NewGeography.com blogs

California High Speed Rail officials and the Governor’s office seem to be suffering from selective hearing. Lawmakers and experts at the University of California’s Institute of Transportation continue to challenge the high-speed rail project’s viability due to precarious statistical projections on ridership and cost. One wonders if developers will reconsider upon hearing California treasurer Bill Lockyer’s recent criticisms.

Lockyer’s first major issue lies with the basics: the ability to raise enough capital from private sources needed to complete the project. The Rail Authority claims it would need $10 to $12 billion from private investment alone, although some analysts think that, like most of the monetary figures associated with the rail line, this number will ultimately grow. Investors are reluctant to fund such a risky venture, as nothing proposed in this project has proven stable or certain. If investors do indeed close their checkbooks, there is no way the Rail Authority will complete the project.

Lockyer doesn’t think selling the idea in smaller chunks would work either. He questions the willingness of anyone to buy state bonds for the HSR, even though voters approved $9.95 billion worth in November 2008.

Despite these reservations, Governor Schwarzenegger is protecting the funding promises made in the 2008 ballot measure. The Rail Authority is also ignoring the warnings of Lockyer and others. They are also trying to start building in the Bay Area in order to meet deadlines for federal funding. But the way things are going, it looks as if federal funding is all they will get. As more and more powerful people add their names to the list of skeptics, the high-speed rail line seems that much closer to complete failure.

Rather than overriding their critics and spending money they may not get, the Rail Authority should invest in consumer confidence. They need more concrete plans and more promising statistics to create a market for this line because right now, most think the project will turn out to be nothing more than a huge budgetary debacle.

Looking for a business-friendly state? You had better skip California. Extensive regulations, high taxes, and high worker’s compensation rates have made California unappealing for resident and out-of-state businesses alike in the past two years. However, according to the business relocation coach, 2010 marks an economic “emergency” as there have already been 84 instances in California of companies either closing their factories, moving their headquarters out of state, or investing heavily in another out-of-state location. This nearly doubles the 2009 total of 44 instances, and more than doubles the 2006-2008 total of 35. California is losing its economic luster at an alarming rate, which does not bode well for job seekers.

Some of the companies moving or hedging their bets by shifting operations elsewhere include Google, Apple, Genentech, Facebook, and Hilton. Orange County, Los Angeles, and Santa Clara counties have suffered the most in 2010 with 25, 19, and 16 company moves respectively. Santa Clara in particular houses some of the big tech names like Google, Hewlett Packard, and Apple. In 2009, Los Angeles had the largest number (and the only county in double digits) of company moves with 12. California is not only losing out economically, but it is also losing some of its character as the technology-hub of the US.

This exodus follows recent trends emerging during the recession. The states benefitting most from California’s high taxes and strict regulations include Texas (with 18 events), Colorado (17 events), Arizona (11 events), Nevada (10 events), and North Carolina (10 events). Increasingly, these states have established themselves as promising havens for job seekers and have fared better during these tough times.

The state that once drew thousands of hopeful migrants during the Great Depression is now stifling growth opportunities. This is a bleak and unfortunate reversal, particularly for a place struggling to stay afloat in the recession.

For years, the United States has been portrayed by both international and domestic interests as an environmental outlaw, because of its high rate of greenhouse gas (GHG) emissions. The United States, Canada and Australia have the highest GHG emissions per capita in the world. Further, the United States has historically had the highest overall GHG emissions, until having recently been passed by China.

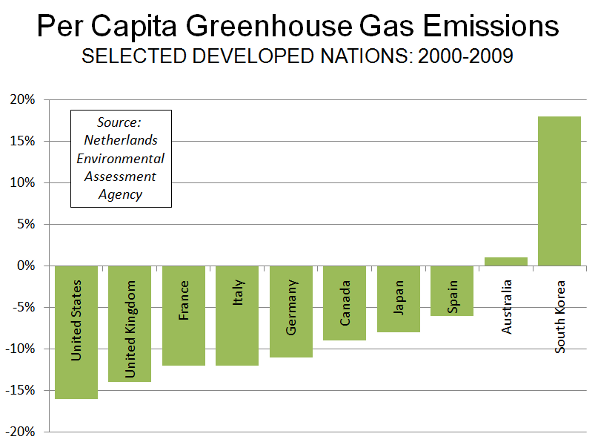

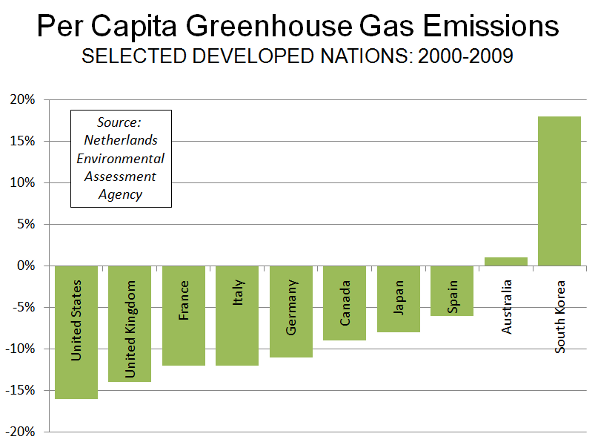

It is likely to come as a surprise that the US has become a model for its reduction in GHG emissions over the last decade. According to a report by the Netherlands Environmental Assessment Agency, GHG emissions per capita fell more in the United States from 2000 to 2009 than in any other area reviewed. The Agency also reported that there had been no growth in global GHG emissions in 2009.

Per capita GHG emissions fell 16% in the United States from 2000 to 2009. This is half again as large as the 11% reduction in the highest income portion of the European Union (EU-15). Among EU-15 nations for which data was provided, per capita GHG emissions were down 14% in the United Kingdom, 12% in France and Italy, and 11% in Germany. Spain, where economic reality is forcing a reduction in support for its highly touted "green" energy program, reduced per capita GHG emissions by little more than one-third the US rate, at 6%. The Netherlands achieved a 3% reduction (Figure).

In both the United States and Europe, the deep recession contributed to a reduction between 2008 and 2009. Between 2000 and 2008 (pre-recession), US GHG emissions per capita declined 9%, while EU-15 emissions declined 7%.

Canada's GHG emissions declined 9% from 2009 to 2009, while Japan's per capita GHG emissions declined at one-half the US rate (8%). Australia's emissions rose 1%, while emissions per capita rose 18% in South Korea.

GHG emissions per capita increased in all of the developing nations surveyed except for the Ukraine (-12%) and Brazil (-1%). Such increases are not surprising, as people in developing nations move from the countryside to urban areas and as they seek greater affluence. GHG emissions per capita increased in all of the developing nations surveyed except for the Ukraine (-12%) and Brazil (-1%). Such increases are not surprising, as people in developing nations move from the countryside to urban areas and as they seek greater affluence.

There was more good news for the United States. Biofuel use in road freight transport was more than double that of the European Union (EU-27). This is significant because road transport volumes in the EU-27 are nearly the same as in the United States.

Photograph: Southern Greenland (by the author)

In the lead up to the G20 conference, the security costs were projected to approach a billion dollars. As high as this number sounds, sources are now speculating that the total bill could be closer to $2 billion. Shocking as that number is, the costs incurred by local businesses may have exceeded that total.

In addition to the physical damage to the hundreds of shops that were smashed in, there were major productivity losses during, and in the week before the conference. The most visible opportunity cost was the sharp decline in retail sales. According to Monaris Solutions, businesses within the security barrier saw a 28.08% decline in sales, and a 40.87% decrease in transactions. Businesses outside of the barrier experienced a 10.78% decline in sales, and a 16.43% decrease in transactions. The total city decline in sales was 9.31%, with 14.96% less transactions. This may not seem like that much, until you consider that the city has $47 billion in annual retail sales. A crude calculation puts the total retail losses in the $386 million range for the 25-27th. Given that this is a summer weekend, it is probably a low estimate.

The implicit costs to the financial sector would be difficult to tabulate. With 223,000 employees, even minor disruptions to the sector are extremely costly. Many of the large banks asked their employees to work from home for several days, which certainly caused some level of productivity costs. Many of them also had to temporarily move their trading floors outside of the downtown core. Moreover, each bank needed to prepare its employees for the inevitable disruptions during the conference. As the security boundaries shifted, and government policies to deal with the conference changed, banks were required to hold multiple meetings in preparation. Assuming each meeting lasted a half hour, and the average employee earns $20/hour (an understatement), the financial sector would have lost roughly over $2 million for every single preparatory meeting.

Unfortunately, it is impossible to calculate the full cost of the summit to Toronto businesses. The banks have been fairly quiet about their own costs, likely because of the Harper government’s strong stand against implementing a global bank tax, a move that would have devastated the global financial sector. Though there have been no public statements from the banks, there are rumors circulating that the financial sector lost at least as much as retailers. Those same rumors have it that the overall economic losses exceeded the security costs (based on the original security estimates). With nearly $400 million in retail losses alone, this seems realistic. Let’s hope this G20 experience has finally put to death the myth that hosting controversial global political meetings in major cities brings economic benefits.

If one measures a state’s popularity on the cost of U-Haul rentals, then Ohio is losing out to the sunny Florida beaches big time. The one-way rental fees for a 26-foot U-Haul truck show a significant disparity in the cost to go from Florida to Ohio and the cost to go from Ohio to Florida. The rate for going from Miami to Cleveland is $1,000 compared to $1,457 if the destination was swapped, resulting in a 45.7% premium to leave Ohio. That percentage still pales against the 50.4% premium to go from Cleveland to Tampa or the whopping 56% premium to go from Cleveland to Orlando. U-Haul is offering deep discounts for Ohio-bound travelers, which hopefully for Ohio, will attract more people.

This is not unique to Florida either. U-Haul rates to go to and from states like Texas and Pennsylvania reflect the same pattern. Some speculate that Ohio’s higher taxes are to blame for the exodus, but who knows; maybe Ohioans just want a change of scenery.

In a surprise move, the Vietnam National Assembly rejected plans proposed by the government to built a high speed rail line from Ho Chi Minh (Saigon) to Hanoi.

Some opponents expressed concern that the line would not be competitive with air service. The 900 mile route, which was to operate at up to 186 miles per hour, would take between five and six hours to make the trip between Vietnam's two principal cities. This compares to the current two hour trip by air. Concerns were expressed that this travel time, combined with fares that would need to be competitive with those of airlines would be insufficient to make the line a viable economically.

But the strongest objections were expressed with respect to the context of such a large expenditure in a developing nation. The high speed rail line would have cost an amount equal to 60% of Vietnam's gross domestic product, even before the cost overruns that have typically plagued such projects. This is akin to spending $8.5 trillion on high speed rail in the United States (more than $25,000 per capita). But the strongest objections were expressed with respect to the context of such a large expenditure in a developing nation. The high speed rail line would have cost an amount equal to 60% of Vietnam's gross domestic product, even before the cost overruns that have typically plagued such projects. This is akin to spending $8.5 trillion on high speed rail in the United States (more than $25,000 per capita).

National Assembly member Nguyen Minh Thuyet told the Agence France-Press that some children in the Central Highlands can only get to school by swinging on a cable across a river because they have no bridge, questioning the validity of such an expensive project in light of the nation's low income.

Photograph: Ho Chi Minh (Saigon)

Bay Area businesses beware, San Francisco is once again considering banning a common city commodity. This time it is not environmentalists, but city lawmakers who are howling for change. If San Francisco’s Commission of Animal Control and Welfare approves the proposed ordinance, it will be illegal to sell any pets in the city except for fish.

Commission Chairwoman Sally Stephens, who seems to be the voice of pet sale opposition, claims that people buy small pets without thinking and end up giving them to shelters where they are euthanized. Those looking for an animal companion would have to buy one from a different city, adopt one from a shelter, or buy one through the classifieds. While this does make it that much harder to buy a pet on impulse, San Francisco residents would still be giving up their pets to shelters in the city. It also seems that many of the animals you would buy on impulse – guinea pigs, birds, and mice – do not typically go to shelters when they become difficult to manage or forgotten.

Pet store owners around San Francisco are making a fuss as their major attractions are being threatened. Dogs can sell for a few hundred dollars or more at pet stores, and losing this income source would surely strike a blow to pet businesses. The Board of Supervisors has the final say, but pet lovers and owners around the city are piping up.

As such a compact city, San Francisco seems to want to clear out any waste they set their sights on. Yesterday it was plastic bags, today it is animals. Who knows what San Francisco lawmakers will target next?

Hat tip: Newsalert

For years, the world's busiest airports in passenger volume have been Atlanta's Hartfield-Jackson International and Chicago's O'Hare. However, there are indications that this long dominance may be about to end. According to Airport Council International data for 2009, Chicago O'Hare had fallen to 4th position, following Atlanta, London-Heathrow and Beijing Capital International Airport.

Beijing's Capital International increased its passenger volume by 17% in 2009, while European and American airports were experiencing slight declines due to the recession. Beijing's increase is more significant, because growth might have been expected to level off after the 2008 Olympics, which were held in Beijing. Between 2008 and 2009, Beijing rose from 8th in the world to 3rd, and from 20th place in 2004, when its volumes were approximately one-half the present level.

Early 2010 data (first quarter) indicates that Beijing Capital International has become the second busiest airport in the world, trailing only Atlanta. Passenger volumes were up 10.5% from a year earlier. If the current rate of growth continues, Beijing should pass Atlanta in two to three years, even if the American economy improves.

London's 130 million annual passenger traffic was the greatest of any metropolitan area in the world in 2009 (distributed among five airports). The new Conservative-Liberal Democrat government seems determined, however, to forfeit this ranking, having banned further London airport expansions to combat what it calls "binge flying."

New York was second with passenger traffic of 105 million at its three major airports, while Tokyo was third at 95 million. "Binge flying" does not seem to be a concern in Japan, where Tokyo's Haneda Airport is adding a fourth runway and will soon serve international flights again, providing competition to more distant Narita. Atlanta's single airport handles an annual passenger volume of 88 million.

Other airports in China are also growing. In the Pearl River Delta (the world's largest "mega-region," an area of adjacent urban areas), the four large airports, Hong Kong, Guangzhou and Shenzhen accommodated passenger traffic of more than 105 million in 2009. Traffic at Shanghai's Pudong and Hongqiao grew 14% and 10% respectively.

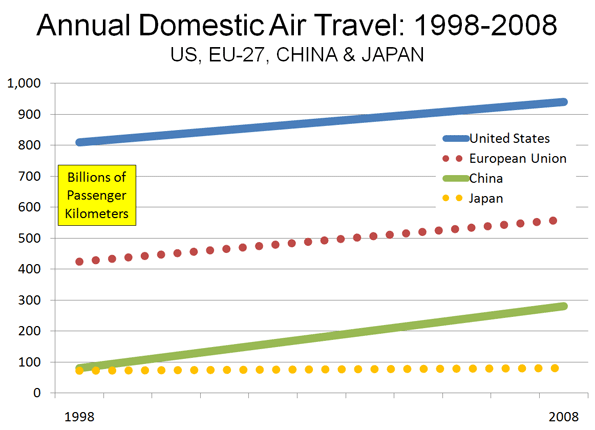

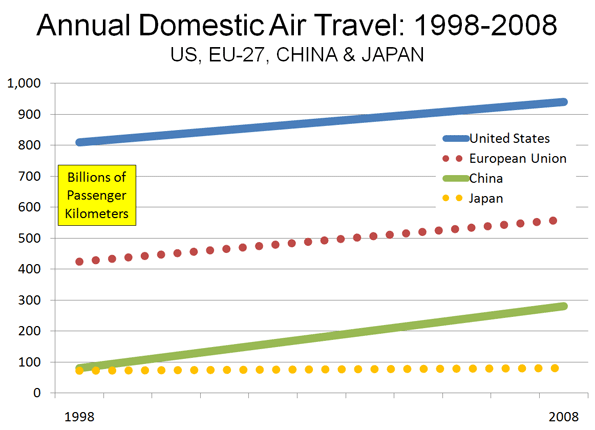

Overall Chinese air traffic is also growing rapidly. Over the past 10 years, annual passenger volumes have risen an average of more than 25%. This compares to an average annual growth rate of 3.2% in the European Union (EU-27), 1.6% in the United States and 1.1% in Japan (Figure). The US continues to be dominant in passenger volumes, at 940 billion annual passenger kilometers, compared to 560 billion in the European Union, 280 billion in China and 80 billion in Japan (data calculated from US, Europe, China and Japan national sources).

If Tara Siegel Bernard of The New York Times is right, (city of) New Yorkers must be among the most irrational people in the world. In "High-Rise or House with Yard," she describes the purported financial advantages of living in a co-op apartment in Brooklyn versus suburban South Orange, New Jersey.

The irrationality is that, despite the money that households can save by staying in the city, a net more than 350,000 left for the suburbs between 2000 and 2007, as E. J. McMahon and I found in Empire State Exodus, which summarized IRS inter-county migration data. Indeed, each of the city's five boroughs lost domestic migrants to the suburbs during the period. An analysis by The New York Times itself found that the city had lost net domestic migrants to every suburban county in the metropolitan area as well as to every county in newly exurban northeastern Pennsylvania. This includes Allentown-Bethlehem and Scranton-Wilkes Barre, toward which New Jersey land use regulations have driven new development.

"High Rise or House with Yard" stands alone in claiming that New York City is less costly than its suburbs. The most recent (and authoritative) ACCRA cost of living index for Brooklyn is a full 40% higher than in the South Orange (the Newark-Elizabeth area). This is before considering the fact that the Brooklyn home is a 1,000 square foot coop apartment with two bedrooms and one bath, while the suburban home is a 2,000 square foot house in South Orange with four bedrooms and 2.5 baths. Smaller apples may well be less expensive than bigger oranges. The Times also assumes that the suburban resident will commute by train to Manhattan, at more than $400 per month. It is also possible that, like 80% of South Orange commuters, the new suburbanite may choose to work in the New Jersey suburbs. Maybe New Yorkers are not all that irrational after all. "High Rise or House with Yard" stands alone in claiming that New York City is less costly than its suburbs. The most recent (and authoritative) ACCRA cost of living index for Brooklyn is a full 40% higher than in the South Orange (the Newark-Elizabeth area). This is before considering the fact that the Brooklyn home is a 1,000 square foot coop apartment with two bedrooms and one bath, while the suburban home is a 2,000 square foot house in South Orange with four bedrooms and 2.5 baths. Smaller apples may well be less expensive than bigger oranges. The Times also assumes that the suburban resident will commute by train to Manhattan, at more than $400 per month. It is also possible that, like 80% of South Orange commuters, the new suburbanite may choose to work in the New Jersey suburbs. Maybe New Yorkers are not all that irrational after all.

Moreover, people are moving even further than the suburbs and exurbs, with almost as many people moving from New York City even further away. The latest Bureau of the Census data indicates that every borough experienced a net domestic migration loss between 2000 and 2009. More than 1.2 million residents left New York City, nearly as many people as live in the cities of Washington and Boston combined.

- Manhattan lost more than a 140,000 net domestic migrants, more people than live in the city of Hartford.

- Brooklyn lost nearly 450,000 net domestic migrants, more people than live in the city of Miami.

- Queens lost a 420,000 net domestic migrants, nearly as many people as live in the city of Cleveland.

- The Bronx more than 200,000 net domestic migrants, more people than live in the city of Providence, Rhode Island.

- Staten Island did much better, losing only 5,000 net domestic migrants. But then, much of Staten Island looks more like suburban New Jersey than New York City

In the face of these losses of which at least some at The New York Times are aware, the article notes that "Many empty-nesters are giving up the high-maintenance house in the suburbs in exchange for the attractions of city life." Not that many.

Photo: New Jersey Suburbs

Even though cities all over the United States are running large deficits, Chicago Mayor Richard Daley feels that an investment in one particular charity is an investment for the future. After School Matters, founded by Mayor Daley’s wife Maggie Daley, funds l youth programs and helps low-income youth obtain job skills. It has received more than $46 million from the city since 2005, with nearly one-third of that total coming in 2009 alone ($15 million). This is a 50% increase from 2008, when the charity received $9.36 million.

The city has even given some of its federal stimulus package to fund After School Matter’s job program, which pays low-income 14 to 24 year-olds $9-$10 an hour for four and a half hours of work each workday. The contract, signed in 2009, has allotted $1.31 million to the charity for three years. However, Illinois lags behind its projected job growth, and Mayor Daley must find a way to create sustainable jobs for these new workers if he is going to justify this allotment of stimulus money.

Aside from that, companies that have contracts with the city are donating money to the project as well. Mayor Daley may not be accepting money from city contractors for his campaign, it certainly does not hurt that these contractors are giving millions to his wife’s charity. The Mayor has encountered a lot of criticism for patronage in City Hall after his nephew was found to have used city pension money to buy union land. After School Matters may represent a much more righteous investment, but the Mayor’s seems determined to make Chicago’s budget a family affair.

Hat tip to Steve Bartin’s Newsalert

|

GHG emissions per capita increased in all of the developing nations surveyed except for the Ukraine (-12%) and Brazil (-1%). Such increases are not surprising, as people in developing nations move from the countryside to urban areas and as they seek greater affluence.

GHG emissions per capita increased in all of the developing nations surveyed except for the Ukraine (-12%) and Brazil (-1%). Such increases are not surprising, as people in developing nations move from the countryside to urban areas and as they seek greater affluence.

"High Rise or House with Yard" stands alone in claiming that New York City is less costly than its suburbs. The most recent (and authoritative) ACCRA cost of living index for Brooklyn is a

"High Rise or House with Yard" stands alone in claiming that New York City is less costly than its suburbs. The most recent (and authoritative) ACCRA cost of living index for Brooklyn is a