NewGeography.com blogs

Perhaps no region in the world is more associated with talent than the once-booming San Francisco Bay Area and Silicon Valley. In the first four years of the decade, the area netted an average of 10,000 domestic migrants annually. But by 2016, the tide had turned. About 12,000 residents fled San Francisco that year, and the net outflow for 2017 climbed to 25,000. Nor is the future prognosis particularly great. Seventy-four percent of millennials in the Bay Area are currently considering an exit, according to the Urban Land Institute.

No surprise. San Francisco has devolved in recent years, with streets in some areas marred by the presence of homeless people, excrement and needles. Yet, housing prices are such that the California Association of Realtors now suggests a $181,000 income is necessary to purchase a home, more than 3.5 times the national average.

Expect Bay Area prices to rise further— even if Valley economic expansion continues to slow due to planning policies that block the peripheral growth required to improve affordability. Meanwhile, the outflow of households from the Bay Area could be accelerated by the new federal income tax provisions.

To date, the Bay Area’s job market has survived largely by hiring foreign workers; immigrants account for virtually all the region’s population growth. Many of these are essentially indentured servants on H-1B visas; the Bay Area accounts for a disproportionate share of these contract laborers and depends on non-citizens almost twice as much as other tech-oriented metropolitan areas. If the Trump administration follows through on promises to cut this program, the Bay Area may face even greater talent challenges in the years ahead

The complete listing for the Best and Worst States for Business can be found here.

This piece originally appeared on Chief Executive.

It has long been known by economists, but ignored by planners, that urban containment policies create speculators markets. This has been especially evident in Vancouver, the third most unaffordable market in the Demographia International Housing Affordability Survey, and Toronto, which has experienced record breaking house cost escalation relative to incomes since enacting its “Places to Grow” urban containment policy in the middle 2000s.

Evidence continues to mount to support the relationship between urban containment policy and speculative profits. Now the Globe and Mail, one of Canada’s national newspapers, reports that realtors in Vancouver “are working with developers to obtain preferential access to condos in the Vancouver area.” The Globe and Mail also found that “ Many realtors also purchased one or more presale units for themselves and then resold them for six-figure profits.” Further, “A look at six buildings found flips for insiders and foreign investors brought a windfall of $10.6-million.”

Reprehensible as this is, it is to be expected. Vancouver has not only increased poverty by its urban containment policies that profoundly increase house prices, but also provided heretofore unavailable “get-rich-quick” schemes to make life even worse for those whose choice is a lower standard of living in Vancouver, or an unwanted move elsewhere just to enjoy the average lifestyle of other Canadians.

As George Bernard Shaw is reported to have said, Britain and America are two countries separated by a common language. So too, America and Australia, not to mention America and Canada, New Zealand, and elsewhere.

That was brought home to me with respect to my recent article (The Urban Containment Effect (Zoning Effect) on Australian House Prices) which detailed the extent to which land use strategies that destroy the competitive market for land on urban fringes also destroys housing affordability. This is a malady evident virtually everywhere in Australia.

For Australian readers, a better title would have been “The Urban Consolidation Effect (Zoning Effect) on Australian House Prices,” since “urban consolidation” is the most used term for urban containment in Australia. “Urban containment” is the more widely used international term.

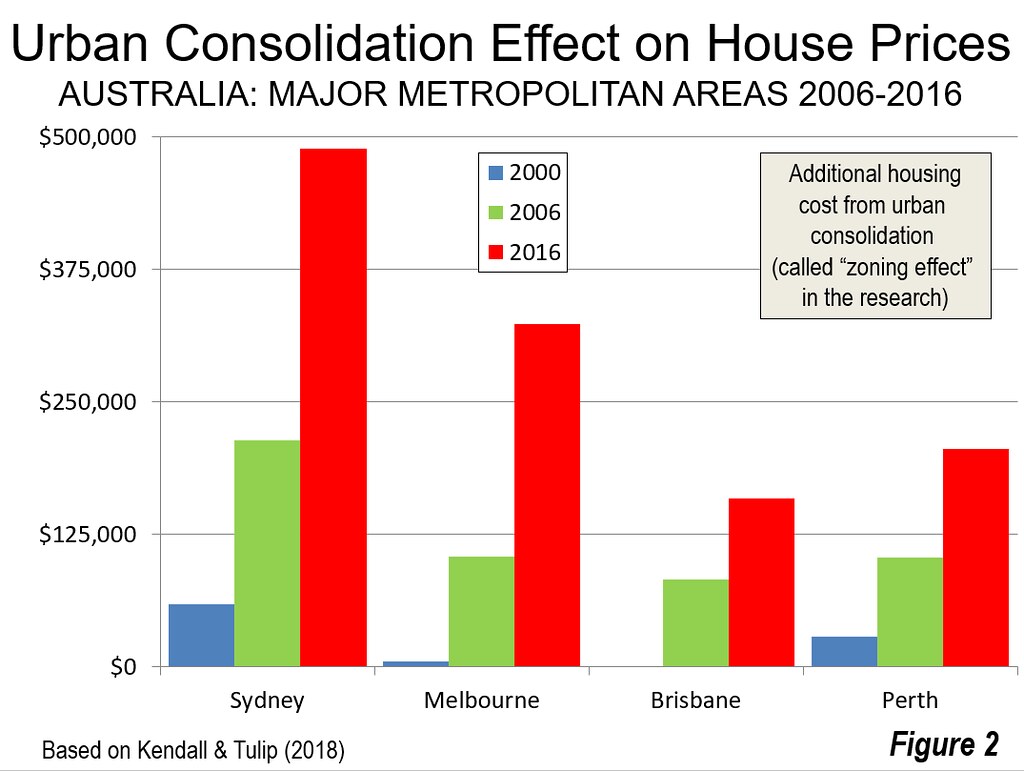

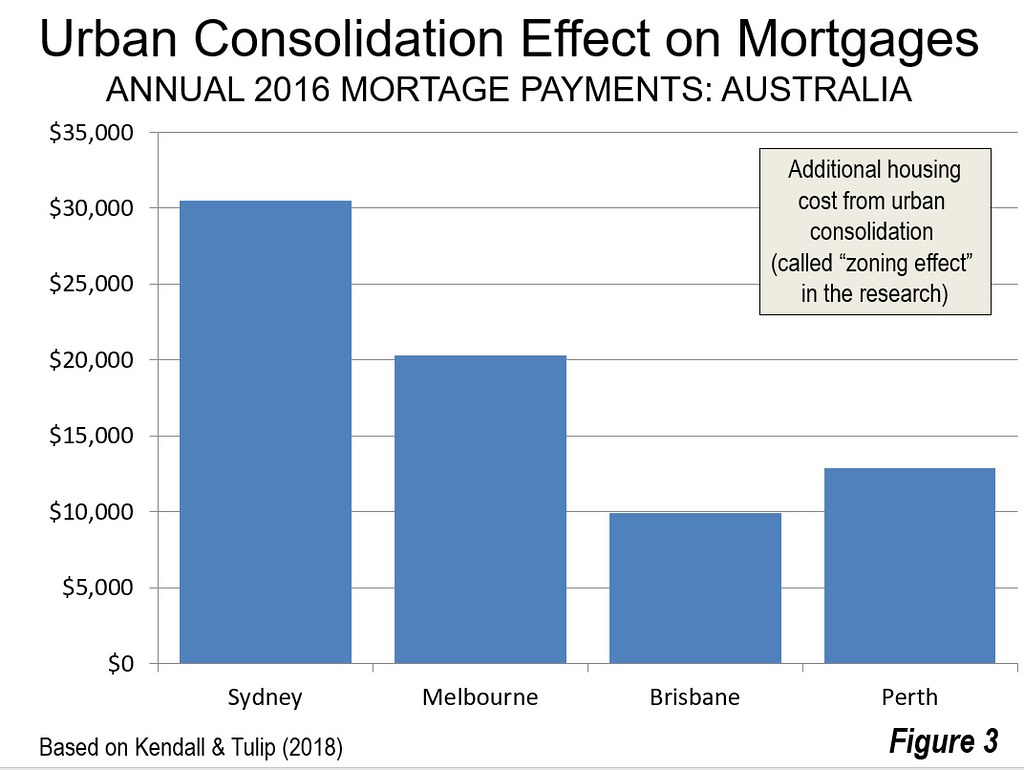

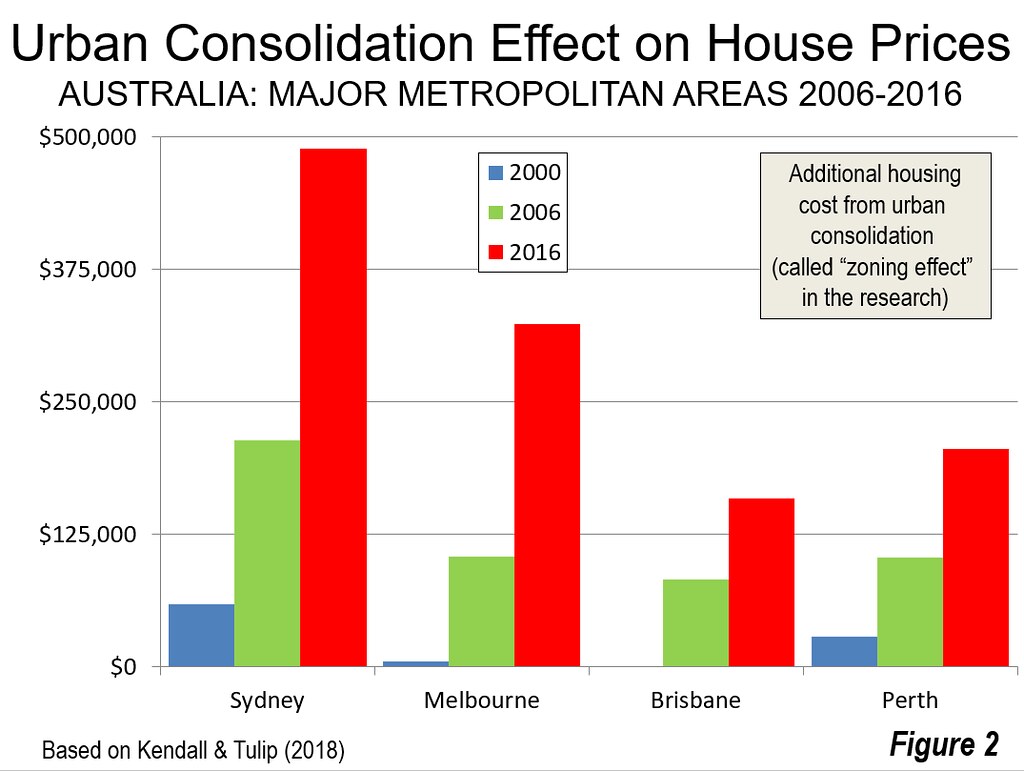

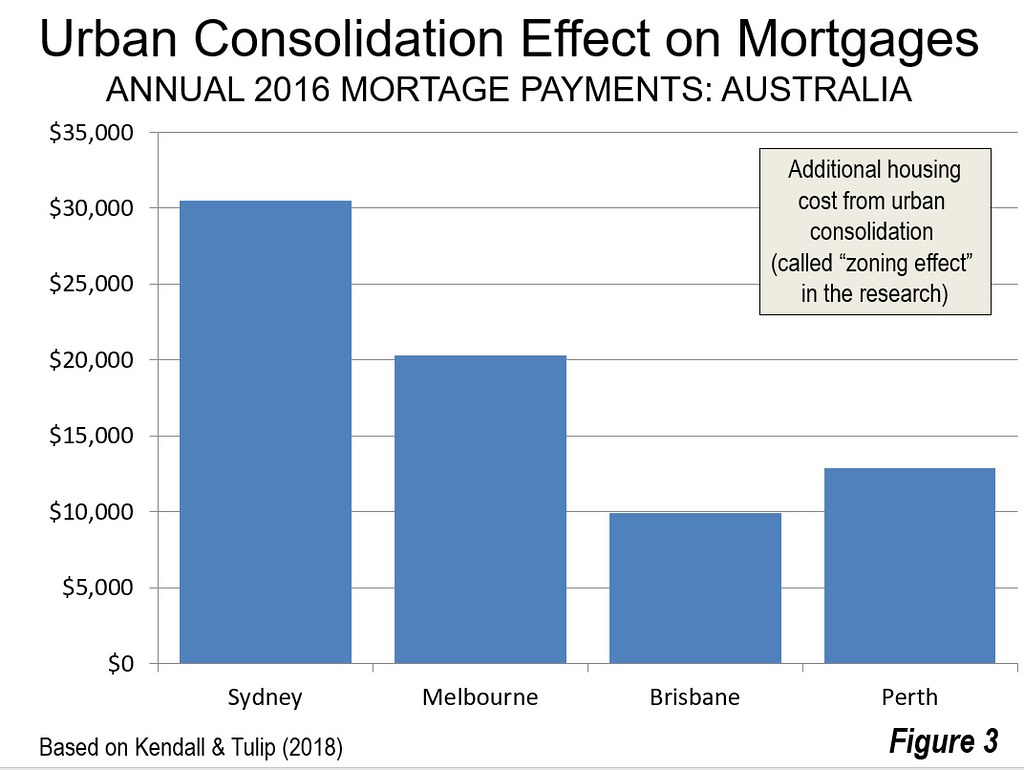

Figures 2 and 3, from the original article, are reproduced below, substituting “urban consolidation” for “urban containment.” The core findings are revised to substitute “urban consolidation” for “urban containment” below:

The Urban Containment Effect in Major Australian Cities (2016)

Houses are more costly as a result of urban consolidation. Assuming typical mortgage provisions, (Note) the urban containment effect adds from $150,000 to nearly $500,000 to house prices in major Australian metropolitan areas --- this is not the house price, but the additional impact of urban containment (Figure 2). The urban containment effect adds up to $29,000 to annual payments on the average house in Australia’s major metropolitan areas (Figure 3).

• In Sydney, the urban consolidation effect adds $489,000 to the house price making the annual mortgage payments $29,000 higher. Figure 4 shows the components of the average house price in Sydney.

• In Melbourne, the urban consolidation effect adds $324,000 to the house price, making the annual mortgage payments $19,000 higher.

• In Brisbane, the urban consolidation effect adds $159,000 to the house price, making the annual mortgage payments $9,000 higher.

• In Perth, the urban consolidation effect adds $206,000 to the house price, making the annual mortgage payments $12,000 higher.

• No data is available for Adelaide, but the present median multiple (median house price divided by median household income) suggests that the urban consolidation effect adds at least $13,000 to the mortgage.

These are significant amounts, especially to families starting out and renters who would like to participate in the proverbial “Great Australian Dream” of home ownership.

For years, wishing thinking planners and others have imagined a “return to the city.” Of course, one cannot return to where they have never lived, so the whole concept was flawed from the beginning. While the suburbs did less well than before a few years of the Great Financial Crisis and its aftermath, they have experienced a steady increase in net domestic migration in more recent years. In 2017, suburban counties of the major metropolitan areas gained nearly 700,000 more net domestic migrants than core counties, up from a low of 120,000 in 2012. Overall, domestic migration to the suburbs was 2.8 million more to the suburban counties than the core counties between 2010 and 2017. William Frey, writing in The Avenue for the Brookings Institution, effectively analyses the trends (see: “US population disperses to suburbs, exurbs, rural areas, and ‘middle of the country’ metros”).

But not everyone is moving to the suburbs. The Wall Street Journal reports that rich golfers in Charlotte are moving from their houses adjacent to suburban golf courses to “thriving urban neighborhoods” (See: “In Charlotte, Golfers Are Leaving Gated Communities for Hipper Urban Neighborhoods: Many homeowners in the North Carolina city are fleeing developments built around courses for thriving urban areas that are close enough to links”). The article indicates similar trends elsewhere, but its anecdotes relate only to Charlotte. Moreover, the houses discussed are a bit pricey, from $1.5 to $3 million, well above the median house price of under $250,000.

But lest any should think that the pack and stack densities sought by planners will be achieved by attracting multi-millionaire golfers, there are two reasons for caution. (1) There are not enough of them. (2) The number of golfers in the nation is declining --- down seven percent in just five years.

The recent Uber fatality of bicyclist Elaine Herzberg, struck by an autonomous car fatality in Tempe (Phoenix, Arizona area) raises serious concerns. Bern Grush, an expert in autonomous vehicles, offers a sobering analysis of the situation.

The Tempe police video of the accident is here (warning: graphic). Grush comments that: “Several viewers of the crash video have suggested there was time for the Uber vehicle to brake and/or sufficient lane space behind Herzberg to avoid a collision.” It looks that way to me. That there was no evasive action or apparently no slowing should raise the most serious of concerns.

Grush also indicates the obvious, that cases like the Herzberg fatality will accelerate negative publicity about autonomous cars. This is not at all surprising, given the aggressive implementation narrative that has been adopted by so many. For example, a Stanford University study (according to one report) suggests that car dealerships will be a thing of the past before 2025 and 95 percent of cars will be autonomous by 2030.

There is a (not perfect) parallel. San Francisco’s BART, the Bay Area Rapid Transit system, was to have operated driverless as well. But then, a train ran off the end of the line at Fremont and landed in a parking lot shortly after service began (the “Fremont Flyer”). Autonomous operation of the BART system has never resumed. There have been substantial advances in automated rapid transit. The first systems were within airports. Eventually, Lille, France opened an automated rapid transit system. Now, even the busiest Metro route in Paris (Line 1, La Defense to Vincennes) is fully automated. But there is a big difference between autonomous cars and automated transit systems. The transit systems are designed (or redesigned) from the “ground up” for driverless operation. Autonomous vehicles will not have the luxury of such a controlled environment in the foreseeable future.

At the same time, the public seems to be increasingly concerned about both the operation and conduct of the broader information technology industry. This has been fueled by cases like the Equifax data breach, to the Facebook (and other) privacy concerns and the hacking of international intelligence systems. Many of us have had the unhappy experience of not-ready-for-prime-time PC operating systems, so flawed that they were quickly replaced by entirely new systems. In short, despite the transformative effects of automated technology, premature implementation is more likely to lead to delay than sustainable implementation.

Autonomous cars will doubtless replace self-driving cars. However, people will be enticed, not forced into a driverless future --- when the technologies are ready. The tragic death of Ms. Herzberg suggests that this is later rather than sooner.

The Sunday Times reports an ominous finding for London (the Greater London Authority, as opposed to the larger metropolitan area that includes the suburban development outside the greenbelt), with a murder rate that exceeded that of the city of New York for the first time (in February). The story is summarized in a video by The Evening Standard, which also provides detailed coverage of the Sunday Times report (behind a paywall). London’s murder rate has increased 40 percent in just three years, according to the report. The report notes that the New York murder rate has declined 87 percent since 1990, since the 1990s, an accomplishment for which former Mayor Rudolph Giuliani has received considerable credit, including in academic research.

Meanwhile, early reports are that things are getting worse. While there were 15 murders in London in February, the Daily Mail reports that this increased by nearly half to 22 in March.

Source: https://www.standard.co.uk/news/crime/london-murder-rate-overtakes-new-y...

Patrik Schumacher, managing partner of Zaha Hadid Architects, and consultant Wendell Cox join Aaron M. Renn on his podcast to speak on their beliefs and what it's like to challenge the urbanist conventional wisdom.

You can find their conversation here.

For the first time, oil has been exported from the United States to the United Arab Emirates (UAE). The UAE has been one of the world’s leading producers of oil, which has financed the urban centers of Dubai and Abu Dhabi, with their spectacular architecture. This is an indication of the rise over the past decade of the United States as a fossil fuel producer. The US Energy Information Administration indicates that the US has reclaimed the crown as the world’s largest producer, regaining the position lost in the 1970s tumultuous oil embargo.

More inforrmation here.

When Amazon’s list of 20 cites that will move forward was announced, I noted that cities like Indianapolis and Columbus win just from making the cut. You could also add Nashville and Raleigh to that list.

I’m just following up with some brief evidence of how this played out. First, the New York Times coverage of the Amazon cut list selection led with an image of downtown Indianapolis and also featured a large picture of Columbus, Ohio.

Image of Columbus used in the NYT (by Andrew Spear)

The Wall Street Journal’s coverage included this paragraph:

Three metropolitan Washington, D.C., sites—including the city itself—made the cut, while Toronto was the only non-U.S. city on the list. Some surprise candidates included Columbus, Ohio, and Indianapolis.

The idea that these cities were a surprise could in one sense be seen as a negative. But being put on this list will likely cause writers like the author of this piece to go “Huh?” and potentially start recalibrating their impressions of those cities.

The NYT and WSJ are the flagship national print media. But the finalist cities got a mention in pretty much every publication of note. That’s a nice blast of earned media.

However, now the potential challenges begin. Round one was reasonable cost. Now cities will be investing a lot more money and civic leadership time and attention on the bid. 19 sites will lose out. There may be some future PR wins to be head, but the cost/benefit becomes a factor to consider.

Also, being in contention for Amazon probably complicates attempts to bid on other facilities. Apple is looking for a new location. I happen to think these smaller cities would be much better suited to an Apple tech support center than HQ2. But can they pursue both at the same time credibly? (If I were one of these smaller cities, I might actually tell Apple that I’d drop out of the HQ2 competition if Apple picked me).

And at the end of the day this is mostly just PR for now. If I were a losing city, I would not be engaging in endless self-flagellation about it. The places weren’t on the 20 city list were long shots at best (just like some that did make it). The PR coup of making the first cut would have been nice, but not getting it isn’t the end of the world.

This piece originally appeared on Urbanophile.

Aaron M. Renn is a senior fellow at the Manhattan Institute, a contributing editor of City Journal, and an economic development columnist for Governing magazine. He focuses on ways to help America’s cities thrive in an ever more complex, competitive, globalized, and diverse twenty-first century. During Renn’s 15-year career in management and technology consulting, he was a partner at Accenture and held several technology strategy roles and directed multimillion-dollar global technology implementations. He has contributed to The Guardian, Forbes.com, and numerous other publications. Renn holds a B.S. from Indiana University, where he coauthored an early social-networking platform in 1991.

Cover image photo credit: Rober Scoble, CC BY 2.0

|