?

Transportation tax

An employer may provide transportation benefits to their employees that are tax free up to a certain limit. Actually in this tax he program offers an employer the ability to enhance their benefits package with an incentive that can be used to attract and retain qualified employees particularly in areas with transit access.Transportation Tax includes many things like Transit Passes: Transit passes include any vouchers, passes, farecards, tokens, or related items that employees can use to pay for transportation on mass transit etc.