NewGeography.com blogs

I suppose we should not be shocked: businesses that spend money for lobbying and campaign contributions get more favors from government than those that do not. I spent the weekend at Creighton University in a seminar sponsored by the Institute for Humane Studies. I asked Creighton Associate Professor of Economics Diana Thomas about her research on the unintended consequences of regulation. One thing led to another and the next day I downloaded her 2013 paper “Corporate Lobbying, Political Connections, and the Bailout of Banks.” Here is a summary of what can be supported with scientific (statistical) evidence about the influence of big money on big government:

- Campaign contributions and lobbying influence the voting behavior of politicians.

- Campaign contributions and lobbying have a positive effect on wealth for the shareholders of the companies that spend.

- Businesses that pay lobbyists before committing fraud are 38% less likely to get caught; even when they get caught they are able to evade detection almost 4 months longer than those that do not pay for lobbying.

- Firms with political connections are more likely to receive government bailouts in times of economic distress.

The US government has a long history of bailing out private industry. In 1970, the Federal Reserve provided financial support to commercial banks after Penn Central Railroad declared bankruptcy. Throughout that decade federal financial support was provided to private companies, banks and municipal governments: Lockheed, ($1.4 billion) Franklin National Bank ($7.8 billion) and New York City ($9.4 billion) were all recipients Uncle Sam’s largess. In the1980s, it was Chrysler Motors ($4.0 billion), Continental Illinois National Bank ($9.5 billion) and the savings and loan industry ($293.3 billion). The data available at OpenSecrets.org doesn’t go back further than 1990, but last year the finance industry spent nearly half a billion dollars on lobbying and campaigns – the most of any industry sector. Just after the terrorist attacks of September 11, 2001, the airline industry received $5 billion in compensation and $10 billion in federal credit. For these favors, the airlines spent barely $15 million in 1996-2000.

These are all pittances in comparison to the money handed out in 2008 and 2009. NewGeography readers know that the average member of Congress who voted in favor of the $700 billion Bank Bailout received 51% more campaign money from Wall Street than those who voted no – Republicans and Democrats alike. The main finding in Dr. Thomas’ paper is that banks that paid lobbyists and made political campaign contributions were more likely to receive TARP money. To put a fine point on it, for every dollar spent lobbying in the 5 years before the bailout, banks averaged $535.71 in TARP bailout money! We knew the bank bailout was rigged, but that is a better rate of return than even Warren Buffett got for his contribution to the bailout of Goldman Sachs.

The only good news is that spending – at least the spending that can be tracked – was down in 2014 from 2013. Spending by most industry categories has been in general decline since 2010. Between Congress and the Federal Reserve, businesses benefited from an estimated $16 trillion in government assistance since 2008. They are either having a “why bother” moment or the 2016 Presidential election will be another record breaking year for campaign spending.

Emigrate tells the story of Jacob, a South-Asian teenager who has just graduated high school in the United States. His parents are immigrants and thus far he has kept his family life and his personal life clearly delineated. However, when his worlds collide he is forced to confront his own dishonesty or lose the relationships that matter most to him.

The film was independently produced in the fall of 2014 by a collaboration of filmmakers from Chapman University.

EMIGRATE from Ijaaz Noohu on Vimeo.

Born in Sri Lanka and raised in Los Angeles, Ijaaz Noohu has spent the last four years studying Economics, English, and Television at Chapman University in Orange County. As an aspiring filmmaker, he hopes to use his unique perspective to tell stories of humanity, identity and hope. More of his work can be found at: ijaaznoohu.com.

When household savings falls and household debt rises, “most people” are spending more than they make. When people find out I’m an economist, they often ask if I can explain why “most people” can’t figure out how to handle their money. The New York Fed recently reported the end of deleveraging: American households are borrowing again. When you get paid, you can do one of two things with your money: save it or spend it. If you aren’t saving AND you are borrowing, then clearly you are spending more than you make.

There are a lot of people in America who are young, struggling and without inheritance or some initial endowment to get started in life. The Census Bureau reports a 17.5% rise in the number of 25 to 34 year olds living with their parents (from 2007 to 2010). This increase cuts across all socio-economic lines. Regardless of the demographics that impact the way the economy grows, we all go through life-cycles. I did it, you did it and “most people” will do it, too. If you are smart, you’ll engage the economy throughout the cycles of your life. Here’s how it works. The six cycles correspond roughly to the decades from your 20s to your 70s.

CYCLE 1 (20s): Without an initial endowment, we all struggle in the first decade after we leave our parents home (or foster care, or whatever situation it was that brought you to adulthood). Your skill set is very low and you may or may not have gotten a college education. You are an unknown quantity in the job market, untried and unproven, so your wages will be quite low. You also have no secondary source of income (no endowment, remember, means no investment income). If you are smart and lucky, you’ll figure out that you have nothing and so you will spend nothing that you don’t have. Focus on keeping a good job, building some skills, try to get a little more education and keep your nose clean. That’s enough for the first decade.

CYCLE 2 (30s): By now, you’ve got a resume built up so you can expect to be promoted or to look for a better job that pays more, maybe has some benefits like health insurance and some kind of a savings plan. Put something into that employer-matched 401k plan: sure, you probably won’t be able to wait until age 65 to dip into it, but it will be money that you won’t otherwise have. The match means that you earn an instant 100% on your money. Even if the penalty for early withdrawal is about 25%, you will still be ahead by 75% even if you can’t wait for retirement. If you have some financial assistance (from family or a grant of some kind), you’ll probably acquire some sort of property at this point. Maybe it’s a small business or a home but it’s the grown-up thing to do. Stay away from making a big investment in some depreciable asset, like a sports car, at this point. These are the beginning of the years in which you will build capital for the future: financial capital (investments), human capital (skills and education), and social capital (a good network of contacts, both social and business). Focus on moving up in your career a couple of times so that you can begin to put money into savings and investment on a regular basis. Avoid the trap of building up a lot of debt during this stage and be sure to stay within your means.

CYCLE 3 (40s): These are the real building years. You should be well-established in your field of work and hopefully you have built strong and stable social connections, too. It’s time to start thinking about giving back to the community that supports you. You can volunteer, start making larger cash donations to charities, attend some charity balls or even run for office (or get active in the campaign of a candidate you support). Some of these social and charitable contacts will be helpful to you in business and some will just be the kind that makes living in a community more pleasant. Your focus now is to set achievable life-goals. Whatever your ambition was in your 20s, by now you will have a clear vision of what you can realistically attain. With that idea in mind, set goals for your career, your finances, when you want to retire from work, etc. Make them realistic for now, based on what you know. You’ll get a chance to adjust them only once more in your lifetime.

CYCLE 4 (50s): Now’s the time to begin planning for the culmination of your work life. It could be another 20 years off, but you need to think through how you will sustain that longer career, or to plan to stop working altogether. If you wait till the next cycle, when you are in your 60’s, it may be too late to make any changes that will be necessary for you to achieve your goal. Your earnings will peak in this decade so if you haven’t saved enough along the way, this is the last chance to start to bring your savings in line with your goals.

CYCLE 5: (60s): By now, if you’ve followed through with planning and budgeting, you should be able to take it easier. A lot easier (retire from working) or a little easier (work part-time or in your own business). If you’ve been able to get some education, you may be able to support yourself fully as a knowledge-worker. Knowledge workers have longer work lives because they won’t have limitations on endurance or other physical job requirements. Even if your job was physically demanding, it is possible that an employer will need your advice as a manager or consultant on a project that will benefit from your years of experience.

CYCLE 6 (70s): Average life expectancy in the US is in the low- to mid-80s for both men and women. That means that, on average, this will be the penultimate decade of your life. Depending on your early choices, you may find yourself now at the pinnacle of your profession. Try to pass along as much of your knowledge as you can to the next generation, both what you learned in your career and what you learned from your life experiences.

If it seems they aren’t listening, keep talking. Maybe something will sink in and when they read in the news that “most people” spend more than they make, they will be able to count themselves among the unusual. Have a safe and prosperous 2015!

Public art may soon get a boost in St. Petersburg, Florida when citizens cast ballots for a new design proposal to redevelop the 1971 St. Pete Pier. After a 4-year process involving two design competitions (citizens roundly rejected the first competition results), this Florida coastal city will, in 2015, implement a design.

This time around, city officials are taking no chances and building consensus with the public step by step, keeping this $33 million public project at the top of voters’ awareness. Seven design proposals are being considered, and after presentations in mid February, it appears that the field is narrowed.

While several schemes radically erase or change the city’s infrastructure, one scheme nicknamed “Discover Bay Life ” by Orlando-based VOA Associates seems to stand out. All things being equal, this scheme’s monumental-scale transformable art by cutting-edge artist Chuck Hoberman can be had for the least capital investment by the city. The team chose to keep the modernistic “Inverted Pyramid” at the end of the pier, shoo cars off of the over-water deck, and move restaurants and retail – which always struggled in such a remote location – from the end of the 1,400 foot pier back onto land.

Hoberman, who designed U2’s “Claw” for their 2011 album tour, is no stranger to moveable structures. “It’s really very simple,” he stated during the presentation. “There are a couple of motors, pulleys, and bearings. We have structures like this in place that have lasted for decades.” St. Petersburg, home to the world’s largest collection of 20th century surrealist Salvador Dali’s work, seems to have an affinity for cutting edge art, and this commitment could result in a grand, lasting civic space.

A popular vote will decide the scheme by March 20. City leaders, anxious to proceed, have stayed neutral about the results and will ratify their decision afterward. The lesson in urban studies is to proceed with caution when you are considering changes to civic space. Far from being a lost cause, the public realm is very much alive and emotionally connected to its citizens, at least in St. Petersburg, Florida.

We are reading a lot about the windfall coming to consumers due to falling gas prices now that oil is under $50/barrel. But cheap energy also represents a windfall for governments, including governments who are hard pressed for cash.

The US uses nearly 20% of the world’s energy consumption every year. That spending includes households, businesses, industries and governments. Households in the US spend nearly $450 billion on gasoline alone to fuel their 2.28 vehicles. Energy for transportation represents about 50% of US consumer spending on average and climbs to nearly 70% in the summer when there is more driving. Governments spend money on gasoline, too.

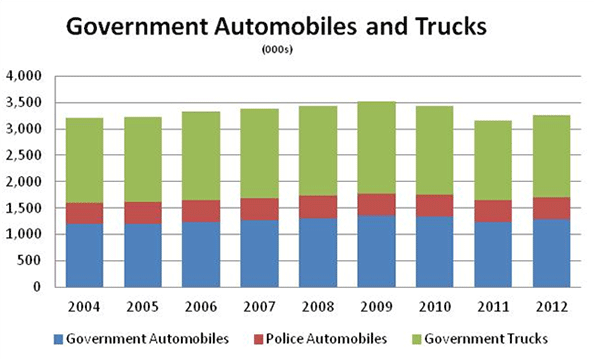

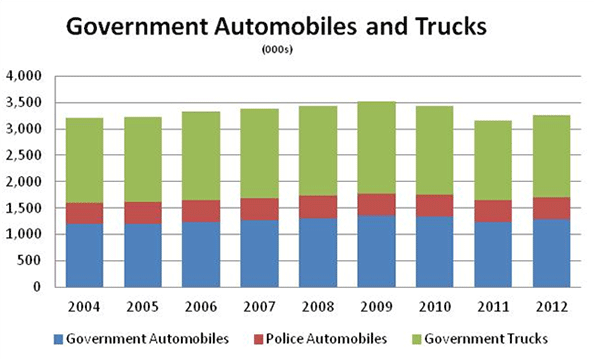

Not just the federal government, but government at every level – federal, state, county, city – all of which have fleets of cars and trucks that use gasoline. We could not locate data on fuel spending by state governments for either gasoline or heating/cooling. The Bureau of Economic Analysis tables lump spending at gas stations in with “Other retail” which includes furniture and appliance stores and places like home depot. We did locate the numbers of cars owned by governments and police. Governments in the United States own about 1.5% of all vehicles on the road. That includes military vehicles, cars and trucks owned by the federal, state, county and local government plus police vehicles.

Data is from www.rita.dot.gov, sourced as www.automotive-fleet.com as of Nov 26, 2013.

Whether we extrapolate from the number of vehicles and use the “per car” savings estimates or estimate the savings based on the governments’ share of vehicle ownership, we guess that governments across the US will be sharing in at least $1 billion this year. And that is just on gasoline alone.

They could also be saving on heating bills for real property. The Federal government alone owns almost 400,000 buildings located throughout the country. According to the Consortium for Science, Policy and Outcomes at Arizona State University, the US Federal government spends up to $610 billion annually on energy consumption. Every 1% drop in the prices could mean a $6 billion windfall for Uncle Sam.

Don’t be surprised if he expands spending instead of using the savings to reduce the national debt or to balance a budget.

Joel Kotkin and I wrote in the Orange County Register that transit work trip market shares in the Los Angeles area had changed little, from 5.9 percent in 1980 to 5.8 percent in 2013. In a response, the Los Angeles Metropolitan Transportation Authority (LACTMTA) noted that we did not cite sources. Fair enough. Our source was the 1980 US Census and the 2013 American Community Survey, a product of the United States Census Bureau. This data shows Los Angeles to rank 10th in transit market share among the 52 major metropolitan areas (over 1,000,000 population), well below its population rank of 2nd.

Then LACMTA goes on to note "the percentage of daily transit commuters in the Los Angeles region ... has stayed steady over the last several decades." That is exactly our point --- that transit is not growing as a percentage of travel in the Los Angeles metropolitan area. This, despite expenditures of $15 billion to build rail over the period in constant 2013 dollars (estimated from data on the Thoreau Institute website).

Earlier this year, an extremely clever married couple named Catherine Herdlick and Gabe Smedresman celebrated the latter's 30th birthday by throwing a citywide Logan's Run-themed chase game. What a perfect motif for a night out in San Francisco: A pastime for beautiful young adults in this city of beautiful young adults re-creating a movie about beautiful young adults enjoying a lavish, indulgent — and extremely temporary — existence.

In that film, the beautiful young adults of a dystopian future earth lived it up before aging out in the most extreme manner possible: They were vaporized to make way for more beautiful young adults.

Here in San Francisco, that would violate the city charter.

Read the entire piece at SF Weekly.

Joe Eskenazi is a staff writer and columnist for SF Weekly.

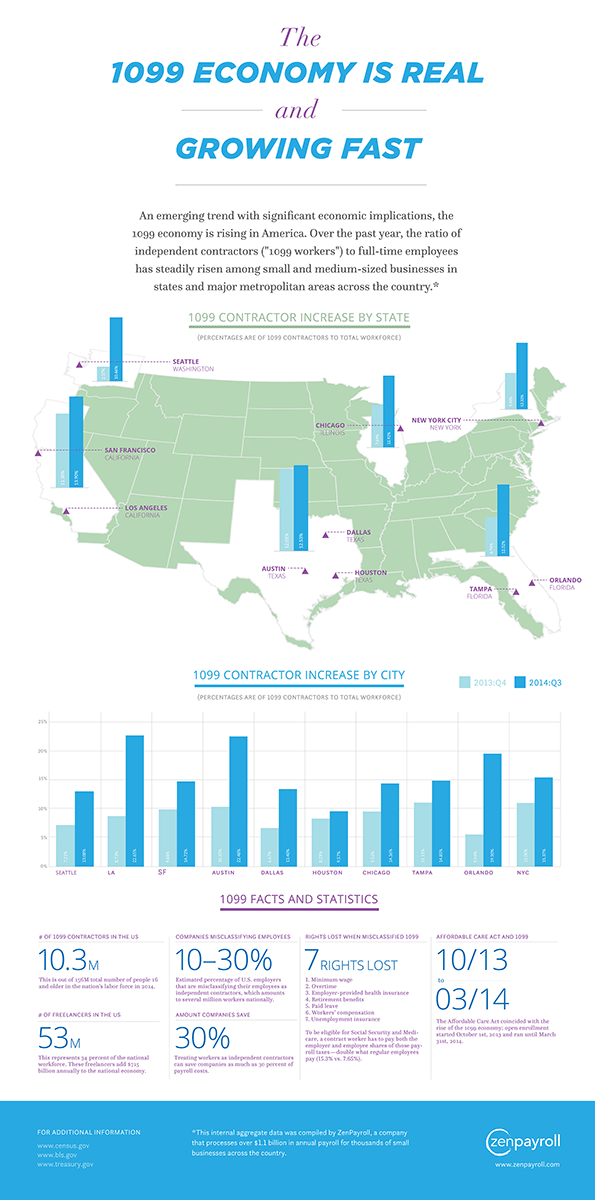

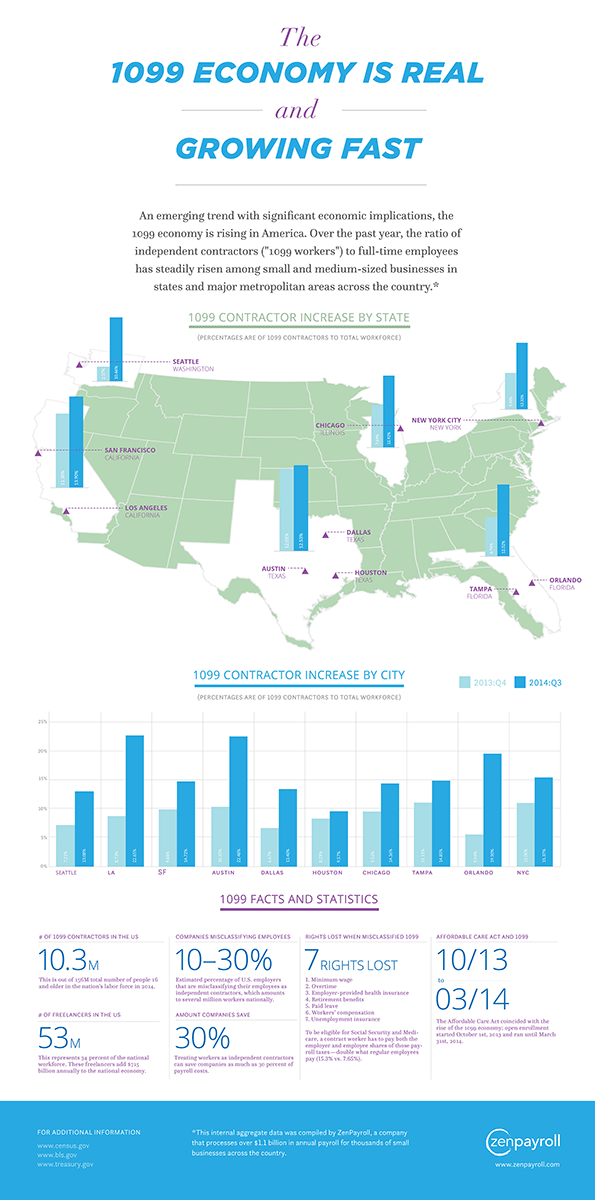

Here at ZenPayroll, we care a lot about how compensation is done, and the effect compensation can have on the relationship between employers and employees. Using the employment data we have as a payroll provider, we decided to look at whether the 1099 economy, which has garnered quite a bit of media attention recently, is really growing as fast as people think.

The short answer is that over the past year, the ratio of independent contractors to full-time employees has meaningfully risen among small and medium-sized businesses in states and major metropolitan areas across the country.

The nature of work is changing given the decline of lifetime employment. Today, very few people plan to work for the same company their whole life, and people often have several jobs at one time. As a result, and as shown by ZenPayroll's data, more small business owners are employing contractors as a part of running their business. There are a number of other reasons for this general trend toward a more flexible work structure.

Click the image to enlarge.

First, employees want to have more choices when it comes to where and when they work, but also who they work for. Millennials in particular are frequently asking themselves whether they're fulfilled by what they're doing. Jess Ostroff, founder of a full-service virtual assistance agency called Don't Panic Management, said that some of her contractors in New York City are aspiring actors, and they do contract work to support themselves as they pursue longer-term passions and ambitions.

Others do contract work purely for the flexibility -- one of the first contractors to work for the Don't Panic Management team is a mother of three who has her own cooking show and also runs a photography business. She supplements those jobs by contracting so she can earn money while spending time with her family.

For some entrepreneurs, hiring independent contractors is key to their business. Lina Pakrosnyte is the founder and owner of UrbanLeash, a professional pet care company based in Chicago. There are four full-time employees on her team, but she works with over 30 contractors for tech and marketing help, as well as dog walking and cat sitting. With the high turnover in pet care professionals, Lina needs to keep finding contractors to serve her UrbanLeash clients.

I've also talked to many small business owners who prefer having a remote or distributed workforce. Adam McLane, founder of a youth ministry resources company called The Youth Cartel, is one example. Because his business requires expert writers and public speakers, he works with over a hundred contractors from all over the country to produce content and events.

After the economic downturn several years ago, many people who lost their full-time jobs found contract and part-time work as a way to fill that gap. When times are uncertain, employers also tend to prefer contractors. With the government promising to crack down on employers who misclassify their workers as contractors rather than employees, it's important for business owners to know the distinction between the two. We published a post recently on the ZenPayroll blog to help small business owners avoid misclassifying their workers.

The future isn't set in stone, and there will be ongoing debate about the responsibility employers have towards their workers, whether they are employees or contractors. It is important to care of your people if you want to attract and retain great talent.

The Responsive City: Engaging Communities Through Data Smart Governance

by Stephen Goldsmith and Susan Crawford

Technology, and especially the use of data and analytics, has been transforming the way cities manage service delivery. Former Indianapolis mayor New York City deputy mayor Steve Goldsmith, and his colleague at Harvard Susan Crawford, recently wrote a book called “The Responsive City” looking at this technology revolution. I recently read the book and posted some thoughts in a review posted at City Journal. Here’s an excerpt:

The book chronicles more than just technology’s potential; it also highlights what some local governments have already achieved with innovative approaches. After several fires resulted in the deaths of five people, New York City built a system to identify buildings at high fire risk, using predictive models and integrating data from multiple sources. City inspectors are now aggressively targeting those buildings for upgrades. To fight its rat problem, Chicago is using data analytics to predict where rats will gather, instead of waiting for resident complaints. Boston has developed a civic customer-relationship management system, with mobile-device apps, to link residents more easily with city services. Mimicking the way that Yelp collects restaurant reviews, Washington, D.C. uses a website to solicit ratings of city services. Cities around the country are adopting open-data portals.

…

Goldsmith and Crawford are candid about the challenges facing their responsive-city vision. Progressive-era reforms designed to eliminate corruption also curtailed government employees’ discretion, leaving them with narrowly defined roles and limited ability to respond effectively to real-world problems. Rigid job descriptions, such as “temporary full-time permanent intermittent police officer,” are common in cities like New York, which has more than 2,000 such classifications. Procurement rules require that detailed specifications be prepared in advance, unlike in the private sector, where technology and other solutions are often developed iteratively. Government’s rigid contracting processes make it tough to respond to findings during development.

You can click over to City Journal to read the entire thing

I also sat down with Steve Goldsmith recently to talk about the book, and some of the challenges and pitfalls of this technology-drive approach. If the audio embed doesn’t display for you, click over to listen on Soundcloud.

This piece originally appeared at The Urbanophile.

We have posted population data for the nation's major metropolitan areas for censuses from 1900 to 2010 and as estimated in 2013. These data are use the current (2013) boundaries to define metropolitan areas. There is no consistent list historical listing of metropolitan area populations using the commuting criteria that define the 2010 and 2013 metropolitan areas. Thus, in using the data in this new report, caution should be employed.

|