NewGeography.com blogs

“I guess the bailouts are working…for Goldman Sachs!” The Daily Show With Jon Stewart

Goldman Sachs reported $3.4 billion second quarter earnings. Mises Economics Blogger Peter Klein says these earnings are the result of political capitalism – earned in the “nebulous world of public-private interactions.” Klein points to an interesting perspective offered by The Streetwise Professor (Craig Pirrong at University of Houston): Moral Hazard. Goldman Sachs’ status as “too big to fail,” conferred on them by the United States Government, has allowed them to increase the money they put at risk of loss in one day’s trading by 33 percent since last May. Goldman received $10 billion in the TARP bailout on October 28, 2008; they returned the money on June 9, 2009. By April 2009, they had paid about $149 million in dividends on the Treasury’s investment – a negligible return. Goldman Sachs also will be receiving transaction fees for managing Treasury programs under contracts awarded to them during the Bailout and beyond. When Goldman Sachs changed its status to “bank” last year they also gained access to the FDIC safety net, which perversely provides incentives for banks to take risks by absorbing the consequences of losses.

To underscore the importance of cronies in capitalism, Goldman Sachs is on track to dole out bonuses equal to about $700,000 per employee – a 17 percent increase over 2006, when bonuses were sufficient to “immunize 40,000 impoverished children for a year … throw a birthday party for your daughter and one million of her closest friends … and still have enough left over to buy a different color Rolls Royce for each day of the week.”

Since employees of Goldman Sachs will one day be in charge of the U.S. Treasury, it only makes sense that the company has to keep them happy now – how else can they be assured of future access to capital? The House Oversight and Government Reform Committee seems to think that former Treasury Secretary Hank Paulson – himself a former Goldman Sachs bonus recipient – gave bailout money to his cronies after telling Congress the money was for Main Street homeowners.

If it isn’t clear by now that the United States Government is picking the winners and losers in this economy, the experience of CIT Group Inc. – a lender to small businesses that is being allowed to fail – should remove any doubts you may have had until now.

The United States Government passed an additional $12.1 billion to Goldman Sachs through the AIG bailout – money that won’t be returned unless AIG succeeds. To assure their success, AIG is preparing to pay millions of dollars more in bonuses to their executives this year under the premise that a contract is a contract and must be honored (unless it’s a UAW contract, of course.) JP Morgan Chase reported better than expected earnings; even Bank of America, still reeling from the Merrill Lynch merger and extensive mortgage losses in California, earned $3.2 billion in the second quarter of 2009. Citigroup reported $4.28 billion profit in the second quarter.

With government money and government protection coming at them from all sides, it’s a wonder all the big banks and big bank employees aren’t rolling in dollar bills by now.

CIT Group Inc. acknowledged today that “policy makers” turned down their request for aid. It’s always sad when a company fails and goes into bankruptcy – people lose their jobs, all the vendor companies that sell them products suffer from the loss of business, etc. But what makes this one especially sad is that CIT, according to Bloomberg News, “specializes in loans to smaller firms, counting 1 million enterprises, including 300,000 retailers, among its customers.”

This news comes on the heels of an appearance by former Secretary of Treasury Hank Paulson before the House Committee on Oversight and Government Reform. Summing up after the hearing, Chairman Edolphus Towns (D-NY) admitted that Congress turned over complete authority to Paulson in the Bailout last fall (Troubled Assets Relief Program, TARP): “with no accountability, no checks and balances.” The result is “seemingly arbitrary decision-making.”

Representatives at the hearing repeatedly accused Paulson of deceiving Congress by telling them (and everyone else) that the bailout money would be used to help homeowners. In the end, it was as if the previous administration pillaged the U. S. Treasury on their way out of town.

In the third of a series of hearings designed around the Bank of America merger with Merrill Lynch, Paulson told the Committee that he had the authority to remove Ken Lewis as head of the bank if he didn’t go through with the merger.

Rep. Jim Jordan (R-OH) said there was “a pattern of deception.” He asked specifically, when did Paulson know that he was going to give the money to the banks – which he did on October 13 – after telling Congress on October 3 that he was going to use it to buy up bad mortgages? Paulson’s response was that he believed Congress knew they were giving him flexibility to do whatever he wanted – so he did.

The question now is this: did Paulson pick and choose among his friends to decide who got a bailout? Special Inspector General Neil Barofsky will report to the House Oversight Committee next week with the release of his quarterly report to Congress on the use of TARP funds. Recall that Barofsky’s office is the only one with the authority to initiate criminal prosecutions. Maybe Paulson is still on his list.

Last month, an old elevated train track on Manhattan's west side was re-opened to the public as a public park. The High Line was a 1.5-mile stretch of track constructed in the 1930s to carry freight trains. The last train ran on the platform in 1980 and the space has been the subject of battles ever since between park-minded preservationists and residents who wanted to tear down the steel monstrosity with no apparent function.

It is a great thing the preservationists won. The High Line is a magnificent and inspiring park, a one-of-a-kind public space with views of the Hudson River that shows a great respect for the industrial history of the surrounding uber-hip Meatpacking District. It manages to feel both modern and classic at once, with moveable wooden chez lounges that look like they could belong by the pool at a W Hotel sliding along the original tracks at places. Gardens are planted along the walkway and amidst the old tracks making it a perfect place to stroll, visit and view the west side of the city.

The first phase of the park runs from Gansevoort Street to 20th Street with the second phase slated to open next year extending all the way to 30th Street. The Promenade Plantee in Paris was the first elevated garden to be transformed into a public space but the bug is catching on and other projects are planned in St. Louis, Philadelphia, Jersey City and Chicago.

To get to the High Line, get off the subway at the 14th Street and 8th Avenue station and walk west towards the river. You will not be disappointed, even it rains like the day I visited.

Unemployment may be at 11.4% in LA County, pundits may mock the dysfunctional state budget system, but crime is still dropping from already historic lows in the City of Los Angeles.

According to statistics released by the LAPD yesterday, homicides are down a third compared to the first half of last year with violent crime down 6% and assaults down 8%.

It seems to be received wisdom - I'll call it pop criminology - that a spike in criminal activity always accompanies an economic crisis and a drop in employment. The recent movie "Public Enemies" milks this association most explicitly, and it may have been more true in the Depression. Overall, however, this is not the case in the U.S. these days and the numbers for property crime in LA also show a decrease: auto thefts fell 17% and property crime 7% overall compared to Jan. 1-June 30, 2008.

Obviously, the relationship between crime and economic hardship is more complex and requires critical thinking about a host of sociological factors to attempt to explain the causality of crime. But these numbers, and similar findings in other cities, should debunk the common assertion that economic downturns correlate with criminal resurgence.

The forthcoming book, "When Brute Force Fails" by UCLA Professor Mark Kleiman is an important contribution to the subject which I look forward to reading. It should be read by pop criminologists and criminologists alike.

For those of you who have incredible interest in the subject, the LA Times Homicide Blog is an interesting resource. Increasingly, strapped papers like the L.A. Times (which recently discontinued its California section, merging it into the main section) are putting content like this on-line.

In the past month, Washington D.C. has experienced both an increase in number of jobs as well as an increase in unemployment, according to the Washington Post.

The city’s unemployment rate rose from 9.9 in April to 10.7 percent in May – far surpassing the national average of 9.4 percent – despite gaining about 1,400 jobs primarily with the federal government.

The District is often considered to be immune to such job market fluctuations because of steady government employment. But as Alice Rivlin, senior fellow at the Brookings Institution, points out, “[D.C.] has plenty of jobs, mostly high-skill jobs that require education beyond high school.”

The high-paid, higher-skill jobs created within the government are often times given to those not living in the city – Virginia’s unemployment rate: 7.1 percent, Maryland’s: 7.2 percent.

Job loss has also disproportionately affected the city’s African American population. The predominately white and affluent Ward 3 had an unemployment rate of 2.5 percent in April, far better than the largely poor and black Ward 8, where the rate was 23.3 percent.

To my friends and colleagues in the US, it must be easy for Americans, in these times, to think that no one elsewhere in the world thinks about the principle on which America was founded. But many of us do.

These Jacquie Lawson cards are created in England and you will see that she uses the 4th July cards to pass on some information to her subscribers. (She would be well aware that most Americans would be well aware of the contents of the Archives.) So when we say, "we are thinking of you" we mean that in both the personal and historical sense.

The Anglo American tradition lives on, and at times like this we remember that American history is also British history. Queen Elizabeth the First, James Watt, and Adam Smith are part of our common heritage.

View 4th of July ecard

One of the great migrations of Americans was from Dust Bowl Oklahoma to California during the Great Depression. People came from all over the parched plains to California; South Dakotans, Nebraskans, Oklahomans and others. But only one group had a name. No one called them Dakoties, nor Nebies, but they did call them “Okies.” Their legacy was spread by John Steinbeck’s Grapes of Wrath. Indeed, so many came to California that it enacted an “anti-Okie” law, which was duly set aside by the United States Supreme Court (Edwards v. the People of California).

How things change. A Sacramento Bee article reports on the migration of Californians to, of all places Oklahoma and nearby states. For decades, Oklahoma has been the ultimate of “flyover country,” one of the last places people on the coast would think of moving to. Yet, as I pointed out in 2005, Oklahoma has become more competitive, at least partially because its advantages in housing costs and hassle free commuting. Moreover, it’s more than Californians. Seattle, which lost home-grown Boeing to Chicago some years ago, lost its NBA “Supersonics” to Oklahoma City last year. Having spent most of my life on the coast, I never would have imagined that Oklahoma City would become competitive with California and Seattle. But it has.

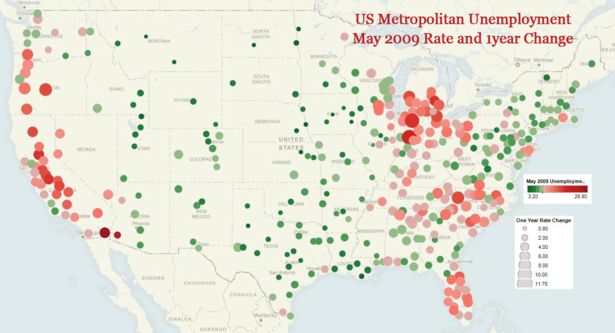

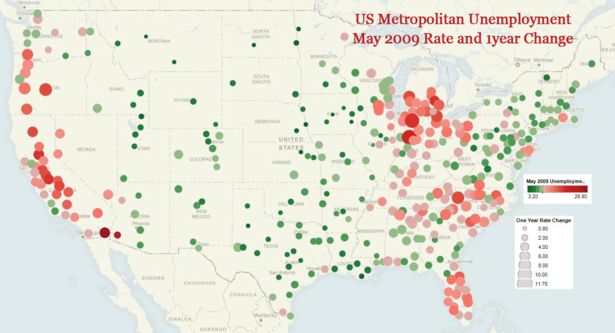

Here's a quick map of the newly released May 2009 metropolitan area unemployment numbers. On this map, color signifies the rate in May 2009 and size of bubble indicates the rate point change since May of last year. Green dots are below the national unemployment level of 9.1 in May, and red dots are above the national number.

We can see that highest unemployment is concentrated on the west coast and California, manufacturing dependend Michigan, Indiana, and Ohio, parts of Appalachia, the Carolinas, and Florida.

Unemployment is increasing the fastest in Kokomo and Elkhart-Goshen, IN; Bend, Eugene, Medford, and Portland, OR; Hickory-Lenoir-Morganton, NC; and Muskegon and Monroe, MI.

While every metropolitan area of the country saw increased unemployment over May 2008, the Great Plains from Texas to North Dakota, the Mountain West, and parts of New England are still holding employment better than the rest of the nation.

The amount of private sector jobs in Manhattan has been declining since 1958, according to the Center for an Urban Future. An increase in job-spread among the other four boroughs – Queens, Brooklyn, the Bronx, and Staten Island – has led to a shift in the New York City job market.

Still, Manhattan has the largest slice of the Big Apple job pie with a share of 61.59 % in 2008. This number has fallen about 6 percentage points over the past 5 decades. In 1958 Manhattan had a hefty 67.59% share of private sector jobs.

Needless to say, as Manhattan’s shares have declined, the other borough’s collective shares have increased overall. However, Queens has grown to eclipse Brooklyn with the second largest share in 1978 and has yet to rescind the title. Queens share of private sector jobs sits at 15.07%, while Brooklyn has a 14.09% share. From 1958 to 2008, the Bronx’s share has increased from 5.36% to 6.50% while Staten Island’s share has grown from a minute 0.75% to 2.76%.

This shift away from the city’s traditional financial sector of Manhattan can seem alarming to those not living in the Outer Boroughs. However, Manhattan-ites can take comfort in the fact that the city’s unemployment rate remains slightly lower than the national average.

Faced with an economic downturn and a bursting real estate bubble, Americans look to be staying put in greater numbers. According to Ball State demographer Michael Hicks, interviewed in an article examining the trend in the San Francisco Chronicle, "Property values have dropped so much, people can't pick up and move the way they used to."

In April, the Census Bureau reported that in 2008, the "national mover rate," declined to 11.9 percent, down from 13.2 percent in 2007. This marks the "lowest rate since the bureau began tracking these data in 1948." As William Frey, a demographer at the Brookings Institute, puts it, "the most footloose nation in the world is now staying put."

According to Frey, the middle of the decade was marked by a "mobility bubble," spurred on "by easy credit and superheated housing growth in newer parts of the Sun Belt and exurbs throughout the country". As the recession took hold through 2008, migration to suburbs and exurbs fell "flat in a hurry," showing "just how rapidly changing housing market conditions can affect population shifts."

While, as Frey suggests, people may be moving into suburbs and exurbs at a slower rate, central cities within metro areas continue to lose population. The Census Bureau reports that during 2008 "principal cities within metropolitan areas experienced a net loss of 2 million movers, while the suburbs had a net gain of 2.2 million movers." While the downturn in migration may help central cities hold onto some of their population, Frey contends that "it remains to be seen whether the migration-fueled engines of the early 2000s—especially the Sun Belt and outer metropolitan suburbs—will regain their former status."

|